$LINK: The Latest Craze Among Crypto Whales

KEY POINTS

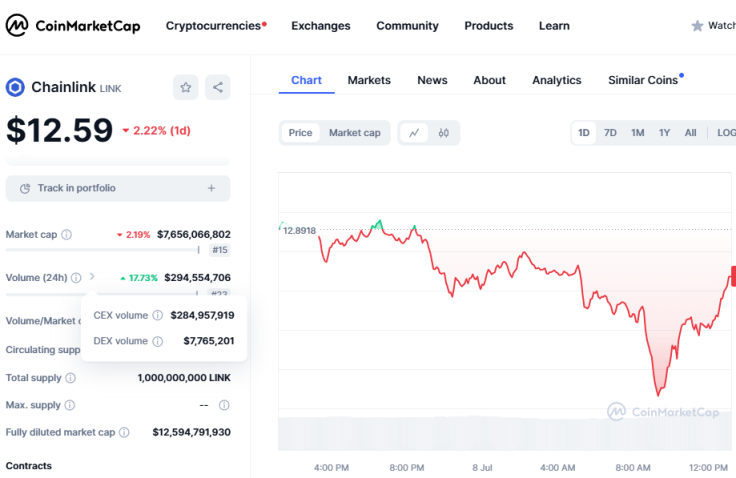

- $LINK is trading at around $12, significantly down from $51 in May 2021

- An observer said whales may be buying the dip that small holders are afraid of

- Some crypto users believe the token is 'undervalued' and 'underrated'

Cryptocurrency whales, individuals or institutions who hold the largest number of digital assets, are one of the key drivers of engagement in the crypto space. Whether they make massive purchases or sell their long-held assets, their activities always grab the attention of the crypto world, and recently, it appears many whales are attracted to Chainlink ($LINK).

What is $LINK?

$LINK is the native cryptocurrency of the Ethereum-built decentralized blockchain oracle network Chainlink, established in 2017. As of early Monday, the token has a market cap of over $7.6 billion and is ranked No. 17 out of thousands of digital currencies on CoinGecko.

While the digital coin's price has been down by over 2% in the last 24 hours, trading volume climbed by more than 17% in the last day, with centralized exchanges accounting for the larger chunk of the trading activity, as per data from CoinMarketCap.

Whales accumulating in the past 2 weeks

On-chain-data and crypto market insight provider Lookonchain revealed that crypto whales have been snapping up $LINK in the millions in recent weeks.

Whales/institutions continue to accumulate $LINK!

— Lookonchain (@lookonchain) July 7, 2024

A total of 90 fresh wallets withdrew ~6.72 $LINK(86.7M) from #Binance recently!https://t.co/W6JaoFM1zShttps://t.co/6Scx8SLtNl pic.twitter.com/m2eqwKvnYE

A total of 90 wallets acquired 6.72 million $LINK worth around $86.7 million from crypto exchange giant Binance, Lookonchain's Sunday round-up showed. The exact reason why whales are accumulating such massive amounts of the token is unclear, but several traders and industry observers have an idea or two.

What's with the whale $LINK shopping?

Crypto investor and analyst Patric H. confirmed when asked by an X (formerly Twitter) about whales accumulating $LINK that the buying spree has been going on "for a while now," adding that he purchased some coins too. He was asked if he sold off 33% of his portfolio in loss to "buy back later," to which he replied "yes," suggesting that $LINK investments could be a "reserve" strategy of some sort that some whales are adopting.

$LINK lost it's momentum trend line, retested it and continue on it downward trend.

— 𝑀𝑟. 𝑈𝑔𝑜𝑑𝑒𝑣✶ (@MrUgodev) July 8, 2024

Thus it formed a head and shoulder pattern.(A bearish pattern)

Yet, we see whales are starting to accumulate $LINK(which is what they do when we are scared of buying the dips)$LINK is an… pic.twitter.com/3K1KEcyNJx

Pseudonymous trader Mr. Ugodev said whales are buying up the token, which has developed a "bearish" price pattern. The trader said coin accumulation takes place among whales "when we [retail investors] are scared of buying the dips." As mentioned above, $LINK prices are down, and it is trading at around $12 as of early Monday – a significant downturn from its $51.85 high in May 2021.

Retail holders react

Some crypto token holders are reacting to the movement of whales around the asset. Some users said $LINK has become undervalued and underrated, while one prominent Bitcoin investor said the token "is the most obvious play this cycle."

Chainlink on a roll

The whale accumulations come as Chainlink continues to expand its partnerships and integrations across the vast Web3 space. Its latest activities include integration with the decentralized finance (DeFi) protocol Umami, open-source protocol Aave, and Blast-built decentralized protocol SynFutures.

⬡ Chainlink Adoption Update ⬡

— Chainlink (@chainlink) July 7, 2024

This week, there were 9 integrations of 5 #Chainlink services across 9 different chains: @arbitrum, @avax, @base, @BNBCHAIN, @ethereum, @LineaBuild, @Optimism, @0xPolygon, and @zksync.

New integrations include @aave, @Arkanys_io, @joincommonwlth… pic.twitter.com/4GUd6Dzji8

$LINK is one of the highest-grossing cryptocurrencies in the market – backed by Chainlink's focus on secure interactions between smart contracts and external data sources, the token may be down on price ranks, but the attention it's getting from whales is way up there.

© Copyright IBTimes 2024. All rights reserved.