Institutional investors, turned off by a slow-growth economy that?s led to low-return stocks, piled in to oil, driving up its price, worsening the economic conditions that led them to invest in oil in the first place.

Critics have chided President Barack Obama for his economic reforms, which they view as too big, or too liberal. The reality is however, that if Obama's reforms don't stand, and the economic/social problems are not addressed, an even more-liberal public official will likely emerge to propose and enact bigger changes.

A summary of all-things Washington for Monday, August 15, 2011.

National Oilwell Varco Inc , the largest U.S. oilfield equipment maker, struck a $1.5 billion deal to supply drilling equipment for seven drillships to Brazil's Estaleiro Atlantico Sul.

Did last week?s wild stock market swings make you concerned that your 401K will soon turn into a ?201K? ? Then it sounds like it?s a good time to get an assessment of the U.S. economy from two respected economists, Paul Krugman and Irwin Kellner.

New findings by researchers at the Joslin Diabetes Center and Children's Hospital Boston have shown the presence of a type of "good" fat or "brown" fat that might be able to combat the obesity and diabetes epidemics. Researchers foresee this new revelation as a tool to combat childhood obesity.

Apple has redefined its line of laptops making it more productive and fast concentrating on previous mistakes over the years.

Economist Nouriel "Dr. Doom" Roubini, the NYU professor who four years ago accurately predicted the global financial crisis, says tough medicine is needed to end it: another round of massive fiscal stimulus or a universal debt restructuring. If neither occurs, a systemic flaw will, at minimum, continue to hinder economic recovery.

After a week of wild gyrations that saw the Dow Jones Industrial Average rise or fall 400 points on four consecutive days, there?s word that a major bank in France with a funny-sounding name may be in trouble. Further, if you think a possible problem at France's Societe Generale won?t affect the value of the U.S. stocks you own, think again.

The 2010 U.S. Health Care Reform Act will likely be decided by the U.S. Supreme Court in 2012, in a case that pits individual liberties concerns versus the U.S. Government?s authority to limit public health care costs via universal insurance. If the court hears the case by the spring 2012, it could issue a ruling in June 2012.

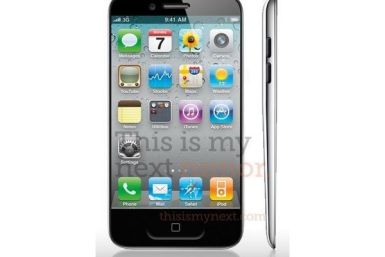

Apple?s anticipated iPhone 5 is expected to arrive in September but new rumors suggest that the Cupertino-based company may delay the launch even further up to October.

Japanese manufacturers concerned about China's restrictive export quotas on essential rare earths may have found a way to resolve their supply concerns -- relocate production to China.

There has been a steady uptick in buzz surrounding Texas governor Rick Perry as he prepares to announce his run for White House on Saturday in South Carolina.

Which party creates more jobs per year, on average -- Democratic presidents or Republican presidents? The answer may surprise you.

The U.S. will donate an additional $17 million to nations in the Horn of Africa coping with severe drought, Secretary of State Hillary Clinton has announced.

A split U.S. Appeals Court in Atlanta ruled Friday that a key provision of the 2010 U.S. health care reform act is unconstitutional, siding with a group of 26 states that challenged the law.

House Minority Leader Nancy Pelosi, D-Calif., rounded out the super committee by announcing her three House Democratic members for the special bipartisan board. Now the tough work begins: reducing the deficit by at least another $1.5 trillion over 10 years, and as far as the financial markets are concerned, the sooner the reduction is announced, the better.

Never Dead is expected to arrive in the last quarter of 2011.

Organic agriculture, long seen as the best foot forward for supporting good health has now found new proof in a recent study that expects to reduce existence of drug-resistant bacteria on U.S. farms that "go organic".

After a week of gyrations that's seen the Dow Jones Industrial Average rise or fall 400 points for four straight days, it's understandable if U.S. investors are bewildered. Given the tumult, what stance should investors adopt now?

Wilmar International , the world's largest palm oil plantation firm, said on Friday it has no plan to further hike cooking oil prices in China after raising the price by 5 percent recently.

Eight Republican presidential hopefuls duked it out on Thursday night in a Fox News and Washington Examiner sponsored debate in Ames, Iowa.The debate ranged from the recent Standard & Poor's downgrade of long-term U.S. to illegal immigration. Here are the night's winners and losers:

The Republican Party argues it's the party of job creation, but the statistics indicate otherwise, at least concerning U.S. presidential administrations. Democratic presidents have a higher annual job creation average, 1.647 million per year, than Republican presidents, 966,388 per year.

U.S. home mortgage interest rates fell again this week, and the average 30-year fixed rate is now at a low 4.19 percent -- which creates an opportunity for prospective home buyers with good credit histories.

With the appointment of nine of 12 members, the "super committee" charged with reducing the budget deficit by at least another $1.5 trillion is taking shape. The body could help stabilize the financial markets by announcing a ?quick-start? agreement on additional debt reduction.

There's some debate over whether Anonymous will actually be able to take down social networking giant Facebook on November 5th, as it claims, but let's say that it does.

HP is making the right move by permanently cutting the price of its Touchpad tablet according to one analyst.

The Dow registered another volatile day Wednesday, plunging 520 points to 10,720 on chatter of additional banking sector concerns in Europe. Further, until investors can sort out which debt concerns are real, and which are not, look for choppy trading conditions to continue.

August's dramatic financial shock, which is now both feeding off and risks fueling another economic downturn, may well introduce a third phase of the four-year-old global credit crisis -- the infection of the ultimate creditors.

Crude oil historically trades at about 8 times the price of natural gas. Currently, it's trading at about 20 times natural gas. Is oil overpriced, natural gas underpriced, or is it a combination?