For tycoon Cheng Yu-Tung, 86, listing his jewellery retailer Chow Tai Fook, the world's largest, on the Hong Kong Stock Exchange paves the way for his younger generation to strengthen its position in China's glittering market.

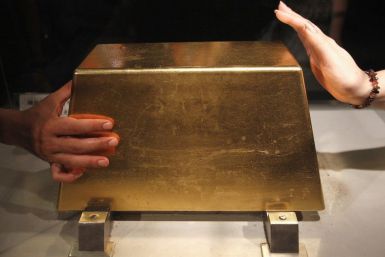

Gold prices Thursday appeared to halt the previous session's big plunge, though prospects they were carving a bottom defied the extent of damage precious metals prices suffered.

Spot gold weakened further on Thursday after dropping 3.5 percent in the previous session, as investors remained nervous about the eurozone debt crisis amid the year-end rush to liquidate positions.

The bottom dropped out of gold prices Friday as technical supports collapsed, hedge fund managers turned holdings into cash and a surging dollar killed any vestige of physical demand.

Stocks fell on Wednesday as weak commodity prices sparked a selloff in the energy and materials sectors and as a falling euro and high Italian bond yields kept Europe's debt crisis in focus.

Fire River Gold Corp said it resumed operations at its Nixon Fork mine in Alaska on Tuesday night, three days after it suspended operations at the mine and mill as bad weather prevented fuel-carrying aircraft from landing at the site.

Gold and silver assets were plunging dramatically Wednesday, with prices for bullion falling below their 200-day moving average for the first time since 2009 and shares of precious metals miners dropping hard.

South Africa's trade union Solidarity said on Wednesday it has reached a two-year wage agreement with platinum miner Lonmin that will see its members get pay rises of up to 8 percent.

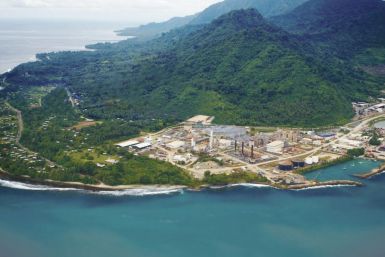

Freeport McMoRan Copper & Gold Inc. and its Indonesian union signed a pay deal on Wednesday to end a three-month strike that had paralysed output at the world's second-biggest copper mine, a union official and the company said.

Rajesh Exports, the world's biggest jewellery maker, expects to raise gold imports by 17 percent next year to power its renewed thrust in the competitive and fragmented local jewellery market as a cushion against a volatile export market.

India's Rajesh Exports, the world's biggest jewellery maker, expects to raise gold imports 17 percent next year to power its renewed thrust in the competitive and fragmented local jewellery market as a cushion against a volatile export market, its chairman said on Wednesday.

Italian government bond yields eased on Wednesday after the country sold 3 billion euros of five-year debt in the first longer-term auction since the European Union took steps towards greater fiscal integration last week.

Gold prices fell for a third consecutive day Wednesday -- extending a weeklong plunge to more than 6 percent -- after the U.S. central bank warned that slowing global growth threatens the nation's weak recovery.

Gold prices slipped Tuesday, its seventh consecutive daily decline, to a two-month low as the dollar posted big gains in light trading.

The Federal Reserve on Tuesday pointed to turmoil Europe as a big risk to the economy, leaving the door open to a further easing of monetary policy even as it noted some improvement in the labor market.

ECR Minerals Plc said Tuesday it expects exploratory drilling on its El Abra gold prospect in Argentina to begin next month.

Hecla Mining Co., the largest U.S. silver producer, acquired the remaining 30 percent interest in a prolific Colorado silver project that it did not already own, the Idaho-based company said Tuesday.

The amount of gold held in exchange-traded products is near record highs and although the gold price is suffering from investors' desire for the safety of cash, the risk of this $116 billion stash of bullion being jettisoned is distant.

Gold and gold receivables held by euro zone central banks fell by 1 million euros to 419.822 billion euros in the week ending Dec. 9, the European Central Bank said on Tuesday.

Canadian miner Endeavour Silver Corp said it has discovered two high-grade silver-gold zones at its Guanajuato mine in Mexico and expects a substantial increase in reserves and resources at the mine at the year-end.

Papua New Guinea's governor-general decided on Tuesday that the two men claiming to be the resource-rich country's prime minister must negotiate a solution, leaving a tense political deadlock unresolved.

Freeport McMoRan Copper & Gold Inc and its Indonesian workers' union expect to sign a pay deal on Tuesday to end a three-month strike that has crippled production at the world's second-biggest copper mine, two sources told Reuters.

An independent arbitrator cleared the way on Tuesday for mining group Rio Tinto Plc/Ltd to take over Ivanhoe Mines Ltd, saying the $16 billion Canadian group's poison pill defense was not valid.

Gold hardly moved Tuesday with prices stretched between stronger physical demand from Asia and Eurozone worries, including bank weakness and more sovereign debt downgrades.

A sharp drop in bullion prices prompted some buying interest on Asia's physical market, but many remained reluctant to purchase large quantities as the year end approaches and the eurozone debt crisis threatens to further sink prices.

Gold prices tumbled to a six-week low Monday as bank selling and a skyrocketing dollar offset support from central bank buying.

African Barrick Gold Plc (ABG) has agreed with the Tanzanian government to raise the royalty rate it pays on gold exports, the country's minerals ministry said on Monday.

Precious metals assets tumbled Monday on doubts that last week's Eurozone restructuring plan addresses immediate threats of dollar liquidity, bank defaults and national bankruptcies.

An Indonesian workers' union plans to extend a three-month strike at Freeport McMoRan Copper & Gold's Grasberg mine until Jan. 15, union official Virgo Solossa told Reuters on Saturday.

Australia-listed Indophil Resources, which holds a 37.5 percent stake in Southeast Asia's largest undeveloped copper-gold prospect, said on Monday it was considering also listing its shares in the Philippines, where a key shareholder is based.