Chinese, Spanish, US News Hammers Investors: Daily Markets Wrap

The bears were on the prowl Friday, as negative economic news out of China, Spain, and the U.S. left global investors struggling to find safe places for their cash -- and the positive developments that did surface appeared to have little effect.

Citigroup's 1Q Earnings Expected To Be Flat

Analysts expect quarterly revenue of $19.85 billion, which would be a bump up from the $19.73 billion Citi posted a year ago. Net income is expected to be 99 cents a share, compared with $1 a share in the first quarter of 2011.

US Consumer Confidence Down On Mixed, Polarized Readings

A preliminary survey of consumer confidence for April shows the lackluster job creation seen in March is playing into people's pessimism more than economists had expected. But a recent, tiny, decline in gasoline prices, following a dizzying climb at the beginning of the year, is at least making consumers feel better about inflation and hence, expectations for the future.

Investors Pump Money Into Stocks Hoping For A 'Goldilocks' Moment: Daily Markets Wrap

Risky assets rose on moderate volume and moderately bad news Thursday, as investors seemed to be placing a paradoxical bet that a slowdown in economic growth would jolt the U.S. central bank into action -- inflating the prices of stocks, commodities and other assets -- while at the same time assuming the slowdown would not be so harsh as to throw the current recovery completely off track.

Wells Fargo Seen Riding Wave of Mortgages to Solid 1Q Earnings

Wells Fargo & Co. (NYSE: WFC) is expected to report a big jump in quarterly earnings and a small rise in revenue on increasing mortgage refinancing during the first three months of the year.

JP Morgan Chase, Wall Street Enigma, Sees Earnings Upside

That Wall Street expects J.P. Morgan to outperform its peers shouldn't come as a surprise. Besides being the biggest, it's arguably among the three or four most stable big banks.

Spike From Best Buy CEO Exit Reverses On Fundamentals

At one point Tuesday the shares fell to 31 percent below their price on June 23, 2009, the day before Dunn took over as CEO, through Monday's close. Initial euphoria over Dunn's resignation soon gave way to a selloff.

IBTimes 1000: Clean Tech German Sector Booming At Home and Abroad

The world's demand for alternative energy sources is powering growth in German industry, or so a look at the list of fastest-growing public companies in that country would suggest. Already the world leader in solar panel manufacturing, Germany is also home to an array of booming companies whose business is on the more peripheral side of clean energy creation and conservation.

GM China Sales Up On Demand for Buick Excelle

GM sales in China rose sharply in March, a somewhat unexpected increase, as competitors in the country are seeing only modest gains. Sales were driven into high gear by the six-speed Buick Excelle, a luxury sedan manufactured locally that -- at over $20,000 -- is an icon of achievement for the burgeoning upper middle-class in China.

Markets Tailspin On New Greek Bank Woes

Stocks and commodities plunged Wednesday after the head of the European Central Bank -- a lynchpin in the euro zone's effort to contain the effects of its sovereign debt crisis -- suggested that some Greek banks will be left to collapse.

Fed Minutes Send Markets Lower On Dimmed QE3 Hopes: Daily Markets Wrap

Investors re-adjusted their value calculations for risky assets on Tuesday, selling off stocks, bonds and all manner of commodity futures after the Federal Reserve released minutes from the most recent meeting of its rate-setting committee. The minutes strongly suggested that the U.S. central bank was backing away from the possibility of further monetary easing in the short-run, including any kind of quantitative easing.

Indonesia Mulls Steep Tax On Mineral Exports

One of the world's largest exporters of raw materials is working to introduce a steep tax on just such shipments this year, Reuters is reporting, a move that is catching foreign investors and major trading partners by surprise.

Big Brazilian Companies Eye Major Portuguese Cement Maker

Two Brazilian industrial titans are circling a big Portuguese cement maker in the latest sign that the euro zone's recession is cutting the value companies based in struggling European countries and making them takeover targets.

Euro Zone Unemployment At All-Time High as Europe Simmers

Unemployment in the euro zone grew to 10.8 percent in February, up from 10.7 percent in the prior month and the highest since the euro was adopted as a currency, Eurostat, the statistical arm of the European Commission, said Monday.

European Action, Upbeat US Data Drive Results: Daily Markets Wrap

Stocks and other risky assets rallied Friday, rounding out the quarter with even more price gains on a day that encapsulated the main developments of the year so far: encouraging news out of Europe, better-than-expected consumer sentiment in the United States, and the perceived and steady pull of inflation.

A 3rd Bailout For Greece May Be Needed: PM

Greece will do everything possible to make a third adjustment program unnecessary, Lucas Papademos told an Italian business daily. Having said that, markets may not be accessible by Greece even if it has implemented fully all measures agreed on.

