Republican Senators Will Save Millions With Special Real-Estate Tax Break

When the U.S. Senate took up the final tax bill Tuesday, more than one-quarter of all GOP senators were voting on a bill that includes a special provision that could give them a new tax cut through their real estate shell companies, according to federal records reviewed by International Business Times.

The provision was not in the original bill passed by the Senate on Dec. 1. It was embedded in the final bill by Sen. Orrin Hatch of Utah, who is among the lawmakers that stand to personally benefit from the provision.

In response to Democratic lawmakers who have slammed the provision as a lobbyist-sculpted giveaway to the rich, Republican Majority Whip John Cornyn promoted on Twitter a column by Ryan Ellis, a registered bank lobbyist who has been working to influence the tax legislation and who has defended the provision.

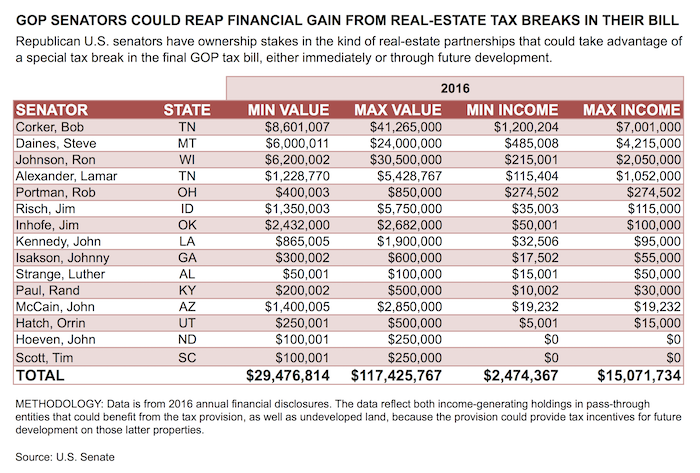

More than a dozen Republican senators (along with their spouses) hold financial interests in over 30 real-estate-related partnerships — worth as much as $117 million in total. Most of the holdings are income-generating investments — and those holdings together produced between $2.5 million and $15.1 million in rent and interest income in 2016, according to federal records.

IBT first reported on the tax carve-out, which allows investors in “pass-through” entities, including real-estate partnerships such as LLCs and LPs, with few employees to deduct part of their income that passes through those partnerships. In response to IBT’s reporting, Republican Sen. Bob Corker, whose disclosure forms list up to $41 million in “pass-through” real-estate partnerships, claimed he did not know of the carve-out when he announced his support for the legislation on Friday, after previously casting the only Republican vote against the bill in the Senate, which did not then include the provision.

In the face of a Twitter-trending hashtag #CorkerKickback, Corker has been vociferously defended by Liam Donovan, a registered lobbyist for the construction and real estate industry who is lobbying Congress on tax reform and specifically on “pass-through rates,” according to federal records.

While Republicans have argued the House version of the bill contained the controversial provision, experts have told IBT the provision appeared in the legislation only after the bill was finalized during House-Senate Conference Committee deliberations.

“The mechanism is completely new and can’t be found in any prior version of the bill,” Matt Gardner, a senior fellow at the Institute of Economics and Tax Policy, previously told IBT.

Because the provision was added by the conference committee, it is “unlikely to have been fully priced into the revenue estimate, because the new provision was never subject to the benefits of crowdsourced analysis of all its implications,” University of Southern California law professor Edward Kleinbard told IBT.

Corker, the Senate’s fourth richest member in 2015, with an estimated net worth of over $69 million, reported the highest 2016 income from real-estate partnerships — up to $7 million — among GOP senators. His income came from three properties held by LLCs that together were worth as much as $35 million. Montana Sen. Steve Daines, whose estimated net worth was $14.4 million in 2015, reported earning between $485,000 and $4.2 million last year in rental income from eight properties managed by Genesis LLC. Daines, with Wisconsin Sen. Ron Johnson, pushed for a more generous tax deduction for pass-through entities during the Senate tax bill process.

Other top earners were Johnson and Tennessee Sen. Lamar Alexander, who earned as much as $2 million and $1 million, respectively, in 2016 from real estate pass-through vehicles.

Elaine Hatch, the wife of the chairman of the Senate Finance Committee who said Monday that he wrote the real-estate tax break and disputed IBT’s report that the provision had not been in previous versions of the bill, owns a stake in a real-estate LLC worth up to $500,000 that generated between $5,000 and $15,000 of income from rent/royalties, interest and capital gains in 2016.

Several of these senators were also top recipients of campaign cash from the real estate industry during the 2016 election cycle. Ohio Sen. Rob Portman’s campaign took in over $900,000 from real estate industry PACs and individuals; Johnson received roughly $780,000; and Georgia Sen. Johnny Isakson got $520,000 from the industry.

Beyond Republican senators, another major beneficiary of the provision could be President Donald Trump, who owns or directs over 560 companies, most of which are LLCs or LPs.

Some lawmakers’ holdings are in undeveloped parcels of land, and would not necessarily reap the provision’s tax benefits when the bill becomes law. However, the provision could provide a lucrative tax incentive to develop the holdings into income-generating properties in the future — the kind that could then take advantage of the tax change.

“Investments in land do not, in themselves, allow business owners to qualify for the pass-through deduction,” New York University law professor David Kamin, a former Obama administration official, told IBT. “The new provision is based on amounts of property that depreciate over time — like buildings. However, land can be combined with things like buildings in a business and then income from the land and other activities can get a preferential tax rate as a result.”

Democrats in recent days have seized on the provision — and its potential benefits to Republican lawmakers — in demanding the bill be halted.

“President Trump made several promises to the American people on tax reform, including the assurance that his tax proposal wouldn’t enrich people like him,” Democratic U.S. Sen. Tom Carper of Delaware told IBT in an emailed statement. “Unfortunately, Republicans are rushing through a tax plan that does indeed enrich the wealthiest people in our country, including business-owners like Mr. Trump. It’s regrettable and, frankly, shameful that my Republican colleagues are rushing ahead with their partisan tax bill despite the mounting questions and concerns about its provisions.”

UPDATE, 12/20, 6:25 p.m.: This article originally included Sen. John Barrasso on the list of senators affected by the provision. His office has said the lawmaker recently divested from pass-through entities. Data about Sen. John Hoeven has been revised to reflect that he recently divested from one partnership, and his farm rental properties would not currently benefit from the provision. After further reporting, additional Republican senators have been added, and the data has been revised to reflect these changes. The story also reflects that the Senate approved the bill Tuesday.

© Copyright IBTimes 2024. All rights reserved.