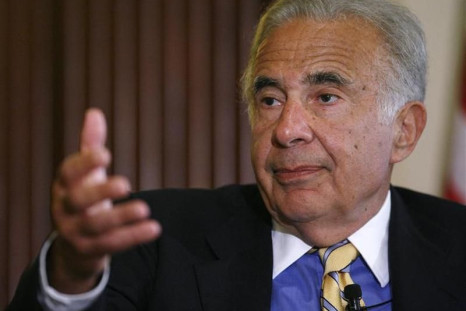

Icahn's Stake In Texas Refiner CVR Now 80%

Billionaire Carl Icahn raised his share in CVR Energy Inc. (NYSE: CVI) to 80 percent and is completing the replacement of the nine-member board of directors after winning the support of shareholders in the Texas-based refiner and marketer of transportation fuels.

Campbell Soup Reports Income Fell 5% In 3Q Sending Shares Down

Campbell Soup Co. (NYSE: CPB) reported net income fell 5 percent to $177 million, or 55 cents a share, as revenue rose to $1.82 billion in its third quarter ended April 29. A decline in U.S. and international sales of its simple meals, a drop in global sales of its beverage products, a rise in the cost of ingredients and an increase in marketing spending were attributed to the 2-cent decline in EPS from the same quarter last year.

Lowe?s 1Q Profit Up, But Earnings Forecast Downgraded

Home improvement retailer Lowe's Companies Inc. (NYSE: LOW) reported a 14.4 percent increase in profit in the first quarter but downgraded its estimated earnings for the year on concerns over momentum in the U.S. housing market on Monday.

Robin Gibb Of The Bee Gees Dies At 62

Robin Gibb, a member of the fraternal trio that created some of the most recognizable sounds of the disco era as the Bee Gees, died Sunday in Oxfordshire, England. He was 62.

Steelmaker Nucor Buys Skyline For $605 Million

U.S. steelmaker Nucor Corp. (NYSE: NUE) said Friday it will buy Skyline Steel LLC and its subsidiaries from Luxembourg's mining and steel company ArcelorMittal (NYSE: MT) for $605 million.

Gold Continues Its Two-Day Rally, Rising More Than 1%

Gold prices continued its rebound Friday after dipping to a five-month low earlier this week. June delivery of the metal rose was up over 1 percent to $1,595 on Friday after jumping 2.3 percent the day before, the biggest one-day gain since January.

Spanish Non-Performing Debt Highest In 18 Years

The ratio of bad debt held by Spanish banks increased in March and hit an 18-year high of 8.37 percent, or $187.5 billion, the country?s central bank announced on Friday. The number of nonperforming loans with payments that are 90 days overdue is now about 10 times larger than it was during the peak of the property boom in 1997.

Spain, Greece Spur Fear, Boosting US Dollar, Bonds: Daily Markets Wrap

European stocks lost big Thursday as Greek banks were cut loose from European Central Bank support and Spain's borrowing costs kept skyrocketing. The head of the International Monetary Fund, Christine Lagarde, also warned today of the extremely expensive consequences of Greece leaving the currency bloc.

ECB To Greek Banks: You're On Your Own, For Now

The European Central Bank in Frankfurt said Wednesday it is temporarily cutting off liquidity to Greek banks that are inadequately capitalized, pushing the onus of emergency assistance on the Greek central bank.

Greece Concerns Counteract Good News In US: Daily Markets Wrap

Greece continued to weigh heavily on confidence Wednesday as bank customers there began sending cash out of the country or hiding it under their beds -- this despite hints from German Chancellor Angela Merkel that a stimulus would be forthcoming if the country stuck to its austerity commitments.

Investors Shift To Safer Stocks On Concern About Greece

U.S. investors bought shares of industrials, airlines, gold mining companies and agricultural assets Wednesday as robust economic data offset fears stoked by the likelihood of Greece leaving the euro zone.

Greece Sends Buyers To German Debt

Germany's benchmark 10-year bond yield approached Wednesday the record euro-era low it struck on Monday, as investors reduced risk exposure as Greece seemed to be edging closer to leaving the currency bloc. The yield fell to 1.44 percent, just over the 1.43 it struck just two days ago, before rebounding to 1.5 in afternoon trading.

German Growth Rescues Euro From Dive

The euro pulled back from a four-month low against the dollar during Asian trading Tuesday after Germany, the euro zone's largest economy, announced first-quarter GDP growth of 0.5 percent.

April US Retail Sales Cooler On Earlier Warm Weather

U.S. retail sales growth slowed last month as warm weather earlier this year pulled shopping that normally occcurs in April into February and March, the Commerce Department said Tuesday.

Europe Uneasiness Endures, China Frees Up Cash: Daily Markets Wrap

Political discord in Greece, voters punishing German Chancellor Angela Merkel's Christian Democrats, lower euro zone manufacturing output and China freeing up cash for lending all contributed to a global stocks slide as investors pursued the safe havens of government debt and the dollar.

