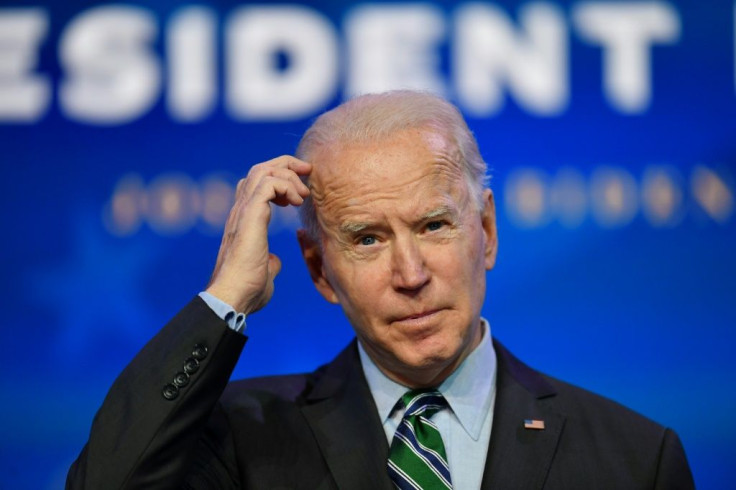

European Stocks Steady Amid Biden Stimulus Doubts

European stock markets were steady Monday despite doubts about the passage of US President-elect Joe Biden's flagship stimulus policy.

London's benchmark FTSE 100 index was down by 0.2 percent at the close, while Paris was slightly higher and Frankfurt added 0.4 percent.

"With so much good news priced in over the last couple of months, stock markets have been running on fumes," said Craig Erlam, senior market analyst at Oanda Europe.

New York markets were closed for Martin Luther King Jr. Day.

Some Asian markets slipped lower following a recent rally, though Hong Kong and Shanghai rose on data showing China's economy expanded by a forecast-beating 2.3 percent last year.

While the reading was the weakest in four decades, it showed growth was picking up again after a devastating start to 2020 as swathes of the country were shut down to contain the deadly coronavirus.

The dollar was mixed against other major currencies, while Bitcoin held steady and oil prices declined.

Traders began to focus on corporate results, Biden's inauguration on Wednesday, and the chances that his huge spending plan can get through Congress.

"European markets have stumbled into a new week, with Biden's stimulus promises doing little to help sentiment given doubts over just how much of that package will be approved in Congress," said Joshua Mahony, senior market analyst at online traders IG.

"Speculation over whether Biden will be able to garner enough support to pass his full stimulus package remain a key concern for markets," he added.

While broadly welcomed on trading floors, the $1.9-trillion stimulus proposal failed to fuel fresh gains because it has already been priced in for the most part.

Concern about a frightening spike in new virus cases kept a lid on buying sentiment meanwhile, as governments are forced to impose lockdowns as they battle to get vaccine programmes off the ground.

On the corporate front, shares in French supermarket Carrefour fell by 6.9 percent to 15.46 euros after Canadian convenience store chain Couche-Tard pulled out of a mega takeover bid.

Elsewhere, newly-created European carmaker Stellantis made its debut on the Paris and Milan stock exchanges.

Stellantis -- created by the merger of France's PSA and US-Italian rival Fiat Chrysler -- is now the world's fourth-biggest automaker by volume.

Its brands include Peugeot, Citroen, Fiat, Chrysler, Jeep, Alfa Romeo and Maserati.

On Monday, its shares gained 6.9 percent to 13.44 euros in Paris, and were 7.6 percent higher at 13.52 euros in Milan.

The group is to make its New York stock market debut on Tuesday.

EURO STOXX 50: UP less than 0.1 percent at 3,602.58 points

London - FTSE 100: DOWN 0.2 percent at 6,720.65 (close)

Frankfurt - DAX 30: UP 0.4 percent at 13,848.35 (close)

Paris - CAC 40: UP by 0.1 percent at 5,617.27 (close)

Tokyo - Nikkei 225: DOWN 1.0 percent at 28,242.21 (close)

Hong Kong - Hang Seng: UP 1.0 percent at 28,862.77 (close)

Shanghai - Composite: UP 0.8 percent at 3,596.22 (close)

Euro/dollar: DOWN at $1.2079 from $1.2082 at 2200 GMT

Dollar/yen: DOWN at 103.65 yen from 103.85 yen

Pound/dollar: DOWN at $1.3578 from $1.3590

Euro/pound: UP at 88.96 pence from 88.90 pence

West Texas Intermediate: DOWN less than 0.1 percent at $52.33 per barrel

Brent North Sea crude: DOWN 0.2 percent at $55.00

© Copyright AFP 2024. All rights reserved.