MF Global’s Fall: New York Fatality to Euro Crisis

ANALYSIS

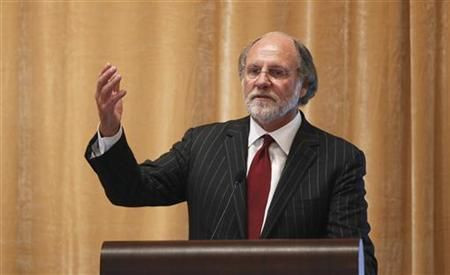

The bankruptcy of New York-based MF Global Holdings brought the European debt crisis to New York, wiping out a respected firm and tarnishing the reputation of a former Goldman Sachs CEO, Jon Corzine.

MF Global filed for bankruptcy in New York after the New York Fed removed it as a primary dealer in debt and the firm was suspended from trading on the Chicago Mercantile Exchange, ICE and NYSE Liffe.

The firm's filing reported total debt of $39.7 billion compared with assets of $41 billion. U.S. affiliate MF Global Finance USA reported debts as high as $50 million and assets of $500 million.

The company's collapse ends for now the saga of a New York-based unit of Man Group, one of London's oldest and most respected commodities and futures groups.

MF Global had been downgraded last week by credit rating agencies that didn't like its massive holdings in European sovereign debt issued by Italy, Spain, Portugal and other countries ensnared in the European debt crisis.

The collapse also tarnishes the role of CEO Corzine, 64, a former CEO of Goldman Sachs, who left to spend $62 million to get himself elected as Democratic senator from New Jersey in 2000, then another $38 million to be elected Governor of New Jersey in 2005.

Corzine was defeated for re-election by Republican Chris Christie in 2009.

Corzine's MF Global stint was his return to Wall Street after a generally respected career in politics. But last week, he took personal responsibility for MF Global's $6.3 billion gamble on European bonds.

Earlier in October, MF Global reported net income jumped 36 percent to $202.5 million on revenue of $385.6 million a year ago. The downturn so fast illustrated the collapse of confidence in European debt, one reason for last week's decision to pump in about $1 trillion into a special reserve fund.

MF Global had also hired a blue-chip bevy of advisers, including Evercore, for advice on a possible sale, as well law firms Sullivan & Cromwell, Weil Gotshal & Manges and Skadden Arps for legal help.

Reports as late as Sunday night said MF Global might be close to a sale to Interactive Brokers, the New York Times reported; other services said some other financial firms had expressed interest.

Besides ending MF Global as an independent firm, at least for now, its collapse may also tarnish the reputation of former Goldman partner J.C. Flowers, now chairman of his own buyout company, JC Flowers & Co.

Now that MF Global is in bankruptcy court, creditors may be able to pick apart holdings, acquiring them for far less than before.

Flowers recommended Corzine as CEO of MF Global and made him an operating partner of JC Flowers. The firm acquired $300 million in MF Global preferred stock with a conversion price of $12.50 a share, as well as a board seat.

MF Global's last trade price before the bankruptcy was $1.20.

The filing may also tarnish the role of MF Global's largest unsecured creditors including JP Morgan Chase, with about $1.2 billion in debt, and Deutsche Bank, with $690 million.

For the last month, Occupy Wall Street demonstrators have demonstrated near Wall Street in New York as well as worldwide. They have assembled outside the Manhattan residence of JPMorgan Chase CEO Jamie Dimon.

contact David Zielenziger at d.zielenziger@ibtimes.com

© Copyright IBTimes 2024. All rights reserved.