India's Inflation Rose More Than Expected In April

India's inflation accelerated in April to 7.23 percent, higher than expected and amid sluggish growth, as food and manufacturing costs jumped.

Carl Icahn To Reveal 'Significant' Stake In Troubled Chesapeake Energy

Shareholder activist Carl Icahn is expected to disclose his acquisition of a significant piece of Oklahoma City-based natural gas company Chesapeake Energy Corp. (NYSE: CHK), which has seen shares tumble amid a federal inquiry, a securities class-action suit and near-record-low natural gas prices. Both parties have yet to publicly confirm the deal.

JPMorgan, China, Greece Weigh On Investors: Daily Markets Wrap

China's announcement that construction was down and manufacturers bought less factory equipment in April drove oil prices down and caused concerns that the global economy was slowing down. These concerns were reflected in market activity.

Bruno Michel Iksil: White Whale, or Jonah?

Following Thursday's financial earthquake at JPMorgan Chase & Co., fingers are pointing to Bruno Michel Iksil, who recently boasted that he could walk on water -- suggesting the French trader's ego is as outsized as the nemesis in Melville's novel from which his nickname the White Whale originates. Whether or not Iksil's reputation will go from fearsome whale to Jonah after he's blamed for the storm and tossed overboard is not yet known.

Respite From Euro Jitters, US Jobs Bolster Stocks: Daily Markets Wrap

New Labor Department data suggests a strong start to jobs growth in January may not get wiped out by negative growth heading into the third quarter.

Japan's Trade Surplus Extends Decline

Japan?s current account surplus fell 8.6 percent in March compared to a year earlier, thanks largely to higher energy costs, the country?s Finance Ministry revealed Thursday. A stronger-than-desired yen is also weighing on export growth and it makes Japanese goods less competitive.

March US Trade Gap Climbs To Record On Non-Oil Imports

The U.S. trade deficit widened to $51.8 billion in March, up from a revised February figure of $45.4 billion, the U.S. Department of Commerce reported Thursday.

Spain, Greece Send Buyers To German, US Bonds: Daily Markets Wrap

Anti-austerity momentum in Greece continued to weigh down markets with the prospect of the country defaulting or leaving the euro. Spain?s Ibex 35 Index lost 3 percent, led by bank stocks, while its 10-year yields rose more than 6 percent over banking-sector concerns.

Euro Zone Uncertainties Sink In: Daily Markets Wrap

Post-election uncertainty in Greece pushed investors away from stocks and commodities, lowering German and U.S. bond yields and eroding the euro's value as investors sought the dollar. France's benchmark CAC 40 Index erased its Monday gains, which had confounded investors. The reality sank in a day late as euro zone uncertainties that popped up over the weekend took root. Greek stocks have lost 10 percent of their value so far this week.

Western Markets Shake Off Euro Election Jitters: Daily Markets Wrap.

Western markets rallied Monday to make up for jitters about French and Greek election results that sent them down earlier. The rebound was possibly due to investors looking for bargains after stocks were dumped Friday after the disappointing U.S. nonfarm payrolls report.

India Delays Tax-Dodge Rule That Riled Foreign Investors

India has delayed for a year the implementation of controversial rules, first announced in mid-March, to combat tax-avoidance, Finance Minister Pranab Mukherjee told lawmakers in New Delhi on Monday.

March German Factory Orders Up, Led By Demand Outside of Euro Zone

Germany's Economics and Technology Ministry reported Monday factory orders rose in March, spurred primarily by businesses looking away from the euro zone and to the United States and emerging markets. Orders rose 2.2 percent from February, spurred by a 4.8 percent growth in export orders from outside the currency zone.

Oil, Stocks, Yields Tumble: Daily Markets Wrap

Disappointing jobs growth in the U.S., together with shrinking manufacturing and services activity in the euro zone, had equities and commodities in retreat and bond yields down. News this weekend isn't likely to calm jitters, with elections in both Greece and France, which may get its first new socialist president since 1981.

Hutchison Resubmits Bid For Debt-Laden Irish Telecom

Hong Kong-based diversified holding company Hutchison Whampoa Ltd. (Hong Kong: 0013) resubmitted its ?2 billion ($2.62 billion) cash bid for Dublin-based Eircom Group Ltd., the closely held fixed, mobile and broadband telecommunications services provider.

PMI: Downward Revisions To April Euro Zone Manufacturing, Services

Output for the eurozone manufacturing and services sectors shrank in April more than initially reported, according to Purchasing Managers Index (PMI) data released Friday by Markit, the London firm that publishes a monthly independent surveys that gauges economic activity worldwide. Business conditions deteriorated at a faster rate towards the end of the month, said Chris Williamson, chief economist at Markit, explaining the downward revision from preliminary estimates released April 23....