It Didn’t Take Much to Rescue U.S. Stocks From Bear Status

U.S. stocks were saved from bear market territory and it didn't even take that much.

U.S. Stocks Surge on EU Bank Rescue Report

U.S. stocks surged in the last hour of trading on a report that European Union officials are coordinating a rescue for European banks.

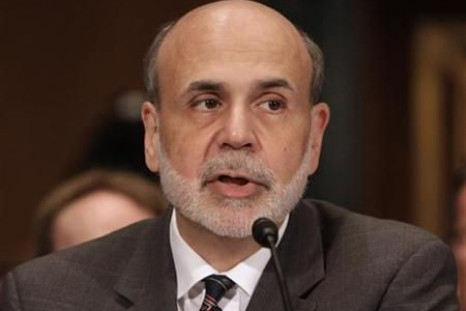

Bernanke Pressures Congress to Save Economy

With the economy slowing and the markets crashing, Federal Reserve Chairman Ben Bernanke put the burden squarely on Congress to act.

S&P 500 Dips to Bear Market Territory: 5 Reasons Why

Tuesday’s early morning drop has taken the S&P 500 Index down over 20 percent from its May 2 high. Although there is no official definition of a bear market, one commonly accepted metric is falling 20 percent over an extended period.

U.S. Stock Futures Down on Eurozone ‘Water Torture’

U.S stock futures are down on Tuesday as Eurozone debt crisis fears intensified on authorities’ inability to step up and calm the situation.

Eurozone Considers Making Banks Pay More for Greece

European finance ministers are considering making banks take bigger losses on Greek debt and have postponed a vital aid payment to Athens until mid-November, setting up a crunch point in the euro zone's sovereign debt crisis.

Occupy Wall Street Protest: 5 Things it Needs to Succeed

The Occupy Wall Street Protest has somewhat succeeded. Still, it's not a huge success yet. It's not close to having the impact of the 1963 March on Washington or the U.S. labor movement in the early 20th century.

Bank of America Charges Debit Card Fee: Time to Consider Credit Unions?

Starting in early 2012, Bank of America will charge a $5 monthly fee for debit card usage. The fees will be assessed on a month-to-month basis, will not include ATM cash withdrawals and will not affect premium customer accounts.

Bank of America Debit Card Fees: Rage Burns Like it’s 2009

The $5 Bank of America debit card fee has sparked rage that hasn't been seen since the height of the financial crisis in 2008 and 2009.

Gary Johnson 2012: Broke His Leg, But Climbed Everest, Now Wants to be POTUS

When I told former New Mexico Gov. Gary Johnson that President Barack Obama used to run three miles per day, he wasn't impressed. I do the equivalent of running 15 miles a day. That's 45 miles biking, said Johnson, an avid triathlete.

10 Reasons Why U.S. Stocks Closed Quarter on Sour Note

U.S. stocks concluded the third quarter on a bad note. For the quarter, the Dow Jones Industrial Average plunged 1,500.96 points, or 12.09 percent, its worst performance since the first quarter of 2009.

U.S. Stocks are ‘the Asset Class to be in’: Siegel

U.S. stocks are the asset class to be in, Jeremy Siegel, a Finance Professor at the Wharton School of the University of Pennsylvania, told CNBC.

Chinese Private Equity Firms Set Sail Abroad

Flashed on the side of a building here in Shanghai's historic Bund district, an image shows a giant ship named Hony, setting sail from China, traveling past the Statue of Liberty, past Big Ben, and bringing home crates of golden coins.

Gold Prices Tank 11% in Sept, But Jim Rogers Isn’t Scared

Gold prices tanked 11 percent so far in September, shaking the confidence of some investors and spectators. “Gold is not a safe-haven asset” and “gold is no longer a one-way bet” are common exclaims.

Major Markets in Liquidation, S&P 500 May Hit 1,010

Major markets around the world are in liquidation mode, meaning investors long risk-assets are still trying to sell out of their positions, Craig Ferguson, a currency hedge fund manager at Antipodean Capital Management in Melbourne, told Bloomberg TV.

Euro Crisis: Greece Must be Kicked Out if Euro to Survive

When Stratfor, a geopolitical intelligence firm, takes on the euro crisis and Greece, you know it's going to offer a fresh perspective.

Occupy Wall Street Protest: Why Reckless Bankers Still Owe America

The Occupy Wall Street protesters are angry.

U.S. Stocks Are in a Bear Market: Strategist

U.S. stocks are in a bear market, Mikio Kumada, global strategist at LGT Capital Management in Singapore, told Bloomberg TV.

Why the Euro Could Drop Below 1.30 With ECB Bailout [GRAPHS]

One may be tempted to think that a bailout from the European Central Bank (ECB) will send the euro higher against the U.S. dollar because it will calm Eurozone debt crisis fears.

Occupy Wall Street Protest: How is Bloomberg Different from Mubarak?

The Occupy Wall Street protesters aren’t actually protesting on Wall Street.

As Europe Wobbles, FX Options Signal Distress

Europe's never-ending debt saga has investors girding for volatile, unsteady currency markets for years to come.

Despite European Debt Crisis, Faros Goes Long Euro Against U.S. Dollar

Despite the worsening European debt crisis, forex services firm Faros Trading recommends investors to go long the battered euro against the surging U.S. dollar.

Gold Prices Plunging Because Europeans Are ‘Dumping’ it

Gold prices are plunging in September partly because struggling Eurozone sovereign states are dumping [it] in the open market, speculated Michael Pento, president of Pento Portfolio Strategies.

How to Play it: Fund Triage as Europe Leaves Intensive Care

European government officials and financial institutions are starting to make dramatic steps needed to manage their way through a debt crisis that threatens to drag the world economy into recession.

Gold Prices Blow Through 100-Day MA, ‘Elephants’ Still Trapped [CHART]

Gold prices fell below their 100-day moving average ($1,635) and barely stayed above their 200-day moving average ($1,525) as the decline continued on Monday.

Speculators Pile Into U.S. Dollar, Analysts Say It Could Go Higher [CHART]

Speculators have piled into the U.S. dollar in the wake of September’s global economic and financial turmoil.

Investors Assess New UBS CEO, Hope For Fast Revamp

UBS investors welcomed the Swiss bank's choice of caretaker chief executive, Sergio Ermotti, on Monday after Oswald Gruebel resigned in the wake of a $2.3 billion rogue trading scandal and cleared the way for a major overhaul of the investment bank.

European Debt Crisis: Can Politicians Ignore the People’s Will?

The European debt crisis doesn't have to exist because there are a number of feasible solutions to fix the mess.

European Debt Crisis: a Small Hint at Fiscal Union?

The European debt crisis has deteriorated to a point where global leaders are publicly urging the Eurozone to get its act together.

A Case for Redistributing $5 Trillion to the Poor

The U.S. economy is sick right now because there is over $5 trillion of dead money.