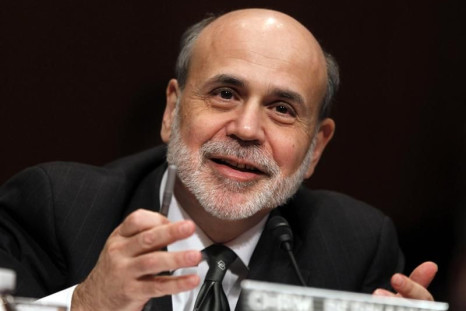

Pessimistic Fed Gives Markets 6 More Months Of Twist

The powerful rate-setting committee of the Federal Reserve decided to extend its current strategy of manipulating the credit markets to artificially depress the cost of long-term financing, a strategy colloquially known as Operation Twist, until the end of the year.

How Much Does Coca-Cola 'Like' Facebook? Enough To Take A 'Leap Of Faith'

The chief marketing executive at Atlanta-based soft drink giant Coca-Cola Co. (NYSE: KO) said he believes online and mobile advertising is an effective driver of sales for the company, even if it can't be quantified with any currently available standard measures.

Lumber Shipments Signal Stronger Than Expected Homebuilding Recovery

The amount of lumber being moved through America's intercity rail system suggests a stronger-than-witnessed housing recovery could be just around the corner, according to London-based economics research company Capital Economics.

Commodities Take Bearish Turn After Early-Monday Rally Fizzles

Commodity prices posted a brief rally on Monday after a pro-austerity party got the most votes in Greece's weekend elections, but the market's upswing fizzled almost as soon as it began, confounding traders who might have expected developments to lift risky assets for at least a few of sessions.

Pictures Of Chaos In Greece, Courtesy Of German Broadcaster

Ahead of what is likely to be a week full of drama, stomach-churning market action, and violence in the streets of Athens, a German documentary is making the rounds online outlining the severe socioeconomic dysfunction that led Greece to its current state of affairs.

Europe's Future Hangs On Who's Got The Best Bluff

Political brinksmanship is a common feature of modern democratic politics. Nowhere on the planet, however, is the convoluted logic of basing your electoral strategy on claiming the other guy is bluffing seen as splendidly as in Greece.

Stock Markets In Spain, Italy, Greece Rise In Spite Of Headlines

A dead cat bounce was apparently at play Thursday in the equity markets of Spain, Italy and Portugal. With no more room left to fall, stocks rose in those three countries, propped up in spite of horrendous headlines across the financial media.

Spain's Next Downgrade, Already In Motion, Could Trigger Bank Run

Moody's Investor Service's downgrade of Spain's sovereign debt sent the nation's borrowing costs sky high on Thursday. But as costly as this latest downgrade is, the next one could be even more devastating.

Gold, Metals Rising in Anticipation of Monetary Stimulus

Precious and industrial metals have been moving higher over the past few sessions in spite of fundamentals, suggesting commodities traders are loading up on the physical assets in anticipation of seeing at least one of the world's major central banks turn on the money spigots later this month.

Dimon Says JPMorgan's Actions 'Violated Common Sense'

JPMorgan Chase & Co (NYSE:JPM) Chairman Jamie Dimon floated unscathed through a hearing of the Senate Banking Committee meant to examine what happened inside his banking behemoth earlier in the year, when a massive bet on the credit-default swaps derivatives market reportedly meant to 'hedge' other bank risks went sour, resulting in multibillionaire losses.

Why Spain's Bank Bailout Failed: It's Called 'Subordination'

The European Union's ?100 billion ($126 billion) bailout of Spanish banks may have, at least temporarily, saved those institutions. But the rescue is being judged a failure by the markets, as it appears to have seriously damaged the government's ability to borrow from international creditors, something a country running on deficit financing for the foreseeable future is vitally dependent on.

Front-Running Markets, Spaniards Rage Against Bailout On Twitter

Global markets disapproved of the Spanish bailout on Monday. People monitoring Spanish Twitter feeds had an early warning.

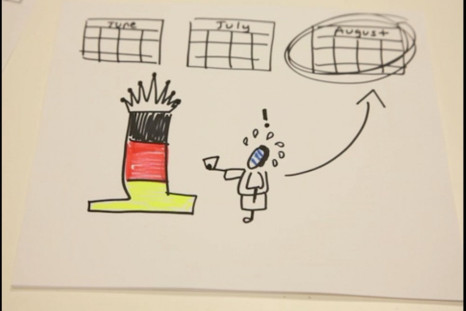

George Soros Speech, 'Most Important' on the Euro Financial Crisis ... Illustrated

After George Soros, the influential hedge fund manager, posted a speech he gave at an economics conference in Italy last week, the financial blogosphere lit up. It got lots of praise as the best analysis yet of the ongoing fiscal debacle in Europe. But at over 4,400 words, it's definitely not for the ADD-challenged. Which is why we've turned it into a handy illustrated video.

