Loopring For Beginners

Loopring (LRC) token had at one point appreciated over 400% during the last three months. What value have investors recognized in this project, and is it worth keeping an eye on Loopring in the long run?

What problem does Loopring solve?

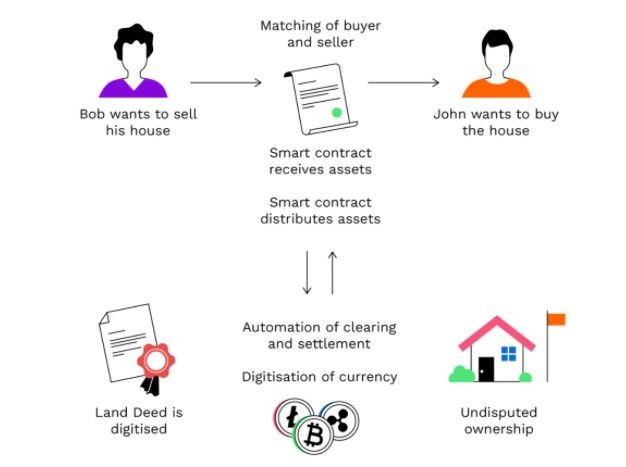

The story of Loopring begins with Ethereum. Unlike Bitcoin's blockchain, which only produces the eponymous cryptocurrency, Ethereum's blockchain is a generalist one. It gained this flexibility thanks to smart contracts, which are computer programs stored within the blockchain. Smart contracts can automate actions that would otherwise require some third party to intervene or facilitate.

If an agreement can be put to paper, it can be automated via smart contracts. In turn, DApps (decentralized applications) are the front-end web interface to smart contracts.

Of the nearly 3,000 DApps hosted on Ethereum, the most value locked within smart contracts is in decentralized exchanges (DEXes) and lending protocols.

Effectively, Ethereum's smart contracts have recreated the world of finance but without banks, exchanges and market makers. Unfortunately, the Ethereum blockchain network is not yet a finished project. It is currently undergoing a transition from Proof-of-Work to Proof-of-Stake consensus, called Beacon Chain. The latter should prove to be more efficient and affordable to use. This brings us to Ethereum's biggest problem in this transition — enormous transaction fees (called ETH gas fee) for even simple transactions like transferring altcoins from one crypto wallet to another, let alone more complex ones like swapping tokens on DEXes.

To give you an idea of how prohibitively expensive these transaction fees are, Ethereum's current average transaction fee (at the time of writing) is 0.008 ETH ($33.26), which is considered on the lower side. In contrast, Ethereum's competitor, Solana blockchain, offers an average fee of $0.00025 per transaction and a much greater speed of up to 40,000 tps.

You may be wondering by now, why would anyone use Ethereum then, and what does this have to do with Loopring? The issue is, Ethereum has the highest number of developers and DApps available. And everyone is expecting the Ethereum 2.0 transition to be complete sometime in 2022. In the meantime, Loopring is there to alleviate the fee-related constraints.

Loopring’s role in making the Ethereum experience better

While Ethereum's blockchain highway is congested, Loopring stepped in to provide a scaffolding above it, building something analogous to a monorail, called a Layer 2 scalability solution. Specifically, Loopring is a zero-knowledge rollup, or zkRollup for short. What does this mean exactly?

zkRollup explained

Let's say some organization requires you to prove your identity, but without revealing to them your private data. A zkRollup cryptographic method makes that possible, hence the name zero-knowledge. Moreover, a zkRollup like Loopring dramatically boosts the speed of transfers by bundling hundreds of transactions into a single one. Then, it is returned to Ethereum's main chain (Layer 1).

Borrowing from the previous metaphor, that means that Ethereum's congested highway is getting less so because cars are driving to an elevated ramp (Layer 2) above the highway onto the monorail system. In turn, this speeds everything up and less gas (transaction fee) is expended.

Loopring’s decentralized exchange

As Loopring supports both automated market makers (AMMs) and order books, Loopring's non-custodial protocol can be used by both centralized and decentralized exchanges. This is why such platforms are also called agnostic, making Loopring easily integratable into smart contract platforms.

In a nutshell, Loopring creates the best of both worlds, a hybrid exchange that combines centralized order matching and decentralized order settlement. The necessary steps needed to take advantage of Loopring's fast (up to 2,000 tps) and cheap token swaps are explained in this tweet.

New to Loopring L2 + Ethereum?

— Loopring💙🏴☠️ (@loopringorg) November 29, 2021

Check out our new quick guides to help you become an L2 wizard in minutes🧙♂️✨

You'll learn how to:

🌟 connect MetaMask to Loopring L2

🌟 deposit to Loopring L2

🌟 transfer L2 <> L2

🌟 withdraw back to Ethereum L1

👇👇https://t.co/ihMyPKEOXy pic.twitter.com/DG3abGSZM7

In practice, this means that you can get ahead of the game in crypto trading. For example, what if you are interested in a coin that is not available on major exchanges? As we all know, once they get listed on them, they tend to jump sky high in price. With a MetaMask wallet, connected to Loopring Layer 2 app, you can now become an early adopter of such coins, but without draining your funds on transaction fees.

Who created Loopring and when?

The lead developer of Loopring, and the CEO of Loopring Foundation, is Daniel Wang, who is based in Shanghai. He holds computer science degrees from both China and the U.S., previously serving as a lead software engineer for Boston Scientific. His notable Chinese project was JD.com, an e-commerce platform where he served as director of engineering, ads and search.

In August, 2017, Wang revealed the Loopring project via an initial coin offering (ICO), having raised $45 million worth of ETH.

LRC token performance

Loopring's LRC token is used to pay for the fees when swapping tokens, some of which goes to the developers. Due to rumors of Loopring being employed by GameStop for its upcoming NFT marketplace, the LRC token has jumped in value by over 400% since late October. However, it went down from its ATH (all-time-high) price of $3.6 on Nov. 10 to its present level of $2.

There is a maximum of 1,374,513,896 LRC coins, which means that no new coins will be issued — a good sign for its price because limitation creates scarcity, and scarcity creates LRC price appreciation.

Given Loopring's valuable utility and the fact that Ethereum is still a long way from completing its upgrade, it is likely that LRC is poised to burst through its previous ATH price.

Rahul owns less than 1 BTC and 40 LRC.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2024. All rights reserved.