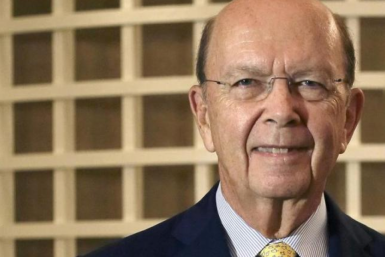

"In view of the volatility of politics in Greece, investors will not be comfortable with committing new equity capital to banks that are effectively nationalized," billionaire investor Wilbur Ross says.

The bill says the bank-rescue fund called the Hellenic Financial Stability Fund (HFSF) would have full voting rights on any shares it acquires from banks in exchange for providing state aid.

Although the banks are currently being kept afloat by access to money through the eurozone monetary system, there is a rush to get recapitalization completed.

The Federal Reserve is looking to reduce risk in the banking system by determining how much debt and equity the banks should use to fund themselves.

With a population of nearly 80 million, Iran is the Middle East's second biggest market for beauty products after Saudi Arabia.

Banks favor using chip cards verified by signatures, even though chip-and-PIN usage has led to lower fraud in Europe and elsewhere.

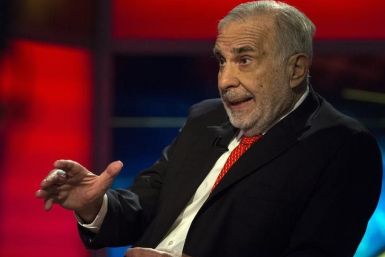

The prominent hedge fund manager launched a two-hour defense of Valeant Pharmaceuticals International Inc. as the company's shares continue to tank.

Investors appeared to be ending the week cautiously, following subdued data from Europe and weak US consumer spending.

Structural economic issues, along with the slowdown in China's economic growth, have taken a toll on Thailand.

The Canadian drug manufacturer is terminating its relationship with Philidor RX, a specialty pharmacy that has come under scrutiny.

Stock markets around the world rallied in October as central banks sought to calm investors worried about a slowdown in China and other markets.

Brushing aside China's slowdown, Asian stocks reported their strongest monthly performance in years in October.

The world's biggest coffee chain said Thursday that its holiday quarter, which began Sept. 28, would be dented by the effect of a strong U.S. dollar.

Speculation on a December rate hike in the U.S. comes amid anxiety over a global slowdown, with a wobbly China in particular triggering volatility in recent months.

Pfizer already faces political pushback at home as presidential candidates take aim at high drug prices and companies looking to avoid paying U.S. taxes.

The Canadian pharmaceutical company saw its shares drop after reports that CVS had cut ties with Philidor RX, Valeant's embattled specialty pharmacy.

Markets were down Thursday after a previous-day rally.

Congressional Republicans are looking to thwart efforts by the White House to keep retirement advisers from offering what some call conflicted advice.

European markets fall amid a slew of weak earnings while Asian markets stayed mixed following hints of a possible increase in interest rates by the U.S. Fed in December.

The German lender, which reported a $6.5 billion third-quarter loss Thursday, also approved sweeping austerity measures, including slashing 35,000 jobs.

Japan's Nikkei added 0.9 percent, buoyed by data released before the open that showed Japan's industrial output rose 1.0 percent in September.

The United Auto Workers made concessions during the recession. Now that GM and its rivals are generating robust profits, UAW members want a bigger share.

A Federal Reserve committee chose Wednesday to once again keep benchmark interest rates at historic lows -- but may be considering a December rate hike.

Experts say the reserve of 695 million barrels helps prevent volatility in crude oil markets and has a part in maintaining the global oil balance.

The stage was set by a disappointing September jobs report and the manufacturing sector falling short of expectations.

U.S. stocks followed European markets upward as markets expect no change in U.S. borrowing rates.

Activist investor and billionaire Carl Icahn told AIG it was too large and unwieldy in an open letter calling for the insurance company to restructure.

On Tuesday, Asian stocks were largely down with the exception of Japan as investors await results of the U.S. central bank meeting.

China's consumer sentiment plunged in October as households curbed spending, worried by recent discouraging economic data, according to a new survey.

A quarterly slowdown of Apple's overall sales in China cast doubt on the robustness of the company's legendary profitability.