Germany's SAP AG expects to reach the high end of its 2011 forecasts after a strong second quarter, confounding fears of a slowdown in economically fragile Europe and lifting its shares.

Billionaire investor George Soros, whose stock-picking career has spanned nearly four decades, said he will manage money only for himself and his family as new regulations threaten to crimp the hedge fund industry he made famous.

The stalemate in debt talks dragged down stocks for a second day on Tuesday, and light volume showed investors remained reluctant to make bets despite another round of healthy earnings.

WHAT: First reading on U.S. second-quarter GDP

General Electric Co has canceled plans to sell its railcar leasing business that could have fetched about $3 billion for the largest U.S. conglomerate, people familiar with the matter said on Tuesday.

Electronic Arts Inc, the video game maker behind FIFA and Madden, reported a 3 percent decline in first-quarter adjusted revenue as customers bought fewer video games than a year earlier.

Shares of top video rental company Netflix Inc fell more than 9 percent on Tuesday, a day after the Wall Street darling shocked investors by projecting a pause in its normally explosive subscriber growth.

Motorola Solutions Inc lost a bid to dismiss a class-action lawsuit accusing it of misleading shareholders about deteriorating prospects for its cellphone business, resulting in investment losses.

BP announced second quarter earnings of 5.3 billion on Tuesday, a stark contrast from last year's second quarter loss of $17.15 billion, behind profits from skyrocketing oil prices.

General Electric Co has ended the auction of its roughly $3 billion railcar leasing business, making it the second time in three years the conglomerate has tried unsuccessfully to do so, sources familiar with the matter said on Tuesday.

Stocks were near flat on Tuesday as ongoing concern about a stalemate in the U.S. debt talks offset healthy earnings from corporations.

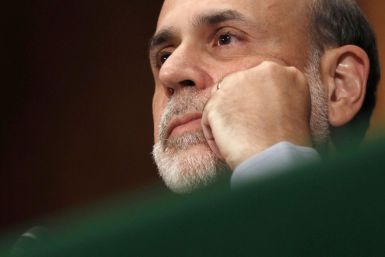

Assuming President Barack Obama and Congressional Republicans can not resolve the debt deal dispute in eight days, the unfathomable will happen -- a default by the U.S. Government. But that begs the question: what will the U.S. Federal Reserve do, if the U.S. Government defaults?

Consumer confidence edged higher in July as jitters over the outlook eased, though consumers remained gloomy about their current situations, according to a private sector report released on Tuesday.

Here is the situation on Tuesday as lawmakers try to close in on a deal to raise the $14.3 trillion U.S. debt limit by August 2 and avoid a federal credit default:

President Barack Obama's Democrats and their Republican rivals on Tuesday headed for a showdown over competing debt plans one week before a deadline for averting a potentially disastrous U.S. default.

Stocks continued to face headwinds on Tuesday from the ongoing stalemate in Washington over raising the debt ceiling, with light volume showing the gridlock in Washington has made investors nervous.

France's Safran has completed a $1 billion purchase of U.S. face-recognition software maker L-1 Identity Solutions and said it was now the world leader in biometric identification.

Concern over Fiat SpA's ballooning debt dragged its stock lower on Tuesday, overshadowing the forecast-beating quarterly results that prompted the Italian carmaker to raise its full-year targets.

Single-family home prices were unchanged in May, the first time in nearly a year they have not fallen on a monthly basis, though prices were still down compared to a year earlier, a closely watched survey said on Tuesday.

Gannett Co is expanding its DealChicken daily deals service, which will be in more than 50 cities by the end of year, as the top U.S. newspaper chain tries to capitalize on the online coupon craze.

Spain and Italy paid a high price to sell short-term debt on Tuesday, compounding investors' concern that last week's bailout package for Greece left the euro zone's debt crisis unresolved.

The S&P and Nasdaq were little changed in thin trade on Tuesday as investors hoped for a resolution in the debt ceiling stalemate, while industrial stocks fell after 3M's profit failed to top estimates.

At this juncture, the most likely solution to the acrimonious stalemate on Capitol Hill between Democrats and Republicans that threatens to trigger a dreaded U.S. Government default may be a hybrid plan combining elements of bills by Senate Majority Leader Harry Reid, D-Nev., and by House Speaker John Boehner, R-Ohio.

U.S. single-family home prices were unchanged in May, though prices were still down compared to a year earlier, a closely watched survey said on Tuesday.

Deutsche Bank AG warned of weakness to come in its core investment banking division, laying bare the challenge facing its two new CEOs named only hours earlier.

New single-family home sales unexpectedly fell in June, but a sharp rise in prices and declining supply suggested the market for new houses was starting to stabilize, a government report showed on Tuesday.

Stocks fell on Tuesday as concerns about debt ceiling talks offset strong earnings from blue chip companies.

American Apparel signed a multi-year deal with EBay Inc for an online store, as the retailer continues efforts to turn around its sagging sales, sending its shares up as much as 12 percent before the bell.

Social games maker Zynga is partnering with Tencent Holdings Ltd, the Chinese Internet company, to launch its first game in mainland China as it tries to find new users by tapping into the $5.8 billion Chinese games market.

Global sovereign wealth funds are set to hasten investing the billions of dollars of cash holdings they have built up in a rebound from the 2008 financial crisis that has lifted their combined assets to a record.