Memo To Mayer: 3 Points For A Better Yahoo

To: Marissa Mayer, Yahoo CEO

Now that you are starting as the third CEO of Yahoo (Nasdaq: YHOO) in a year, have a seat on the board of directors and are about to run your first company, here are a few things to keep in mind:

First, focus like a laser on restoring the brand of the Sunnyvale, Calif., company, which was probably everyone's first search engine, a place where people went for news, sports and, later, email.

Now, the search engine is run by Microsoft (Nasdaq: MSFT), the world's biggest software company, which tried to buy Yahoo once, and the other services are still leaders. If they can be restored and you can build traffic, that's great.

The company has already been through a shareholder battle, and the three directors from Third Point Capital, who were elected in May and overwhelmingly elected last week by the shareholders, are convinced Yahoo has great value.

The share has lost three percent over the past 52 weeks, lowering the value of the company to only $19.1 billion. There's nowhere to go but up.

Second, work with Facebook (Nasdaq: FB), the No. 1 social networking site, now that prior management ended patent lawsuits and the companies have agreed to collaborate.

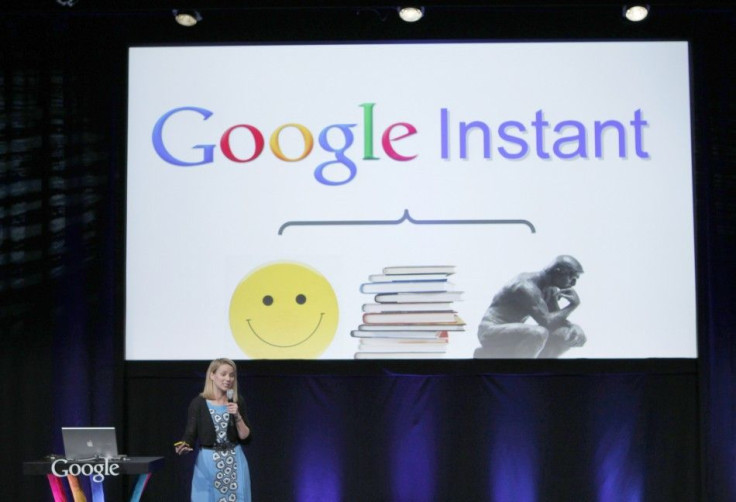

Yahoo so far hasn't ridden the wave in social networking. Google (Nasdaq; GOOG), where you were a vice president and senior manager, got into social networking last year and by now has more than 200 million users of Google+.

There may be plenty of opportunities in this sector for reaching people, as well as new advertisers.

Third, deal with Yahoo's foreign assets, such as its investments in China's Alibaba Group, the online payments company, and Yahoo Japan (Tokyo: 4689), which Third Point and some analysts believe could be valued as much as $40 billion.

After Carol Bartz was fired as Yahoo CEO last September, the old board of directors hired Goldman Sachs (NYSE: GS) and Allen & Co. for advice on restructuring. If new deals can be worked out with these companies, especially with Alibaba so that Yahoo can benefit from growth in China, that could be a great opportunity.

To be sure, Yahoo reported cash and investments exceeding $2.2 billion in the first quarter. Later Tuesday, it's expected to announce second-quarter results. There should be plenty of cash for research, development and acquisitions.

Nobody expects any new CEO to have a detailed plan on her first day on the job, but if you address just some of these concerns, it can only add to your reputation and also help the company.

Investors seem to think so. Shares of Yahoo opened up more than 1 percent at $15.89 Tuesday before easing back to $15.74, up 9 cents.

© Copyright IBTimes 2024. All rights reserved.