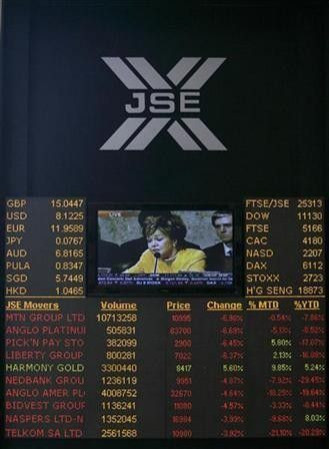

Mining firms drag down South African stocks

Resources firms such as Exxaro led South African stocks lower on Thursday as miners took a knock after weak data from China and disappointing earnings from the United States.

China reported its trade surplus narrowed in September for a second month in a row as growth in exports and imports both came in below forecasts, reflecting global economic weakness.

The start of U.S. corporate earnings season, with JPMorgan Chase & Co reporting lower third-quarter net income, also weighed on market sentiment.

This is just one of those days where there's risk being taken off the table. We had our first disappointment from banks reporting, said Nick Kunze, head of dealing at BJM Private Clients.

The Top-40 index of blue chips shed 1.1 percent to 27,540.79, and the broader All-share index fell 0.9 percent to 30,834.39.

Diversified miner Exxaro had the biggest drop among blue chips, falling 3.5 percent to 171.88 rand.

Impala Platinum, the world's second-largest producer of the metal, slid 2.9 percent to 164.57 rand after agreeing to turn over a 10 percent stake in its Zimbabwe unit to locals.

Zimbabwe has pushed hard in the last few months to have foreign companies, mostly mining firms and banks, to abide by a law to turn over a majority stake to locals.

Only 162.3 million shares changed hands on the Johannesburg bourse, according to the latest exchange data available at 1516 GMT, making Thursday the slowest day of trade in two months.

A total of 140 stocks were down, 110 advanced and 86 were unchanged.

© Copyright Thomson Reuters 2024. All rights reserved.