European markets rebounded Thursday, shrugging off the crisis in Portugal, as the BoE and ECB both held rates steady, as expected.

Crude oil prices reached a 14-month high, on the back of concerns about protests in Egypt.

IBTimes Gold Reporter Mike Obel sat down with IBTimes TV's Sally Turner to discuss gold and its outlook for the next quarter.

Asian markets rallied Thursday after a sharp downward revision of US GDP rekindled hopes that the US Fed might stretch its asset-purchase program.

Roger Altman, founder of Evercore Partners, appeared on CNBC, offering his opinions on why gold is down in the markets. Watch what he had to say here.

Precious metals fell again Wednesday on continued concern about China's cash crunch.

Gold prices are expected to drop lower this week as a sell-off in gold ETFs continues and after Goldman Sachs lowered forecasts for 2013 and 2014.

Armed groups in Colombia are booking higher earnings through illegal gold mining than through illegal cocaine production.

Gold futures fell for the third straight session while Asians markets mostly declined on Wednesday ahead of the Federal Reserve's FOMC meeting.

Mexico's energy sector -- closed to competition for 80 years -- could open up to private investment if President Enrique Pena Nieto has his way.

Gold prices are expected to fall further as a sell-off in ETFs backed by the precious metal extended to 17 weeks.

Canada's Kinross abandoned its project over disputes with the government. Is China now moving into Ecuador's gold-rich Fruta del Norte?

The WGC has reacted with concern over India's attempt to curb gold consumption by raising import duties.

An economic impact study by a pair of mineral developers who want to tap a valuable Alaskan mine faces skepticism from activists, who are backed by a recent EPA report.

Fading inflation fears, among other factors, have weighed on both precious metals.

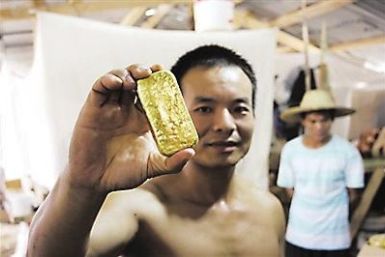

The people of Shanglin county in southern China have ventured to an unlikely place to seek their fortunes.

National Union of Mineworkers believes the strike against Lonmin is in reaction to the killing of a veteran worker from its rival union.

A growing number of buyers in China and India are jumping into the market and driving demand for jewelry, coins and bars.

Amplats halves its planned jobs cutbacks in South Africa.

China's "granny effect" trumps the investment advice of Goldman Sachs.

South African mining strikes plus rising demand put white metals into deficit last year, according to GFMS.

The death penalty is on the books in Sri Lanka, but no executions have taken place since 1976.

In the 19th century, millions of koalas roamed all across Australia. There are now no more than 100,000 on the entire continent.

The damage from the recent sell-off in silver prices will not likely be repaired this year.

Exchange-traded fund redemptions are contributing to Goldman Sachs' prediction that the gold price will slide to $1,450 by year's end.

A number of factors combined to lift the yellow metal for the second day in a row as Asian buyers rushed in to buy bullion.

The recent price drop in gold -- 10 percent since October to about $1,610 per ounce -- could continue.

A Liberty Head nickel that was illegally minted will likely go for millions at an auction.

Most of the demand for silver fabrication next year will come from industrial customers.

The demand for the precious metal by industry is expected rise following a two-year slump.