ECB Floods World Financial System With €529.5 Billion in Loans

The European Central Bank gave the world's financial system a €529.5 ($712) billion Leap Year Day gift, providing financial institutions with that amount in one percent-interest, three-year loans this week, the bank announced Wednesday morning.

Investors See Huge Euro Injection Tomorrow; Banks, Not So Much

Market participants are seemingly expecting European banks to take up a massive amount of euro over the next 24 hours, as the European Central Bank offers them a second helping of ultra-low cost loans. The banks themselves, not so much.

Airlines Forced to Eat Jet Fuel Price Hikes, Again

Less than three days after U.S. airlines raised fares for the third time this year, the air travel providers are rolling back increases, market trackers are saying. The roll-backs -- which mean airliners, will have to eat up most of the recent jet fuel cost increases -- result from major industry player Southwest Airlines' unwillingness to follow peers in hiking ticket prices.

German High Court Puts Speed Bump In Merkel Bailout Plan

The highest court in Germany delivered a political blow to German Chancellor Angela Merkel and her plans to keep decisions about further European bailouts on the equivalent of a parliamentary fast lane Tuesday.

Conference Board Consumer Confidence Jumps to Year-High in Feb

A closely watched index of U.S. consumer confidence put out by the nonprofit Conference Board climbed to its highest level in a year during February, data released Tuesday show. The Conference Board Consumer Index showed a significant surge during the month, climbing to 70.8 from an upwardly revised 61.5 in January.

European Central Bank Ready To Flood Market With Cheap Euros

The European Central Bank is ready to engage in a new round of aggressive liquidity provision this week, flooding European banks with hundreds of millions of euro worth of cheap financing meant to prop up the tattered European banking and sovereign credit funding systems.

Lowe's Beats Profit View on Warm Weather, Housing Recovery

Profits at the nation's second-largest home improvement retailer rose more than expected in the just-ended quarter as a warmer-than-usual winter, an incipient recovery in the U.S. housing sector and consumer's willingness to once again charge their purchases to their credit cards combined to help boost sales.

WikiLeaks to Reveal E-Mails from Inside Private 'Shadow CIA'

Global anti-privacy organization Wikileaks announced Sunday night it would be releasing over five million emails hacked from the servers of a private intelligence newsletter publisher that's been called a shadow CIA by others.

Soaring Gasoline Prices: Six Things You Need to Know

The prices of gasoline and other energy commodities are on the rise -- with further increases just over the horizon -- and it appears that everyone is taking notice.

Michigan Consumer Sentiment Keeps Beating Expectations

A closely watched index of U.S. consumer sentiment narrowly beat market expectations Friday morning, as the continuing optimism about where the economy is going was reflected in the data.

Weekly U.S. Economic Snapshot: How Are we Doing?

Housing, the weakest of the three legs of the stool supporting the U.S. economy, is finally firming up, or so it seems to investors, economists, real estate agents and buildings after a string of heartening reports so far this year.

Fed To Sell Rest of Toxic Waste Bonds From Bailout: Bloomberg

At least one large financial institution has approached the Federal Reserve Bank of New York with an offer to buy out the remaining mortgage-backed toxic waste bonds it received from AIG as collateral for a $19.5 billion bailout in 2008, according to Bloomberg News, as banks are looking to profit from what many see as an incipient turnaround in the U.S. housing market.

As Euro Economy Stagnates, German Business Confidence Up

A closely-watched indicator of German business confidence jumped in February, the fourth month in a row the index has risen, suggesting that country's economy is continuing to grow at a moderate pace even as the wider Eurozone area experiences near-recessionary stagnation.

5 Worst Job Interview Mistake FAILs

An economy that is turning around means there's more people interviewing for newly-minted positions. Yet even during the worst of the downturn, when people should have known better than to make a bad impression, job applicants were committing mind-boggling, jaw-dropping mistakes during their interviews.

Newmont Mining Expects Strong 4Q

As one of the world's top gold producers, Newmont Mining Corp (NYSE:NEM) seems to have a lot of advantages on its side. But uncertainty about peripheral items, including the effect of recent acquisitions and political developments that could hurt its bottom line, are keeping Wall Street analysts skeptical on the company.

Cars Without Drivers to be New Normal For Australian Ore Miner

Rio Tinto PLC, the world's second largest iron ore miner, is set to spend more than half a billion dollars automating cars, trains and trucks at one of its Western Australia mines so that they can be operated remotely.

