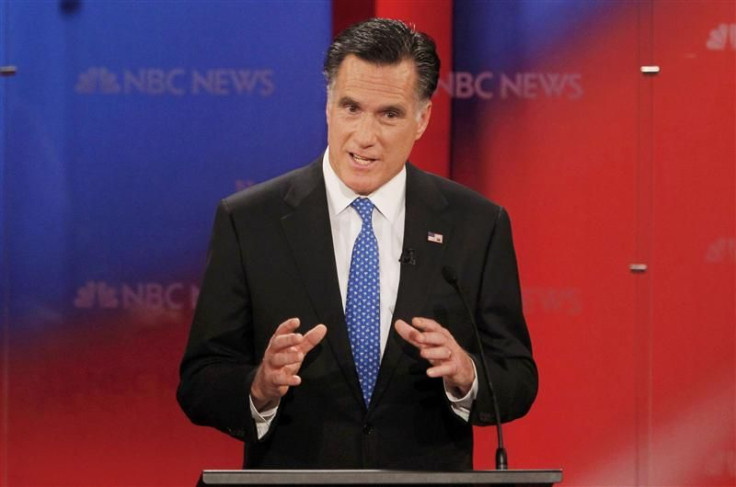

Mitt Romney Tax Return: His 2010 Effective Rate Was 13.9%

Republican presidential candidate Mitt Romney paid only $3 million in federal taxes on reported income of $21.7 million in 2010, making his effective income tax rate 13.9 percent -- lower than the rates paid by the vast majority of wealthy Americans. Romney released his tax returns Tuesday, as promised last week.

The former governor of Massachusetts estimated that he would pay $3.2 million in federal taxes on $20.9 million in income for 2011, implying a 15.3 percent effective rate: higher than the rate he paid in 2010, but still lower than the rates paid by most of his peers.

In 2008, according to the most recent data available from the Internal Revenue Service, just 13.8 percent of taxpayers with incomes over $200,000 paid less than 15 percent in federal taxes. The average effective tax rate for millionaires is 25 percent, according to the nonpartisan Tax Foundation, and the average rate for the richest 1 percent -- those earning $506,000 or more -- is 18.5 percent, according to the nonpartisan Tax Policy Center.

Romney also paid a lower rate than some of his political counterparts: fellow GOP candidate Newt Gingrich had a 32 percent effective tax rate in 2010, and President Barack Obama had a 26 percent rate.

A Very Low Tax Rate

By any measure, Romney's rate was unusually low. This does not mean it was illegal. Romney emphasized, and experts agreed, that he had complied fully with the tax code.

His rate was so low because the majority of his income came from capital gains and dividends, which are taxed at 15 percent, as opposed to wages, which would be taxed at 35 percent in Romney's income bracket. Speaking fees and book royalties would be taxed at the 35 percent rate, but Romney was able to cancel out that part of his income with itemized deductions. These deductions came mainly from charitable contributions -- he donated $4 million to charity in 2011, $2.6 million of which went to the Mormon church -- but also from state taxes and property taxes.

I pay all the taxes that are legally required and not a dollar more, Romney said at a Republican debate in Tampa, Fla., Monday night. I don't think you want someone as the candidate for president who pays more taxes than he owes.

He released his 2010 tax return and his 2011 estimate along with a statement from former IRS Commissioner Fred Goldberg, who wrote that he had examined the returns and found no problems with them.

These returns reflect the complexity of our tax laws and the types of investment activity that I would anticipate for persons in their circumstances, Goldberg said of Romney and his wife, Ann. There is no indication or suggestion of any tax-motivated or aggressive tax planning activities. In my judgment, they have fully satisfied their responsibilities as taxpayers.

Senior White House Adviser David Plouffe told NBC Tuesday that this was a prime example of why tax reform is necessary.

When the average middle-class worker is paying more in taxes than people who are making $50, $60 million a year, we've got to change that, Plouffe said.

© Copyright IBTimes 2024. All rights reserved.