PRECIOUS ROUNDUP - Gold at highest weekly close; silver at new 30-year high as dollar falls on weak NFP

A weaker-than-expected US jobs data on Friday forced investors to sell dollars and seek shelter in precious metals, helping silver and palladium post two-digit weekly rise and reach fresh multi-year highs in the week to December 3. An IB times study on gold and dollar index suggests investor interest to sell dollar for buying gold probably increased in the week.

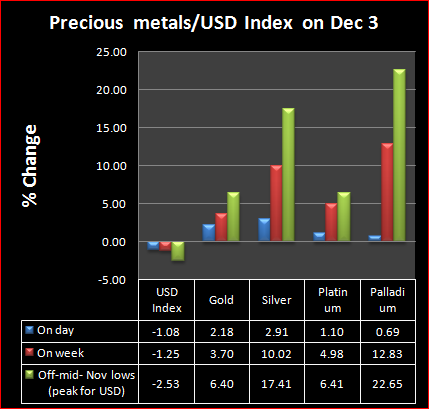

Although a sluggish job growth did not trigger talks about a third round of quantitative easing by the Fed, the regulators have now less reasons to think about the reversal of the accommodative policy, traders said, a view that helped gold cross the $1,400 mark once again in three weeks and end the week up 3.7 percent. Platinum rose 4.98 percent in the seven days to December 3.

Labor department data showed that U.S. employers added only 39,000 jobs in November, much below market expectations of 146,000 rise and compared with a rise of 172,000 in October. The unemployment rate jumped to 9.8 percent from 9.6 in October.

Silver at new 30-year high, palladium at near 10-year peak

Silver for immediate delivery rose to $29.36 per ounce on Friday, its highest in more than 30 years, before settling at 29.33 from previous Friday's $26.66. Palladium jumped to $776.22 an ounce, its highest since March 2001, and closed the week at $765, from previous week's close of $759.72.

Silver was up 2.91 percent on day at close on Friday, taking its week's rally to 10.02 percent. Palladium rose only 0.69 percent on Friday but ended the week up by 12.83 percent.

Silver and palladium were most shining so far in the year, with the first one rallying 74.27 percent from end-2009 levels while the latter rising as much 88.66 percent year-to-date.

It may be compared with gold's 29 percent rise and platinum's 17.41 percent rise so far in 2010.

Gold and greenback

Spot gold rose as high as $1,415.36 per ounce on Friday, only $.8.74 away from its all time high hit on November 9, before ending the week up 3.7 percent at $1,414.49, its highest ever weekly close. The USD index, that tracks the greenback's performance against six major currencies, fell 1.25 percent in the week.

The fact that gold jumped 2.18 percent while the dollar index dropped 1.08 percent on Friday alone suggests the yellow metal took most of its weekly gains on the back of Friday's dollar weakness.

Volatility

Platinum and gold remained steadier metals in the precious group with the volatility on a close-to-close basis on daily charts showing 15.26 for the yellow metal and 21.49 for platinum at Friday's close. It may be compared with 34.41 for silver and 40.06 for palladium. The technical study was done on Reuters charts.

Platinum ended the week at $1,727 an ounce, up $5.28 on the day and from previous Friday's $1,645.

See the chart below for a performance comparison of precious metals in the week to December 3.

Next week

Many analysts believe that a much weaker NFP (non-farm pay rolls) data from the US last week was an outlier especially in the backdrop of a few positive data came earlier in the week including pending home sales that rose 10.4 percent in October against a market consensus of 0.9 percent fall. ISM manufacturing index and a private employment data for November also surprised the market on the higher side.

Stock markets were up on Friday, taking comfort from such a view, which also underlines the importance of data next week.

Important data due from the US are mainly on December 10 Friday including Reuters/Michigan consumer confidence index for November, October trade balance and monthly budget statement for November.

Trade balance and industrial production numbers for October and November consumer price inflation from Germany will help measure the strength of euro and thereby the relative advantage of the greenback over the precious metals. The market will also keenly watch for fresh signals related to the fiscal strength of Ireland, Portugal, Spain and Italy, the debt-laden periphery countries of Euro-region.

Trade balance data due from China and Australian central bank's rate decision due on the week will be major Asia-Pacific signals next week. The market widely expects the RBA (Reserve Bank of Australia) to keep the key rate steady at 4.75 percent this time after a surprise hike last month.

However, the accompanying statement will guide investors about the commodity-driven economy's positioning when China, the largest consumer of commodities and the second largest economy, is expected to take measures to cool domestic price pressures, which will dampen risk friendly investor sentiment across the globe.

© Copyright IBTimes 2024. All rights reserved.