George Soros Speech 'Most Important' on the Euro Financial Crisis -- Illustrated

After George Soros, the influential hedge fund manager, posted a speech he gave at an economics conference in Italy last week, the financial blogosphere lit up. It got lots of praise as the best analysis yet of the ongoing fiscal debacle in Europe. But at over 4,400 words, it's definitely not for the ADD-challenged. Which is why we've turned it into a handy illustrated video.

Fed Says Little Banks Should Follow Strict Basel III Rules

The Federal Reserve is proposing that U.S. banks, large and small, abide by a rigorous interpretation of an international capital standards agreement known as Basel III.

Italian Banks Primed To Blow Up

Italian banks appear close to joining Spanish banks as the euro zone's latest contribution to the financial world's endangered species list.

Merkel Seen Easing Stance Against Aid For Struggling Banks

German Chancellor Angela Merkel appears to have altered dramatically her long-held opposition to euro zone nations sharing responsibility for the debts of the monetary union's most troubled banks.

Euro Crisis Forcing Central Bankers Outside Euro Zone Into Uncomfortable Stances

Massive movements of capital during the latest occurrences of the European financial crisis have forced central bankers into the role of circus contortionists: bending into positions in order to maintain their stated policy targets. And their antics are not being bought by all, with some wagering that these bankers' next attempts will result in a broken back or two.

Portugal To Keep 3 Big Banks Going With $8.2B

Portugal will give ?6.6 billion ($8.2 billion) to its three largest banks to help them beef up their balance sheets. Receiving the capital injection are two private banks, Banco Comercial Português and Banco BPI, and state-owned Caixa Geral de Depositos.

CFTC Probing JPMorgan Emails: WSJ

The U.S. Commodity Futures Trading Commission has issued subpoenas to JPMorgan Chase & Co. to determine whether fraud was committed in connection with the bank's multibillion-dollar proprietary-trading fiasco, the Wall Street Journal reported Friday.

Euro Zone Unemployment Grows By 110,000 In April

Some 110,000 people were added to the unemployment rolls of the 17-nation euro zone in April, the statistical office of the European Union reported Friday, once again setting a record high, as every country in the common currency agreement save for Austria, Germany and Ireland reported a deteriorating labor condition. The unemployment rate held steady at 11 percent.

How Low Can They Go? Forecaster Sees T-note Yield Falling To 1.32%

Following a high-volatility period over that past few days that has seen the political situation in Greece worsen, highly disappointing economic data prints in the U.S. and China and -- most prominently -- a surprise banking crisis in Spain, U.S. Treasuries have been hitting historically low yields on a daily basis. Lawrence Dyer, a New York-based rates strategist for British giant bank HSBC says should soon fall to 1.32 percent or lower.

Greece Struggles To Keep The Lights On As Trade Credit Crunch Bites

A trade credit crunch, driven by trading partners' fears that Greek businesses will soon be refusing to honor their debts in euro, is making it difficult for Greeks to keep their economy running.

May Retail Sales Stronger Than Expected: Reuters

Several top retailers reported stronger-than-expected sales in May Thursday, Reuters is reporting, providing a moderate surprise to Wall Street retail analysts, who had warned May might prove a disappointing month in terms of revenue for many stores.

World Bank President: Euro Bonds Need to Be On the Table

World Bank president Robert Zoellick is calling for the issuiing of a supranational euro bond that would be backed by credit guarantees from stronger euro zone economies while providing cheaper funding to struggling ones.

US Treasuries Hit All-Time Lows For Second Day In A Row

Investors flocked into longer-dated U.S. Treasuries for the second day in a row on Thursday, sending the yield on those products to all-time lows. The movement was one of the clearest signals that money managers took into account the crisis in Europe and some weak U.S. economic data figures and decided against moving into riskier assets.

Spurned by Saviors, Spanish Bank Turns to ... Spider-Man

Facing what seem to be minute-by-minute rejections of various bailout scenarios, Spanish bank Bankia S.A. -- the country's fourth-largest financial institution, which is currently embroiled in a crisis of insolvency -- is putting its faith in the web-shooting hands of a Marvel Comics superhero, Spider-Man.

EU Recommends Bank Bailout 'Union'; Germany Shoots Down Plan

The European Union recommended Wednesday that the 17 countries of the euro common currency union create and fund a banking union for bailing out insolvent banks, preventing the fiscal and political stresses such moves have on individual national governments. The union would be funded by the European Stability Mechanism, one of the EU's standing bailout funds.

Italian Borrowing Costs Soar As Investors Lose Appetite for Peripheral Debt

Italian government borrowing costs rose Wednesday to crisis levels as international investors, spooked by developments in Greece and Spain over the past few days, shied away from lending to that recession-ravaged peripheral European economy.

Spain's Desperate Effort To Save Its No. 4 Bank - AIG All Over Again?

U.S. investors came back from a long holiday weekend Tuesday to news of Spain's government aiming to stave off an apparently imminent collapse of nationalized financier Bankia S.A. -- the country's fourth-largest bank -- with a ?19 billon ($23.8 billion) capital injection.