In the first half of 2011, the United States registered two straight quarters of sub-par GDP growth, and the risk of a double-dip recession has increased. With consumer spending and business investment lagging, that leaves it up to the public sector to fill the gap. Accordingly, here are five programs to increase U.S. GDP growth.

The euro zone is exploring the possibility of leveraging its bailout fund, the European Financial Stability Facility, to better support euro countries, Economic and Monetary Affairs Commissioner Olli Rehn said.

Swiss National Bank Chairman Philipp Hildebrand said on Saturday he would do all that is necessary to maintain a ceiling on the Swiss franc, but declined to provide further details.

The following are highlights of comments by finance ministers and central bankers in Washington this week for meetings of the Group of 20 and the semiannual meetings of the International Monetary Fund and World Bank.

Due to the lingering government debt crisis in Europe and a 9.1 percent U.S. unemployment rate, key economic statistics are pointing to slow-growth conditions in the U.S. for the next two quarters, and a double-dip recession is possible. Is there anything Congress can do to create jobs and get the U.S. economy moving again?

Berlin, under pressure to beef up its response to Europe's debt crisis, wants the region's permanent rescue fund to come into force a year early in 2012, media reported, a move a senior lawmaker in Chancellor Angela Merkel's party said he backed.

Debt-laden Greece must push forward with reforms prescribed by its international lenders or face dramatic consequences, the country's central banker said in an interview.

The United States, China and other countries piled pressure on Europe on Saturday to comes to grips with its debt crisis before it risks causing bank runs and pushing the global economy into ruinous recession.

Oswald Gruebel resigned on Saturday as chief executive of troubled Swiss bank UBS, saying he took the blame for the $2.3 billion loss run up in alleged rogue trading in its investment banking division.

Adoboli is hardly the first UBS employee to engage in questionable conduct.

A senior lawmaker from German Chancellor Angela Merkel's conservatives said on Saturday the euro zone's permanent rescue mechanism should be introduced sooner than mid-2013 to beef up private creditors' response to the Greek debt crisis.

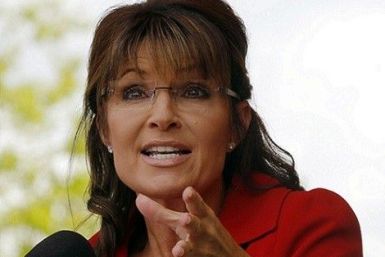

For former Alaska Gov. Sarah Palin, there's no time like the present to jump into the 2012 race for the Republican Party's nomination. But will she choose to join the race?

The United States and China piled pressure on Europe on Saturday to get to grips with its debt crisis before it risks causing bank runs and pushing the global economy into ruinous recession.

The United States and China piled pressure on Europe on Saturday to get to grips with its debt crisis before it risks causing bank runs and pushing the global economy into ruinous recession.

Treasury Secretary Timothy Geithner bluntly told European governments on Saturday to eliminate the threat of a catastrophic financial crisis by teaming up with the European Central bank to boost the continent's bailout capacity.

Obviously, the pressure got to him and he made a sudden turnabout.

Oswald Gruebel resigned on Saturday as chief executive of troubled Swiss bank UBS, saying he took the blame for the $2.3 billion loss run up in alleged rogue trading in its investment banking division.

The Dow Jones industrial average on Friday suffered its worst week since the depths of the financial crisis in 2008, stung by severe anxiety over Europe's spiraling debt crisis and a warning from the Federal Reserve about the U.S. economy.

The daily deal business continues to grow, according to research, but the industry leader -- Groupon -- continues with shakiness in regard to leadership, profitability, and a planned initial public offering (IPO). The latest news is a new regulatory filing late Friday from the company that says the company's chief operating officer Margo Georgiadis is leaving the company to return to Google, her former employer. She was only on the job with Groupon, the Chicago-based Internet daily deal compa...

The CME Group, the world's largest commodities exchange, raised its margin requirement on trading 100-ounce gold futures by 21.4 percent, the third rise since July.

Gold prices slumped more than $100 an ounce on Friday, the biggest fall on record in dollar terms, as traders sold to cover losses, while global stocks edged up on expectations the European Central Bank will take new measures to contain the euro zone debt crisis.

In years past, gold often acted as a safe haven when stocks were falling, and it hit a record in August while equities struggled. Now, however, it's mired in its worst selloff in decades. What does it mean for investors who see gold as a core portfolio holding?

Treasury Secretary Timothy Geithner told European governments on Saturday to eliminate the threat of a catastrophic financial crisis by working more closely with the European Central bank to boost the continent's bailout capacity.

German Finance Minister Wolfgang Schaeuble said in a magazine interview published on Saturday that Greece would not be able to return to capital markets next year and would need a decade to make its economy competitive.

Earnings forecasts for U.S. companies are starting to feel the pain on Wall Street and in the broader economy as the odds of another recession rise.

The board of UBS reconvened its meeting on Saturday to decide the future of its scandal-hit investment bank and Chief Executive Oswald Gruebel after the Swiss bank lost $2.3 billion in alleged rogue trading.

The board of directors of UBS will continue their meeting in Switzerland to discuss the fate of the country's flagship bank, a source told Reuters on Saturday.

The European Union will make a clear decision about boosting the capital of the European Financial Stability Fund before the next Group of 20 finance ministers meeting in mid-October, said Chinese Deputy Minister of Finance Zhu Guangyao.

Gold prices slumped more than $100 an ounce on Friday, the biggest fall on record in dollar terms, as traders sold to cover losses, while global stocks edged up on expectations the European Central Bank will take new measures to contain the euro zone debt crisis.

TransUnion's owners are pursuing a possible sale that could fetch roughly $2 billion for the credit information firm, sources familiar with the matter said.