Bank Stocks Throw a Party But Forget To Invite JPMorgan

Shares of U.S. banks of all sizes and specialties rose Friday over 3 percent, handily beating the performance of the wider stock market, which itself was in a head-first rally following a week of disappointing news. But there was one big exception to the equity party: megabank JPMorgan Chase and Co. (NYSE:JPM), which looked poised to underperform its peers in late-afternoon trading.

Market in Full-Swing Rally Following Week of Disappointments

The financial markets were in a full-throttle rally Friday as stocks, bonds, commodities and foreign currencies all rose, following a week of sell-offs amid various policy and economic disappointments.

Knight Capital, Firm At Center of Wednesday NYSE Trading Glitch, On The Ropes

The firm at the center of a software glitch that prompted highly irregular trading patterns Wednesday morning in shares of more than 100 New York Stock Exchange issues is hanging on by a thread.

Draghi Not The Only One Telling Investors Not To Short The Euro

In a press conference Thursday, European Central Bank President Mario Draghi warned "it's pointless to go short on the euro." The suggestion was lampooned. It turns out, Draghi isn't the only one with that recommendation

ECB Head Mario Draghi In Central Banker 'Hell' After Atrocious News Conference

ECB President Mario Draghi was in policy hell Thursday after disappointing market-watchers at what was the most anticipated and important press conference of his career as a monetary policy leader.

Reaction To NYSE Trading Glitch Muted As Feds, Lawyers Monitor Fallout

The reaction to a market disturbance the affected the price of stock in hundreds of companies early Wednesday was markedly muted late in the day, as market participants, exchange operators and regulators were still trying to get a grasp on exactly what had just occurred.

NYSE Trading In Technical Crash; Volume Explodes

The New York Stock Exchange is looking at irregular trading in the stock of 140 companies, a substantial chunk of the over 2,800 tickers listed on the world's most prominent bourse, after a morning filled with bizarre market action that at least one market analyst is dubbing "flash crash epic."

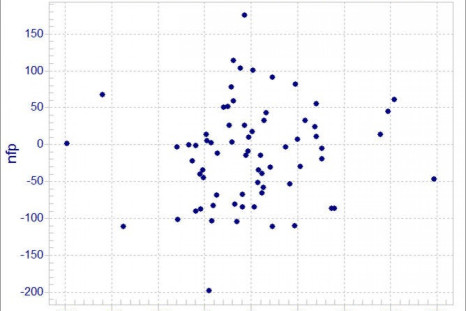

Positive Employment Report Data Nothing To Cheer About

The ADP employment report out Wednesday morning seemed to have a bit for everyone, with both optimists and pessimists claiming the data release supported their views. A slightly more nuanced view of the data seems to hand the case to the bears

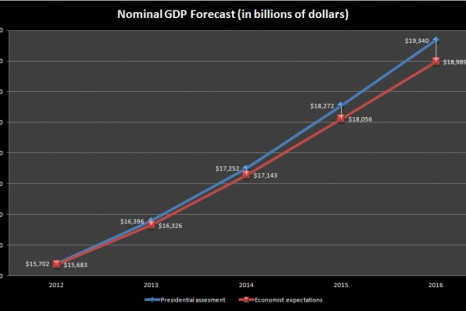

White House Numbers On GDP Growth Optimistic Even By White House Standards

The numbers released by the White House Friday on a Friday report of the future direction of the U.S. economy look optimistic when compared to economist predictions also included in the report.

AIG Earnings Preview: Lower Profit From Divested Assets

In spite of low expectations for profit, market-watchers are actually increasingly bullish on AIG, believing the most important thing to watch when the company reports quarterly results Thursday will be its plans to buy back stock from its largest shareholder, the U.S. government.

Finance to Lose 200,000 More Jobs, Says Respected Bank Analyst

A bank equity analyst famous in financial circles for her prescient analysis on the global banking sector said Tuesday morning she sees the financial industry shedding another 200,000 people off the payrolls in the coming months.

Gold Above $1,600, Could Go Higher As Investors Rediscover Safe-Haven Status

Gold futures steadied over $1,600 per ounce Thursday, breaking above a level the precious metal had not seen since early July.

Horrible GDP Numbers In UK Leave Economists Incredulous

The latest figures on U.K. GDP, released this week, were so demoralizingly bad that some economists and market-watchers are simply refusing to believe them, suggesting they are the result of a statistical anomaly and will be subject to large upward revisions soon.

In Advance Of Q2 US GDP Release, Forecasting Economists Race To The Bottom

The more data market-watchers have seen on the U.S. economy, the less they like what they've seen. Specifically, predictions on what the government might report as the rate of GDP growth in the second-quarter of 2012 have plummeted in the past few weeks, as economists adjust their models to one disappointing data release after another.

Former Citigroup CEO: It's Time to Break Up The Big Banks

Former Citigroup chief executive Sanford I. Weill, one of the most important players in the deregulatory push of the 1990s that repealed the Glass-Steagall Act and allowed the formation of too big to fail banks, said on CNBC Wednesday morning that the nation's financial supermarkets should be split up by government mandate.

World's Reaction to Spanish Crisis: Screw Them!

