Who Creates More Jobs - Democratic or Republican U.S. Presidents?

The Republican Party argues it's the party of job creation, but the statistics indicate otherwise, at least concerning U.S. presidential administrations. Democratic presidents have a higher annual job creation average, 1.647 million per year, than Republican presidents, 966,388 per year.

U.S. Home Mortgage Rates Fall Again - Good Time to Lock-in a Rate?

U.S. home mortgage interest rates fell again this week, and the average 30-year fixed rate is now at a low 4.19 percent -- which creates an opportunity for prospective home buyers with good credit histories.

U.S. Debt Deal: Could Super Committee Help Calm Markets With Deficit Reduction?

With the appointment of nine of 12 members, the "super committee" charged with reducing the budget deficit by at least another $1.5 trillion is taking shape. The body could help stabilize the financial markets by announcing a ?quick-start? agreement on additional debt reduction.

U.S. Stock Market: Is It Headed Higher or Lower?

The Dow registered another volatile day Wednesday, plunging 520 points to 10,720 on chatter of additional banking sector concerns in Europe. Further, until investors can sort out which debt concerns are real, and which are not, look for choppy trading conditions to continue.

Why Is Oil's Price So High Compared to Natural Gas?

Crude oil historically trades at about 8 times the price of natural gas. Currently, it's trading at about 20 times natural gas. Is oil overpriced, natural gas underpriced, or is it a combination?

U.S. Budget Deficit Falls for 4th Straight Month - Can ?Super C? Maintain Momentum?

The U.S. Government posted a less-than-expected July budget deficit of $129.4 billion, but given reeling U.S. and global stock markets, the pressure will be on Congress's new "super committee" to achieve greater than the $1.5 trillion in deficit reduction target called for in the second half of the U.S. debt deal.

IEA Says Economic Problems May Weigh on 2012 Oil Demand Growth

The International Energy Agency says threats to the U.S. and global economies may cut oil demand growth next year by more than 60 percent; however, the group still sees global oil demand little changed this year and in 2012.

U.S. Debt Deal: With Markets Reeling, 'Super Committee's' Task More Important

With markets reeling, and the economic expansion far from self-sustaining, the pressure will be on Congress? new 'super committee' to cut the budget deficit substantially -- by more than the $1.5 trillion called for ? to calm investors.

U.S. Stock Market: Who Is In Charge Now -- Bulls or Bears?

To say it's been an unsettling time for U.S. stock investors would be an understatement. The Dow has been on a wild ride, with plunges followed by sudden reversals. Look for market choppiness to continue until investors determine whether the Fed's latest monetary policy decision -- low interest rates for two years -- will be enough to rev-up U.S. GDP growth.

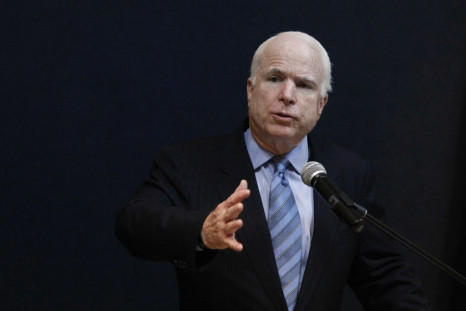

John McCain: I Stand By My Tea Party Criticism

U.S. Sen. John McCain, R-Ari., isn't backing down from remarks he made earlier about the Tea Party during the U.S. debt deal debate.

Fed Sees Need for Low Interest Rates Through Mid-2013

In response to a slowing economy, the U.S. Federal Reserve, despite some internal dissent, announced Tuesday that it plans to keep monetary policy stimulus in place, noting that it will keep short-term interests rates exceptionally low through at least mid-2013. The Fed will also continue to reinvest bond proceeds maturing in its portfolio.

Russia Will Maintain Existing U.S. Dollar-Denominated Investment Levels

Despite the S&P downgrade of the United States, Russia announced that it has no plans to make an immediate change to its U.S. dollar-denominated gold or foreign exchange reserves, a senior Russian bank official has confirmed.

Amid Market, Economic Uncertainty, Investors Flock to U.S. Bonds

With U.S. and global stock markets reeling, investors have sought a traditional safe-haven, but it?s one that may surprise some: U.S. Government bonds. How is it possible that investors would want the debt of the nation they believe has a national debt that's too high?

With Markets, Economy Reeling, All Eyes Turn to Fed

The U.S. Federal Reserve will announce its monetary policy Tuesday following an unprecedented downgrade of the U.S.Government's credit rating by Standard & Poor's and the markets will likely look to Fed Chairman Ben Bernanke to provide appropriate comments on the state of the nation's banking system and its fiscal condition.

Obama Calls for 'Renewed Sense of Urgency' to Balance Budget

In a White House address Monday, President Barack Obama said Standard & Poor's credit downgrade of the United States represented a statement on the nation's political will. Underscoring that "the U.S. is still an AAA country," Obama again called on congressional officials to make the tough decisions necessary to balance the budget long-term.

S&P Downgrade: Is It Time to Sell Your Stocks?

