Standard & Poor's credit rating downgrades of nine Eurozone countries will fuel attempts by European Union lawmakers to slap stricter curbs on sovereign ratings.

Russian steelmaker Severstal said on Monday that a planned London listing of its Nord Gold mining unit would proceed after investors representing 10.6 percent of the share capital in the business participated in a share swap.

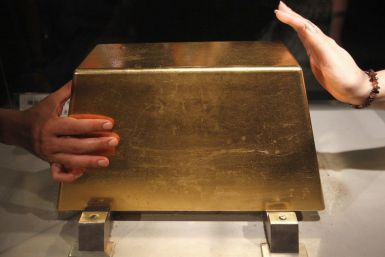

Gold firmed in Europe on Monday, rising back above $1,640 an ounce, as a recovery in stock markets and the euro took some downward pressure off prices, with traders digesting last week's mass downgrade of euro zone countries from Standard & Poor's.

French haute couture fashion designer Jean-Paul Gaultier has reportedly provided a fashionable way for bullion investors to diversify holdings and hedge against inflation.

Consumer sentiment continued to pick up steam in early January, rising to the highest level in eight months as Americans became more optimistic about job prospects, a survey released on Friday showed.

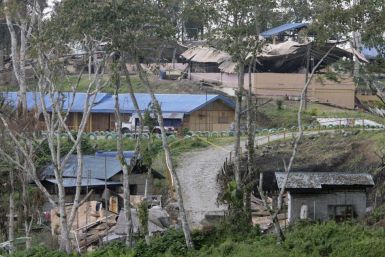

Global miner Xstrata Plc's Philippine unit said on Friday it was extremely disappointed with a government decision not to clear for now its planned $5.9 billion copper-gold Tampakan project, potentially the biggest in Southeast Asia.

Gold prices struggled to hold recent gains Friday as a successful Italian bond auction buoyed optimism about the direction of the Eurozone's economy.

Gold rose to a one-month high on Thursday, as comments by the president of the European Central Bank on cheap money stabilizing the region's banking system extended the metal's gain to a third consecutive day.

U.S. Gold Corp (UXG.TO) Chief Executive Rob McEwen said he expects global financial worries to push gold prices above $2,000 an ounce this year and even higher in the next few years.

South Africa's Department of Mineral Resources has rejected an appeal by platinum miner Lonmin over a prospecting right on part of its mining area granted to a third party, Keysha Investments.

South African miner Gold Fields has signed an agreement with Kyrgyz villagers that will enable it to resume drilling at a prospective copper deposit three months after an arson attack by horsemen on its geologist camp.

Gold prices, which already this week broke above a key resistance level, barreled on Thursday toward a one-month high.

A stronger rupee boosted gold purchases from India just before the wedding season resumes in India, the world's largest gold consumer, while physical flow into China was lukewarm ahead of the Lunar New Year holiday.

Gold prices extended gains into the second day on Wednesday, rising above the closely-watched 200-day moving average. The yellow metal is trading at around its highest level in a month, supported by strong physical demand from India and China.

Gold rose for a second day on Wednesday, hitting its highest in a month, as evidence of strong demand from major consumerChina helped boost the price above a key technical level, and offset the impact of a softer euro.

Ore grades will be approximately 6 percent lower in 2012 than in 2011 due to mine sequencing.

Brigus Gold Corp. said Wednesday exploratory drilling in Ontario will result in increased resource estimates of its Black Fox Complex.

Stock index futures dipped on Wednesday, a day after major indexes hit a five-month high, with pressure on the euro testing the recent view that the U.S. market was decoupling from Europe.

Gold traders in India, the world's biggest buyer of bullion, stepped up buying for the upcoming wedding season, as gold prices stayed near the week's trough, giving silver a boost.

Freeport McMoRan Gold & Copper Inc's Indonesia's unit said on Wednesday it continued to ramp up production at its Grasberg mine where workers on Tuesday halted a gradual return at the end of a three-month strike.

Strong demand from China and India as well as short covering Wednesday extended a gold price rally that has lifted the yellow metal six percent since the end of last month.

Gold hit a four-week high and broke above a key resistance on Wednesday, defying a stronger dollar, as the festering euro zone debt crisis lured investors to its safety and signs of strong demand from the world's top two consumers also supported.

Gold prices rose 1.5 percent near a closely watched level Tuesday to a three-week high as the dollar weakened and stocks rallied.

Gold rose towards $1,640 an ounce on Tuesday and other precious metals rallied, with a rebound in the euro versus the dollar making dollar-priced assets more attractive to holders of other currencies, and after bullion breached a key chart level.

Compared to the year earlier period, silver production was up 25 percent for the quarter to 1.12 million ounces, while gold production was up 45 percent to 7,045 ounces.

Silvercorp Metals Inc., whose shares plummeted after reports of accounting and resource statement fraud, has amended its lawsuit against those it sees as responsible for the allegedly defamatory reports.

India's central bank has allowed four more banks to import precious metals, a move that would boost competition and help reduce premiums in the world's biggest importer of bullion.

Gold producer Centamin posted a 10 percent rise in fourth-quarter output, boosted by higher production rates at its flagship Sukari project in Egypt, lifting its shares on Tuesday.

Gold prices rode a global stock market and commodities rally Tuesday break a two-day losing streak.

Silver for March delivery, the most actively traded contract on the Comex, was up 25 cents to $28.93 and spot silver was up 10 cents to $28.85.