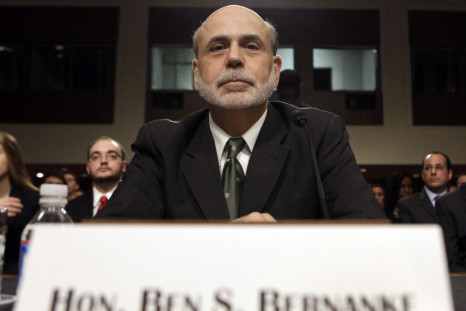

Bernanke's Jackson Hole Speech - Live Blog: Will He Or Won't He QE3?

Two years after Federal Reserve Chairman Ben Bernanke announced plans for a massive second round of monetary stimulus -- so called QE2 -- at a yearly Fed summit in Jackson Hole, Wyo., the world's most powerful central banker returns, with markets primed for him to deliver on even more stimulus.

Ahead of Bernanke's Jackson Hole Speech, Anticipation and Disappointment

Market-watchers continued to use words like "anticipation," "expectations," "disappointment" and "excitement" Thursday, less than 24 hours ahead of a speech by Federal Reserve chairman Ben Bernanke that is being hyped up as a make-or-break moment for economic affairs in 2012.

Bankrupt American Airlines Seeks OK For Big Lawyer Fees As It Seeks More Worker Pay Cuts

American Airlines' bankrupt parent AMR Corporation (PINK:AAMRQ), which is arguing in federal court it needs hundreds of millions of dollars in contract concessions from its employees in order to survive as a going concern, is planning to spend hundreds of thousands of dollars to entice a small group of hedge funds to invest in the company.

In Spite Of Cheery Assessments, Some Claim Australian Economic Boom Is Over

In spite of a cheery assessment recently from the country's central bankers that led projections of 2012 GDP to be raised -- to 3.5 percent -- while views on inflation were lowered, recent days have seen growing signs of economic distress emanating from Australia.

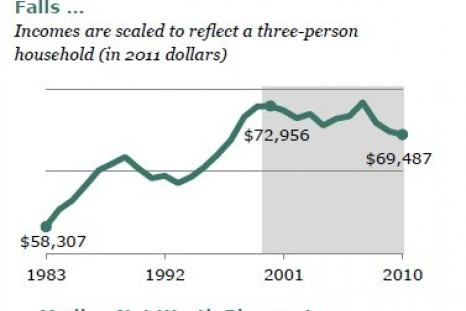

Poorer, Less Optimistic US Middle Class Believes Neither Party Has Their Back, Rooting For Obama

The faithful within both the Republican and Democratic folds claim their chosen party leaders are champions of the American middle class. But the independents who form the largest slice of that vast demographic overwhelmingly aren't buying it.

Coming Flare-Up In Euro Crisis Won't Be So Bad For Rest Of World - Nomura

While the world braces for the next euro zone fiscal crisis flare-up, an analyst at Japanese financial conglomerate Nomura suggests that whatever bad news is just around the corner will not damage global economies as much as such crises once did.

UK Finance Looks Like Wild West of Graft, Incompetence In UK Govt Report

The announcement Wednesday that the notoriously fangless British Financial Services Authority is going after the most blatant fraudsters in U.K. finance opened a window on some of the sleaziest financial hucksterism in Great Britain.

US Stocks About To Fall Off A Cliff - Analysts

There's an almost-daft energy over Wall Street at the moment as stocks keep to four-year highs, a trend that hasn't kept analysts from warning that the party is about to be over.

CME Launching Exchange In Europe For Clients Aiming To Avoid US Rules

Exchange operator CME Group Inc. (Nasdaq:CME) is opening a hot new table in the global financial casino, pushed to set up a derivatives exchange in London by clients who can't be bothered to comply with U.S. law.

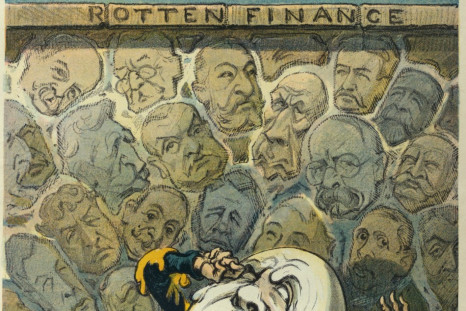

Portrayals Of Wall Street As Greedy, Selfish And Rotten - 100 Years Ago (Photos)

It may be surprising to many who believe that Wall Street and global finance are inherently malevolent that a century ago, the public had a very similar perception of financial services, a notion that was channeled by editorial cartoonists in hard-hitting illustrations in magazines like Puck and newspapers like the New York Herald. These cartoons would be as fitting today as they were in 1912.

Gold's Value Up For Europeans As Exchange Deems Bullion Collateral

European investors looking to bet on risky derivatives will be able to use gold to back their trades, one of the Continent's major exchanges said Friday, a development that could both make the yellow precious metal a more valuable asset and foster the growth of derivative trading volume.

18 Killed By Police Fusillade in South Africa [PHOTOS]

18 people were killed by South African police during a wildcat mining strike Thursday, in an episode that was captured entirely by TV news cameras and has stunned the nation, reminding many of not-too-distant days when police would shoot anti-apartheid protesters.

Stock Trading Suffers On Uncertain, Unpredictable Markets

Trading in U.S. stocks has been going on at a snail's pace recently, a fact market-watchers are blaming on policy uncertainty, but could also be the result of investors fed up with the fragmented, unpredictable nature of the market.