If, as a stock investor, you're a little jittery following Standard & Poor's downgrade of the U.S. Government's credit rating, you're not the only one. The stock market has tumbled, and more declines may be ahead. Even so, keep in mind that a good portion of the money made in stocks stems from not panicking.

S&P Downgrade: Will It Hurt President Obama?s Job Creation Effort?

The U.S. budget deficit was $1 trillion before he took the oath of office, he inherited a nation in deep recession, with a banking crisis, two wars, and now there's a credit downgrade stemming from decades of debt incurred before he was on the scene, but make no mistake about it, President Barack Obama has to create a lot of jobs for his presidency to succeed.

S&P Downgrade of U.S. - Was Firm Courageous or Simply Wrong?

The market's stance heading into the new week is one of caution, following S&P's stunning and controversial downgrade of the U.S. Government's credit rating. Essentially, Wall Street has to figure out if S&P was ahead of the curve, or was remarkably off-base in its analysis, and it's too soon to tell which view will prevail.

S&P Downgrades U.S. Credit Rating - How Will It Affect Your Stocks, Bonds?

S&P?s stunning and controversial downgrade Friday in part reflected the firm?s assumptions about the U.S. political system?s ability to solve its problems. Others hold a more optimistic view, as Winston Churchill did. Churchill said, ?In the end, you can count on America to do the right thing - after she?s exhausted all other possibilities.?

The 3 U.S. Policy Mistakes Most Responsible for S&P Downgrade

While S&P?s downgrade of the U.S. Government?s credit rating is controversial, most agree that the U.S. fiscal condition is serious. And while both Democrats and Republicans increased the budget deficit, three major policy errors by President George W. Bush last decade substantially worsened the U.S.?s fiscal condition, and the nation has been trying to recover ever since.

Will S&P?s Downgrade Increase U.S. Home Mortgage, Auto Loan Interest Rates?

In a stunning development, Standard & Poor?s Friday downgraded the U.S. Government's credit rating from AAA to AA+, arguing Washington has made inadequate progress cutting the budget deficit. The U.S. Treasury disagrees with S&P?s analysis and conclusion, but interest rates on U.S. home mortgages and car loans are likely to rise.

For President Obama, It's Create Jobs, or Lose One

President Barack Obama and the Democratic Party have nine months, or until about June 2012, to demonstrate to the American people that their policies can create 150,000 to 200,000 new jobs per month -- the amount needed to substantially lower employment and create ample opportunities for all.

Will Natural Gas Become U.S.'s Primary Energy Source by 2030?

In the states, oil has been the stuff of riches and the glamour energy form. The reality is, however, in the 21st century the preferred and superior U.S. energy form could very well be domestic natural gas.

NYU?s Nouriel ?Dr. Doom? Roubini: Better Than 50% Chance of U.S. Recession

One of the world's leading economists says don't get giddy over the July jobs report, which indicated the U.S. economy created a better-than-expected 117,000 jobs. NYU Professor Nouriel "Dr. Doom" Roubini, who accurately predicted the housing crisis four years ago, says U.S. GDP will be sub-par in 2011 and the risk of a recession is real.

Bond Vigilantes Push Up Italy?s, Spain?s Interest Rates: Is U.S. Next?

Up to now, the dispensers of global financial justice -- the bond vigilantes -- have given the United States a free ride regarding its large budget deficit and national debt. But history say that can't last forever, which is why it's in the nation's long-term interest to enact the second half of budget cuts called for in the U.S. debt deal.

U.S. Economy Added 117,000 Jobs in July: Better Than Expected

The U.S. economy unexpectedly added 117,000 jobs in July and the unemployment rate dipped to 9.1 percent, the U.S. Labor Department announced Thursday. Equally significant, the private sector added 154,000 jobs. The report was a pleasant surprise, but the nation is still in a deep hole job-wise -- short about 14 million jobs.

Did Congress Cut Spending Too Soon in U.S. Debt Deal?

The Tea Party-swayed Republican Party won the U.S. debt deal crisis: federal spending was cut substantially. But amid a weak economy, did the coalition cut spending too soon?

Bank of New York Mellon Adds Fee for $50 Million-plus Accounts

The Bank of New York Mellon announced Thursday that it will start charging large customers a small fee for taking their deposits. Starting August 8, clients with $50 million or more will be charged 0.13 percentage points for balances 110 percent above their average balance.

U.S. Debt Deal Means Fiscal Stimulus Is Out, and Fed?s Q3 May Be In

The U.S. debt deal means that federal spending will now generate even less demand in the quarters ahead, in an economy that?s already weak, and with an unemployment rate at 9.2 percent. To say the Fed has been monitoring the situation would be an understatement.

Another U.S. Debt Deal Casualty: Congress Triggers Partial FAA Shutdown

The U.S. Debt Deal crisis has claimed another casualty: the U.S. air transportation system -- Congress has left town without funding a key Federal Aviation Administration budget: as a result, 70,000 construction and related workers have been idled, and 4,000 furloughed, work on projects valued at $11 billion has been delayed.