The U.S. economy came perilously close to flat-lining in the first quarter and grew at a meager 1.3 percent annual rate in the April-June period, leading economists to warn of recession if a stand-off over U.S. debt does not end quickly.

China has ordered companies that have issued bonds to submit any asset restructuring plans to bond holders for approval, sources said, as Beijing steps up its efforts to rein in the risks from a mounting pile of local government debt.

U.S. gross domestic product (GDP) rose just 1.3 percent in the second quarter and a scant, revised 0.4 percent in the first quarter -- statistics that reveal a U.S. economy that's not only growing at a very slow rate, it's in danger of falling back into a recession.

The Great Recession was even greater than previously thought, and the U.S. economy has skated uncomfortably close to a new one this year.

U.S. stocks opened 1 percent lower and were on track to post their worst weekly losses in nearly a year on Friday after data showed meager growth in the economy while a setback in Washington over a debt deal kept investors nervous.

Stocks were on track to post their worst weekly losses in nearly a year on Friday after data showed meager growth in the economy while a setback in Washington over a debt deal kept investors nervous.

The U.S. economy came perilously close to flat-lining in the first quarter and grew at a meager 1.3 percent annual rate in the April-June period as consumer spending barely rose.

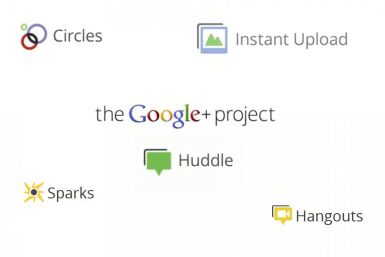

Google's new social networking site, Google+, witnessed a dip in traffic growth, according to Experian Hitwise, which tracks Web traffic.

Greece will get its next 8 billion euro tranche of emergency loans from the euro zone and the International Monetary Fund in September as planned, provided it meets agreed criteria, the spokesman for the Eurogroup President said on Friday.

U.S. stock index futures fell on Friday after lawmakers in Washington delayed a vote on a Republican proposal to raise the U.S. government's debt limit.

With less than five days until a U.S. Government default, incredibly, neither House Speaker John Boehner, R-Ohio, nor Senate Majority Leader Harry Reid, D-Nev., has a bill capable of attracting the bipartisan support needed to raise the debt ceiling. And understandably, financial markets are getting more nervous by the day.

Stock index futures fell on Friday after lawmakers in Washington delayed a vote on a Republican proposal to raise the U.S. government's debt limit.

Lacklustre lending activity in Japan's earthquake-ravaged economy and a shrinking retail investment business capped earnings of the country's top banks and brokerages in the fiscal first quarter, raising pressure on them to take more risks and find revenue sources overseas.

Stock index futures pointed to a weaker opening for equities on Wall Street on Friday after U.S. lawmakers delayed a vote on a Republican proposal to raise the U.S. government's debt limit.

Japan's biggest banks reported lackluster quarterly lending activity in the earthquake-ravaged economy, raising pressure on them to take more risks and find revenue sources overseas.

Japanese imports of rare earths from China fell 13 percent in June to 1,386 tonnes as a rise in prices made it unaffordable to many Japanese hi-tech companies.

Japan on Friday escalated its warning to financial markets against testing the yen's upside further, with the finance ministry signaling that Tokyo may not wait for too long with action if the currency keeps climbing.

Video technology start-up Vidyo unveiled on Friday a deal to supply its software to Ricoh's <7752.T> new small videoconferencing offering, which it expects to significantly disrupt the $3 billion equipment market.

Rating agency Moody's Friday placed Spain on review for a possible downgrade, citing weak growth and funding pressures, hitting the euro on concerns a Greek rescue package has not laid contagion fears to rest.

Moody's Investors Service on Friday put the Spanish government's bond ratings on review for a possible downgrade, citing funding pressures and a precedent set by the euro zone's debt package for Greece.

Japan escalated on Friday its warning to markets against testing the yen's upside further, with the finance ministry signaling that Tokyo may not wait for too long with action if the currency keeps climbing.

Motorola Mobility warned that its third-quarter profit would miss expectations due to a long delay of a key smartphone launch and a tablet computer price cut, sending its shares down 4 percent.

Asian stocks struggled and the dollar wavered on Friday as U.S. lawmakers squabbled over a compromise to avoid an unprecedented debt default, while growing worries about Europe's debt crisis weighed on the euro, adding to investor wariness.

The euro stayed under pressure in Asia on Friday as worries about the euro zone debt crisis flared up following a jump in Italy's borrowing costs, while investors also kept the dollar at arm's length amid the ongoing threat of a U.S. debt default.

Motorola Mobility warned that its third-quarter profit would miss expectations due to the second delay of a smartphone launch and price cuts of its tablet computers, sending its shares down 4 percent.

Republicans in the House of Representatives on Thursday delayed a vote a short-term bill to raise the nation's debt limit by $900 billion, Democratic sources said.

Banks accused of failing to detect Bernard Madoff's fraud won a victory in a U.S. federal court, as a judge said the trustee seeking money for victims of the Ponzi scheme could not pursue many of his claims.

Verizon Wireless plans to pay a $10 billion dividend early next year to its parents, Vodafone Group Plc and Verizon Communications .

Online travel agency Expedia Inc said its quarterly net profit rose as bookings increased by 19 percent.

Banks accused of failing to detect Bernard Madoff's fraud won a big court victory as a Manhattan federal judge rejected efforts by the trustee seeking money for Ponzi scheme victims to pursue many of his claims.