The financial and fiscal crisis in Spain entered a new and dangerous phase Tuesday as economic, political, civic and diplomatic links appeared to quickly disintegrate in the face of panic-stricken markets.

Traders Pile Into Explosive Natural Gas Rally

Traders piled into a frothy rally in the natural gas markets Tuesday, sending the price of the energy commodity to 2012 highs and seemingly hoping to turn a quick profit with a highly volatile trade before the market's momentum shifts.

For Investors In Bank Stocks, Profit, It Seems, No Longer Matters

Investors seem to be disregarding the parade better-than-expected profit figures from major financial institutions this earnings season, instead using top-of-the-line revenue and return on equity numbers to guide their investment decisions.

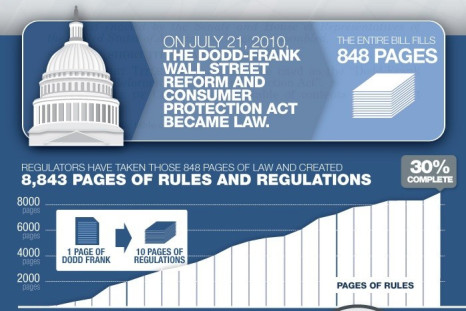

Dodd-Frank Rules Nearly 9,000 Pages, But It's Less Than One-Third Finished

A summary report released Thursday by the law firm David Polk and Wardell LLP graphically illustrates the mind-boggling complexity -- and high level of delay -- regulators have faced attempting to implement Dodd-Frank.

Markets Cheer Walgreen For Express Scripts Deal

Large U.S. drugstore chain Walgreen Co. (NYSE: WAG) announced Thursday it would be renewing its contract with Express Scripts Holding Co. (NASDAQ: ESRX), to provide customers of that pharmaceutical claims manager with prescription drugs at Walgreens retail stores.

Geithner Media Tour Unlikely To Silence LIBOR Critics

U.S. Treasury Secretary Timothy Geithner appeared on a CNBC-sponsored conference Wednesday morning toeing the government's party that the New York Fed is not to blame for helping keep the evolving LIBOR rate-fixing scandal under wraps, even though they knew it was going on since at least 2007.

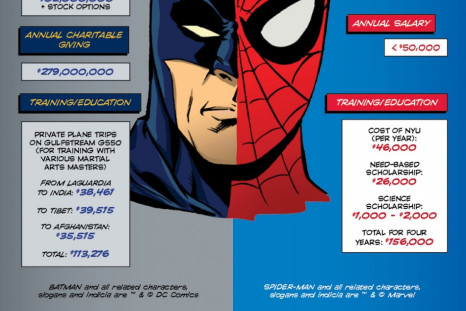

New 'Batman' Movie Seen Indirectly Causing Image Problem For Romney

The newest movie incarnation of DC Comics superhero Batman, which features a protagonist who retroactively un-retires to save fictional Gotham City from a ruthless terrorist, is causing a ruckus among Washington politicos, at least one of whom has claimed the film's plotline will subliminally discredit REpublican Party nominee Mitt Romney in voters' minds.

Summer BBQs More Expensive In Spite Of Stable Cost Of Living

The price of hamburgers, hot dogs and other commonly grilled items shot up dramatically in June, government data released Tuesday showed, far outpacing price increases seen for other food items and the general cost of living, which actually dipped slightly in the month.

All the 'Easy' Gold Has Been Found: Mining Analyst

The world's major miners are not discovering enough new gold deposits to make up for all the extraction they have engaged in over the past decade and a half, a fact that suggests the scarcity of the precious yellow metal could grow in coming decades.

Bank Of America Seen Swinging To Profit, Hobbling to Just Above the Brink

Bank of America Corp. (NYSE:BAC), the troubled financial behemoth that teetered just above the abyss during the last few weeks of 2011 and has since made somewhat of a recovery, is expected to swing to profit when it reports quarterly financial results Wednesday morning.

Despite Mediocre Results, Vikram Pandit Gets His Mojo Back

The chief executive of New York-based Citigroup Inc. (NYSE:C) had a surprisingly confident outlook for his bank's future business prospects during a conference call with analysts Monday.

Fed Economist Warned Of Massive LIBOR Fraud in '08 Didn't Know What LIBOR Is

Emails and phone communications released by the Federal Reserve on Friday show that an economist with the central bank who was told as August 2007 that one of the world's most important interest rates was being manipulated did not understand that rate.

Gold Pops Up To Near $1,600 Ceiling, Lags Silver's Gains

Gold futures popped Friday to nearly $1,600, tracking wider gains in other asset markets, but were underperforming silver and the broad equity market.

Wells Fargo Results Friday Seen as Litmus Test for Housing Recovery, Responsible Banking

When San Franciso-based Wells Fargo & Company (NYSE:WFC), releases quarterly results Friday morning, analysts will be examining the corporate filing for hints as to the state of the U.S. housing market.

As JPMorgan Reports Earnings Friday, All Eyes Turn To London Whale

When New York-based banking behemoth JPMorgan Chase and Co. (NYSE:JPM) reports its financial results for the latest quarter on Friday morning, the market's collective attention will be focused on just one figure: the one finally detailing how much JPMorgan lost as a result of its ill-advised strategy of putting huge hedge bets on the CDS derivatives market.