Midnight Strike Deadline Looms Large For Detroit Car Giants

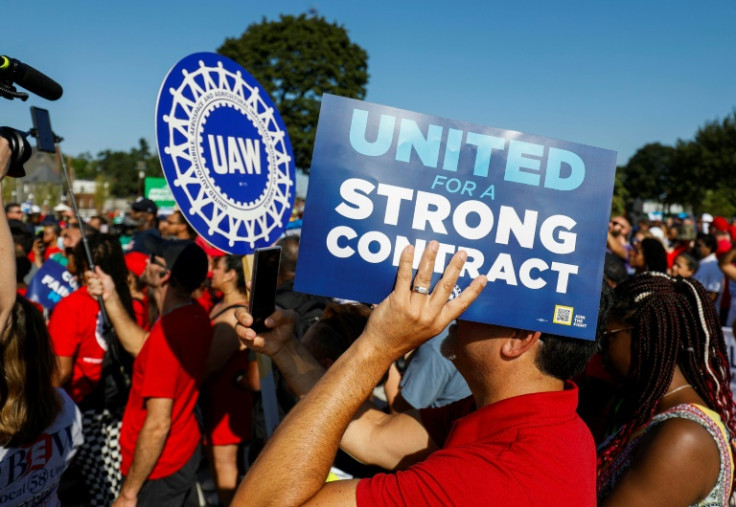

There is a long history of labor strikes at US car plants, but an emboldened auto workers union is poised to announce Thursday the first simultaneous strike of Detroit's "Big Three."

The increasingly likely work stoppage could occur after midnight Friday morning with the expiration of contracts at General Motors, Ford and Stellantis.

Barring a last-minute agreement with one or more of the companies, the union plans to announce at 10:00 pm Thursday which locals will participate in the strike, with the majority of workers remaining on the job, United Auto Workers (UAW) President Shawn Fain said late Wednesday.

"After the first round of locals going out on strike, we will be calling on other locals to go on strike based on what is happening in bargaining," said Fain, who described the plan as aiming to keep the companies off balance.

"At the end of the day, the goal here is to get the best contract we can for our members," added Fain, who said he still hopes to avoid a strike.

Fain, decrying a long stretch of labor defensiveness, said the current moment constitutes a turning point for the union akin to the 1930s. Then, a sitdown strike that originated in Flint, Michigan helped catalyze the UAW.

The 2023 version is the "standup strike," Fain said.

"It is long past time to stand up for the working class, to stand up for our communities and to stand up against unchecked corporate greed," Fain said.

The UAW's demands include a 40 percent hike in wages that Fain has said is needed to match rises in CEO pay.

Thus far, while the Big Three automakers have not matched that level, they have offered double-digit increases.

A note from analysts at JPMorgan Chase predicted that higher costs would be passed on to consumers in increased retail prices as the manufacturers seek to protect profits.

But elevated prices will limit new auto sales and "further push out the recovery in used supply and keep prices elevated," the JPMorgan note said. "The most probable outcome, it seems to us, is that consumers continue to extend vehicle ownership."

Jessica Caldwell, head of insights at Edmunds.com, said the three automakers have a different calculus based on vehicle inventories.

Loftier supplies at Stellantis, formerly known as Fiat Chrysler, would allow it to weather a strike "a little bit better" than the other two companies, where inventories are somewhat improved from last year, but not especially high because of lagging effects from the semiconductor shortage.

That poses a worry heading into the fourth quarter, traditionally a strong period for auto sales.

"As we head into the fourth quarter, that's when we see the most large trucks, large SUVs, (which are) highly profitable vehicles for these three automakers," Caldwell said. "If they don't have the supply on hand, it's really a missed opportunity for them."

CFRA Research said in a note that GM was in the worst position of the three companies as far as vehicle availability.

"Therefore, in the event of a strike, we think GM's inventories could deplete much more quickly," the CFRA note said.

© Copyright AFP 2024. All rights reserved.