Markets Sell Off Despite Positive Jobs Data: Daily Markets Wrap

Positive jobs data from the U.S. and Germany were not enough to keep investors bullish Thursday, as a moderate asset sell-off continued, with traders apparently squaring up their positions in anticipation of earnings season.

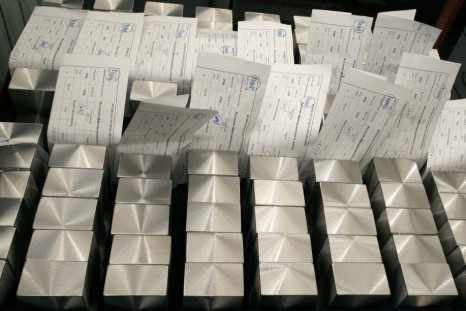

Palladium Set to Soar in 2012: Survey

Palladium prices are set to soar this year, buoyed by high levels of speculative buying, unwavering industrial demand and the general upward price pressure commodity metals are seeing in a zero-interest rate environment, according to a report issued Thursday.

Consumer Confidence Dips In March

Consumers are still confident about the state and medium-term trajectory of the U.S. economy, a highly-influential survey of consumer confidence indicated Tuesday, but an increasingly polarized view of the situation in the labor market -- as well as less-optimistic predictions about the future -- means they are expressing that optimism less emphatically than a month ago.

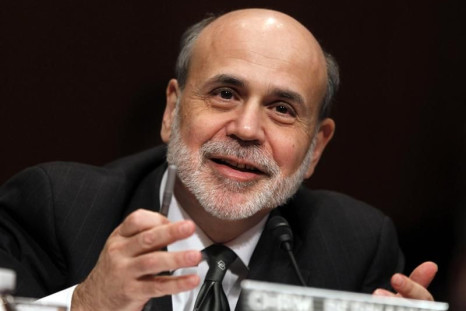

Bernanke Comments Send Markets Into Rally

After calling the recent recovery a puzzle, markets reacted enthusiastically to Fed Chairman Ben Bernanke's pronouncements

TIPS Yields Negative, A Record Low, On Inflation View, Fed Action

Yields on 10-year inflation-linked Treasury bonds fell into negative territory Thursday -- only the second time that has happened -- ona flight to quality in U.S. notes, a belief that inflation will begin rising and the seemingly heady effect of the Federal Reserve's Operation Twist.

US Economic Snapshot: How Are We Doing?

Analysts, economists, and market participants were concerned with three things this week, and three things only: inflation, inflation, and inflation.

Mali Coup Leaders Steer Clear Of Economic Upheaval

Although leaders of the military coup in Mali appear to be rounding up and jailing potential opponents among politicians and policymakers, they seem to be trying to minimize disruptions to the economy and daily life, leaving in place government ministers in charge of finance, trade and industries.

Gold Miners Say Mali Coup Not an Issue For Them

A coup d'etat currently underway in Mali is not affecting gold production there, miners in the country are saying, as events related to the military uprising seem confined to the country's capital, hundreds of miles away from where gold deposits are located.

Biggest Freighters Hit Hardest In Global Shipping Storm

While shipping costs have been recovering over the past month from historical lows earlier this year, rates for the biggest vessels keep falling. Mistrust in the market, bad luck for iron exporters and a slowdown in world steel consumption are to blame.

Markets Bob Up, Down on Slow News Day: Daily Markets Wrap

Markets bobbed up and down Wednesday on conflicting data as to what the U.S. economic picture will look like in the near term. Investors spent the day dealing with conflicting sentiments: a less-than-enthusiastic housing report on the one hand, a view that the U.S. economy is generally getting better on the other.

ING to Sell Stake in Landmark Polish Mall

Dutch financial giant ING Groep N.V. (NYSE:ING) is selling off its stake in a landmark Polish shopping mall, the company announced Wednesday, in an effort to further minimize its exposure to the European real estate market.

Chinese Hard Landing Fears Weigh On US Assets: Daily Markets Wrap

U.S. asset markets sold off Tuesday as investors interpreted new data from China to mean that country's economy might be slowing down faster than previously thought. Of paramount concern was a government report showing new home prices had recently declined in 45 of 70 major cities, with prices static in 21 other metropolitan areas.

AcelorMittal To Close Luxembourg Steel Plant

AcelorMittal, the world's largest steelmaker, announced Tuesday it would keep an operating unit in Luxembourg shuttered indefinitely, the result of poor demand amidst a weak housing market in Europe.

Exxon Valdez, Marking Anniversary of Famous Spill, Slated to Be Scrapped

Nearly 23 years to a day after an overworked mariner crashed it into a reef, causing it to spill hundreds of thousands of barrels of oil into the pristine Alaskan sea, the bulker formerly known as the 'Exxon Valdez' is being retired and sold for scrap. In an ironic twist, the ship at the center of one of the most infamous environmental disasters ever will be recycled in a process called one of the greenest by an executive in the vessel demolition world.