Japan Trade Deficit Up on Aftershocks from Earthquake

Japan reported a record-high balance of trade deficit in January as last year's tsunami combined with floods in Thailand, the Eurozone's sovereign debt crisis, a slowing Chinese market and a soaring yen to leave the world's third-largest economy with its first trade deficit since the last century.

Stock-Market Indicators Forecasting Slump in Near Future

The major U.S. indices floated close to yearly highs Friday, but extremely low volumes of trading, divergences in the behavior of important sub-indices and various other technical indicators suggested U.S. equities might be in for a price-slashing correction soon.

Air Australia Collapse: How It Happened

The convoluted path of Air Australia, which is less than four months old and operated on a leased fleet of five aircraft, is being framed as a case study in which corporate hubris and a hands-off approach from corporate regulators combined to deliver a spectacular demise.

Weekly U.S. Economic Snapshot: How Are We Doing?

Bit by tiny bit, the economy is improving. The progress might at times seem too small or slow to be evident, but it is unmistakably occurring. People may not feel things are good yet, but they are beginning to feel the worse is subsiding, Gary Thayer, chief macro strategist at Wells Fargo Advisors, said.

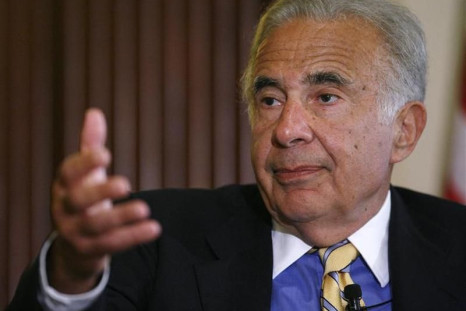

Icahn Sweetens Offer for CVR Energy

Activist investor Carl Icahn announced Thursday he was sweetening a takeover offer for independent petroleum refiner CVR Energy Inc. (NYSE:CVI), proposing to buy all outstanding shares of the company, in cash, at $30 a share.

India's Economic Growth Leaves Starving Children Behind

India's economy, a paragon of development, has more than tripled over the past 20 years, fueling a growing middle class that has helped turn the world's largest democracy into an engine of the world economy and raised millions out of poverty. It is behind only China, in terms of population. But there is one shocking statistic India's economic miracle has not been able to improve: the number of children that are severely malnourished.

Bond Market Update: Rally in Corporates Disguises Churning, Convoluted Dynamic

A current rally in the sprawling $7.74 trillion field for corporate bonds, which are issued as debt by major American corporations, belies a great churning occurring just beneath the market's surface. Recently, Richard Prager, who heads the bond strategy desk at the world's largest asset management firm, put it succinctly: "Houston, we got a problem."

Fed Minutes Reveal Accord on Low Rates, Split on Bond-Buying

Minutes of the Federal Reserve Board's January meeting confirm that current board governors are divided on engaging in another round of bond purchasing, but they also portrayed the central bank leaders as agreed on the propriety of ultra-low interest rates.

Greece After Riots: Life, Euro Drama Goes on in Athens

Greece is currently straddling the knife's edge of crisis, as a deeply unpopular decision by the country's political leadership to impose painful economic austerity measures on the populace to receive a bailout from foreign creditors has not achieved its desired results. Pictures of life in the nervous country.

Empire State Manufacturing Index Up On Future Expectations

An important leading indicator on the state of national manufacturing revealed a high level of optimism in that economic category, suggesting the recovery underway in that sector could become a rolling trend.

Eurozone GDP Falls Less Than Feared In Q4

The economic output of the 17-nation Eurozone declined by 0.3 percent in the fourth quarter of 2011 when compared to the previous quarter, a more-optimistic-than-expected data point that is raising hopes Europe will be able to avoid falling into a technical recession.

European Economic Data Takes Glum Turn as Factory Output Falls

The 17 member nations of the euro common currency union, dragged down by the flagging economies of Greece, Portugal, Spain and Ireland, saw factory activity decrease more than expected in December, the statistical office of the European Union announced Tuesday.

Europe to America: Help!

A European finance minister, in Washington for a panel on global business and economics, sent up a flare to U.S. officials Monday afternoon, saying he hoped the U.S. would be more involved in playing a key role to solving the ongoing sovereign debt crisis in Europe.

Valentine's Day Gift Buying Could Leave U.S. Retailers Jilted

While Valentine's Day has always been sure to disappoint lonely hearts, this year's festivities also may dishearten the retailers used to sweetheart sales during the period, various economic indicators suggest.