Obama Pushes Wind, Solar Programs At Las Vegas Summit Amid Turbulent Day For Clean Energy Stocks

President Barack Obama wants to make it easier for Americans to install rooftop solar panels, adopt energy-saving technologies and reduce their reliance on coal-fired power. The president on Monday evening will announce a series of initiatives to make clean energy more accessible and affordable for U.S. homeowners and businesses.

Obama is set to unveil the measures at the National Clean Energy Summit in Las Vegas, an annual draw for green investors, business executives and environmental leaders. His keynote address arrives as U.S. stocks of solar and wind power companies and utilities are bouncing back from a tumultuous day in global stock markets.

The Dow Jones Industrial Average plunged more than 1,000 points early Monday following a global stock selloff in European and Asian markets. All three indexes saw their worst openings since the 2008 financial crisis amid fears that China’s economy is rapidly slowing down. Stocks recovered slightly throughout the day, and by the close, the Dow was down 588 points.

The S&P Global Clean Energy Index (INDEXSP:SPGTCLEN), which includes 30 companies involved in energy production and technology, fell 3.55 percent Monday to 578.61 points by closing. Two prominent exchange-traded funds for clean energy companies -- which analysts track to get a sense of the broader sector’s performance -- followed a similar path. First Trust Global Wind Energy (NYSEARCA:FAN) was down 4.41 percent to 10.19 points at the end of Monday. Guggenheim Solar (NYSEARCA:TAN) dropped 4.01 percent to 27.02 points.

The stock slump, however, will do little to sideline the rapid growth in the U.S. and global clean energy sectors, which have boomed in recent years as countries and citizens seek to trade highly polluting, carbon-intensive fossil fuels for lower-carbon alternatives. The world spent $310 billion in 2014 on solar and wind power, electric cars, energy efficiency, power storage and other segments, a 16 percent jump from 2013 investment levels, according to Bloomberg New Energy Finance.

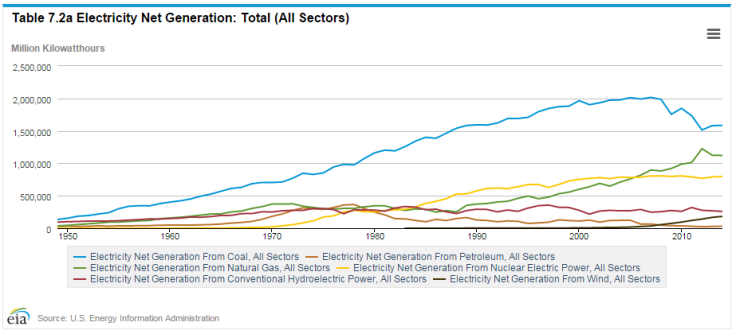

In the United States, solar, wind, geothermal and biomass power together supply 70 percent more electricity generation than they did a decade earlier. Renewables still account for only a sliver of the country’s energy needs, supplying just 7 percent of total electricity generation in 2014, the U.S. Energy Information Administration estimates. But that share is expected to grow substantially in coming decades as federal regulations clamp down on older, dirtier coal plants and as the costs of wind and solar power continue to plummet. This year, 91 percent of all new electric grid capacity will come from natural gas, solar and wind, the EIA forecasts.

“The critical issue for investors to keep in mind is the long-term nature of the growth path for companies and renewable energy in general,” said Ron Silvestri, a senior power utility and renewable energy analyst with Neuberger Berman, an investment management firm. “It’s not about a one-day event.”

Regulations in the U.S., China, Europe and other nations that curb the costs of renewable energy and raise the price of spewing climate change emissions from smokestacks and tailpipes will provide stability and predictability for investors, Silvestri said. He pointed to the Obama administration’s Clean Power Plan, finalized this month, which requires states to reduce carbon emissions from power plants by investing in renewables and energy-efficiency programs.

“Renewable energy growth is really being driven by a transforming fuel mix,” he said. “These are really the key drivers -- not so much one day in the market, which may be bad or good for certain stocks.”

Obama’s announcements Monday aim to continue that shift by enabling more Americans to invest in clean energy systems, the White House said. The president will expand the Department of Energy’s loan guarantee program for distributed energy projects, including rooftop solar panels, energy storage and smart grid technology. The agency will add $1 billion in additional loan guarantee authority, bringing the distributed project program to $11 billion.

A loan guarantee offers assurances to financial lenders that if an innovative technology company were to default on a loan, the government would purchase the debt and pay it down. The same loan program previously attracted criticism for giving $535 million in loan guarantees to Solyndra LLC, the failed solar panel maker that went bankrupt in 2011. The scandal has largely died down, however, and the Energy Department has continued issuing loans and loan guarantees for breakthrough energy technologies.

Through a separate initiative, Obama will unveil $24 million in financing for 11 research projects that could double the energy production from solar panels. The president also will push energy-efficiency incentives for low-income communities, as well as issue new guidance for state-affiliated “green banks” that lend to clean energy companies and green-minded residents.

© Copyright IBTimes 2024. All rights reserved.