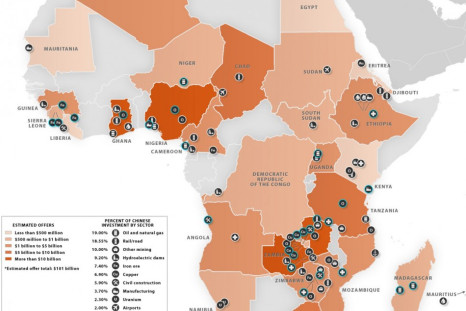

China Goes For The Gold As Huge Investment In African Miner Seen Likely

China may have lost out in its mad dash to get the most gold at the London Olympics this summer, but the country is seemingly still running the race for gold where it counts, as it is currently in the process of bidding for a major African gold miner.

Jackson Hole QE3 Guessing Game Heats Up

Two years after Federal Reserve Chairman Ben Bernanke announced plans for a massive second round of monetary stimulus at a yearly Fed summit in Jackson Hole, Wyo., market watchers are beginning to take odds on the chances that his speech at this year's Jackson Hole summit could produce a similar announcement.

America's Reaction to Shooting Massacres: Buy More Guns

Recent massacres where gunmen shot up public gatherings had Americans scrambling to buy more guns, so much so that Wall Street analysts are seeing little positive upside for gun manufacturers.

Lawsky Wins! Standard Chartered Settles Money Laundering Charges With New York State

British Standard Chartered Bank, which had been accused by New York state's top banking regulator of engaging in illegal money-laundering on behalf of the Iranian regime in an explosive legal filing last week, id settling charges for a fine of $340 million.

Today's Daily Deal: 23% Off on Groupon Shares

Groupon Inc. (Nasdaq:GRPN) saw shares in the company drop by nearly a quarter of their total value Tuesday -- to all time-lows -- after the Chicago-based daily-deals business reported revenue figures that badly missed analyst expectations.

Knight Capital's Woes Continue as Stock Plummets, Issues Defect Market Marker

Knight Capital Group Inc. (NYSE:KCG) saw shares in the company drop precipitously early Monday -- at one point losing over 7 percent of their value -- as the bruised-up broker-dealer continued to pick itself up less than two weeks after a trading algorithm gone berserk saddled the firm with $440 million in losses.

Who Is Benjamin Lawsky? Little-Known Regulator Who Savaged Standard Chartered Stokes His - And Andrew Cuomo's - Political Dreams

When Benjamin Lawsky formally accused U.K.'s Standard Chartered bank of money laundering and a cover-up linked to Iranian financial institutions, the head of New York's newly formed Department of Financial Services was hardly described in glowing terms in the press. He was termed a rogue, an egomaniac and worse by unnamed scorned colleagues in New York and Washington. But in describing his ambitions, what these reports failed to take into account was the depth of his and Governor Andrew C...

Maritime Shipping Rates Tumbling, Sink Established Company

After recovering from near-decade lows in February, a benchmark of how much maritime shippers charge to transport dry goods like steel and coal globally has been swooning to record lows, plunging 31.9 percent in the last month.

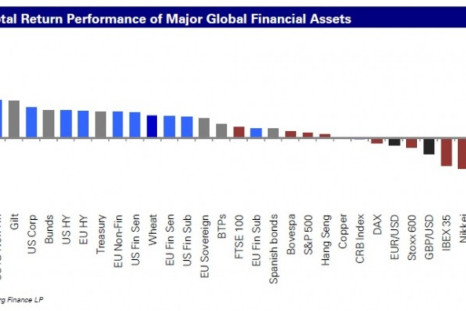

Financial Crisis Turns Five Years Old Today: Deutsche Bank Looks Back

A report out Thursday morning by Jim Reid, head of Global Fundamental Credit Strategy, noted the global financial crisis is five years old today, tracing the beginning of the world's economic troubles to August 9, 2007.

BREAKING: Italy, Spain Downgraded by DBRS

Toronto-based credit rating agency DBRS, Inc. announced today it is downgrading the sovereign credit ratings of the Kingdom of Spain and the Republic of Italy from their current "A (high)" ratings. The rating agency gave Spain's long-term rating a two-notch downgrade to "A (low)." Italy was taken down one notch to "A."

Fed Heads, Breaking Taboo, Talk Politics

Two non-voting members of the Federal Reserve Board of Governors have broken a long-standing taboo against wading into politics by publicly talking about how election-year considerations affect the decisions of U.S. central bankers.

If Standard Chartered Were A Person, How Much Hard Time Would It Be Looking At?

An uncanny legal document that accused British bank Standard Chartered of penal law violations raises the question: If the bank were a person, what kind of hard time would it be facing?

Nomura Urges Dumping Accused Money Launderer Standard Chartered For Admitted Money Launderer HSBC

Citing reputation and legal risk, several brokers downgrade their recommendations of British bank Standard Chartered Tuesday. But one broker's suggestion stood out from the rest

Tokyo Stock Exchange Sees Trading Disruption Due to Technical Glitch

Tokyo Stock Exchange became the third major stock exchange to have a trade-halting technology failure in less than a week, with some interruption during premarket action due to what the exchange operator called a "systems problem."

"Crazy" Knight Capital System "Burnt Money": Analyst Explains How It Happened

A report by market technology firm Nanex LLC that attempts to explain just exactly what happened at Knight Capital last week shows the "crazy" underbelly of U.S. stock trading

Days After Knight Capital And Wild NYSE Trading, Madrid Stock Exchange Sees Trade-Halting "Technical Problem" Of Its Own

Mere days after a systems failure within the automated operations of one of its market-markers caused wild distortions in the New York Stock Exchange, a major European bourse is having its own version of a technical meltdown.

Knight Capital Being Saved By Very People It Tried to Screw Over

There's one developing storyline in the saga of Knight Capital Group Inc., the Wall Street market maker that lost more than $440 million Wednesday when an automated trading program it had just installed went berserk, that's not being talked about: It is being propped up by the very people it tried to screw over.