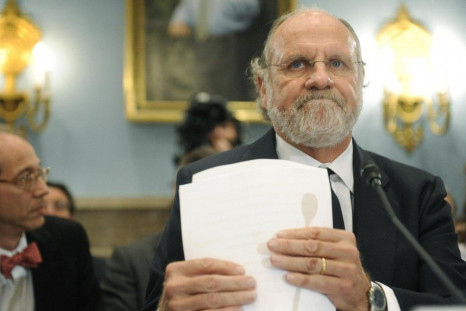

The CFTC charges mean the former U.S. senator, New Jersey governor and Goldman Sachs head likely will avoid criminal prosecution.

The prospectus gives little detail on the offering, which is seen as merely provisional for now.

Tourism spending has largely stayed higher than GDP growth since about mid-2010.

Rajaratnam was convicted in 2011 for massive securities fraud in the biggest-ever U.S. hedge fund insider trading scheme.

The global retail coffee brewer has only reported a taxable profit once in 15 years of operating in the U.K.

Citi is already present in other Middle Eastern countries, like Qatar, Kuwait and Egypt, but would be the first American bank in Iraq.

The sentence-reduction deal between prosecutors and Jeffrey Skilling includes the return of $41 million to Enron victims.

Chevron’s Polish subsidiary says it is merely exploring for shale gas near a Polish village.

German Chancellor Angela Merkel met with Russian President Vladimir Putin to express the EU's interest in closer trade relations.

China in particular is struggling through a period of transition, with lower growth rates, said Barclays economists.

Federal Reserve monetary policy will be the most “immediate risk” to market stability in coming months, Barclays economists say.

Deutsche Bank economists argue that bond yields correlate strongly with GDP growth rates.

U.S., German and French stocks fell, on average, about 2.5%, as investors fled the markets on fears the Fed will turn off the money spigot.

A prominent hedge fund’s suggestion to spin off part of Sony hasn’t yet been matched with a definite yes-or-no response.

TPG-Axon manages to get rid of SandRidge Energy CEO Tom Ward, one of the most highly paid energy executives in the U.S.

European budget airline Ryanair wants to offer long-haul flights between Europe and the United States and boost its growth rate.

A World Bank report predicting the impacts of global temperature rises paints a bleak picture for the world's poorest communities.

The Swiss Parliament formally rejected a U.S.-led effort for more information on wealthy American clients of secretive Swiss banks.

Drugmakers are watching a fight between the EU and Lundbeck to see just how flexible European patent rights really are.

For some kinds of fraud, fines aren't enough punishment. The SEC maps out cases where admission of wrongdoing would be in the public interest.

An IPO by Brazilian cement maker Votorantim Cimentos was reportedly cancelled after shareholders and potential investors expressed concerns.

Major consultancy Deloitte Financial Advisory Services LLP has been banned from some new work in New York state temporarily, after an investigation found conflicts of interest.

G-8 leaders agreed on Tuesday to adopt a broad common strategy in fighting worldwide tax avoidance by companies and individuals.

Swiss lawmakers have criticized U.S. attempts to elicit information on U.S. tax evaders as undermining Swiss sovereignty.

German bank Commerzbank has agreed on a level of job cuts crucial to an ambitious years-long restructuring, said negotiators.

Car sales in Europe had a remarkably poor month in May.

EU regulators look set to approve an $8.2 billion takeover of NYSE Euronext by Intercontinental Exchange, or ICE.

Builders are seeing improving market conditions, as demand for new homes increases, a housing sector analyst said Monday.

The EU and the U.S. launched negotiations over a historic trade deal at the G-8 summit, despite French objections late last week.

Activist investor Starboard Value LP says Smithfield could be worth almost $2.5 billion more than what Shuanghui is valuing the company at.

Editor's pick