Why doesn’t Apple pay a dividend?

Given how Apple shares have sailed into the stratosphere, supported by wildly successful product launches (thereby making lots of happy investors); the company is unlikely to hand out dividends for the foreseeable future.

Bernanke warns jobless rate will not ease to normal levels for 4 or 5 years

In a speech before a congressional committee this morning, Federal reserve Chairman Ben Bernanke warned that it could take years before unemployment falls to normalized levels, thus justifying the continuing need for the central bank’s $600-billion bond-buying scheme

Full-Text: Ben Bernanke's speech to Congressional committee on economic outlook

Fed Chairman Ben Bernanke's speech on economic outlook and monetary and fiscal policy before the committee on the budget, U.S. Senate, Washington, D.C., Jan. 7, 2011

Stocks close mixed on indecisive trading ahead of tomorrow's jobs data

U.S. stocks finished mixed in queasy trading ahead of tomorrow’s nonfarm payroll report from the government. Investors also pondered a rise in initial jobless claims and some weaker-than-expected December sales from some major retailers.

Plight of SuperValu highlights struggles of grocery retailers

Shares of grocery retailer SuperValu (NYSE: SVU) have plunged almost 25 percent since mid-October amidst an increasingly difficult environment for food retailers.

Halliburton, Anadarko sinking on oil spill blame game

Shares of Halliburton Co. (HAL) and Anadarko Petroleum Corp. (APC) are dropping this morning after a report by a presidential commission into the Gulf of Mexico oil spill from last year spread the blame to various parties, not only BP plc (NYSE: BP).

Ghost Towns: Housing collapse will result in new types of 'declining cities'

U.S. metropolitan areas which have suffered the steepest drops in housing prices are poised to endure long-term deterioration similar to how certain cities in the Rust Belt were permanently damaged by the decline of manufacturing.

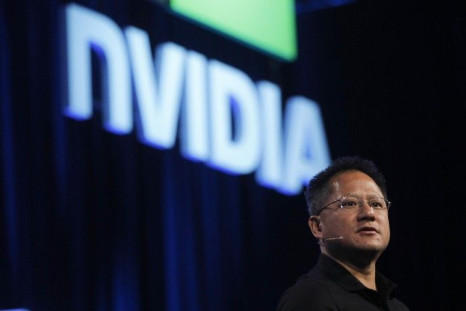

NVIDIA shares jump on ARM-CPU core development

Shares of NVIDIA Corp. (Nasdaq: NVDA) are surging this morning after the graphics chips company announced last night that it has entered into a partnership to manufacture ARM-based central processing unit (CPU) cores that might provide power to PCs, servers, and supercomputers

ARM Holding shares surge in London on Microsoft deal

Shares of British-based chipmaker ARM Holdings are surging on the London Stock Exchange after Microsoft (Nasdaq: MSFT) said last night that its new Windows operating system would work with chips designed by ARM.

Renault warns that industrial espionage poses serious threat

French automaker Renault, which just suspended three senior managers for possibly leaking secrets about its electric car project, has said that industrial espionage poses a grave threat to the company’s “strategic assets.”

Stocks gain on private payroll gain

Stocks climbed, supported by a stunning jobs report from the private sector, raising hopes for a strong nonfarm payroll data on Friday.

ADP data suggests strong employment report on Friday: Sowanick

This morning’s ADP stunning employment report suggests that Friday’s nonfarm payroll data should come in very strong, according to Tom Sowanick, Co-President and Chief Investment Officer of OmnivestGroup.

Brazil pledges to impose capital controls to slow down currency rally

The government of Brazil is pledging to slow down the rally of its currency, the real, by imposing more capital controls in order to help export companies that have been hurt by gains in the currency.

Retail investors slowly, cautiously getting back into stock market

We are starting to see retail investors wade back into equities, given that the allure of bonds has virtually dried up and the economic recovery seems to have some traction.

China signs trade deal with Spain; reaffirms support of euro bonds

China has reaffirmed its commitment to buying Spanish government bonds, amidst growing concern about the health of peripheral euro zone debt.

Layoffs in 2010 lowest since 1997: Challenger

After reaching a seven-year high in 2009, downsizing activity in 2010 fell to its lowest level since 1997, as employers announced plans to eliminate 529,973 positions, according to a report from outplacement consultancy Challenger, Gray & Christmas Inc.

Could Apple become the world’s first $1-trillion company?

Apple Inc. (Nasdaq: AAPL) could become the world’s first company with a $1-trillion market cap, according to James Altucher, managing partner at hedge fund Formula Capital.

Global food prices hit all-time high: UN

Food prices around the world reached record highs last year, according to the United Nations Food and Agriculture Organisation (FAO).

Tourists flocking to New York City

New York City attracted almost 49-million tourists last year, an all-time record, despite the ongoing effects of the recession, according to the city’s mayor Michael Bloomberg.

Qualcomm agrees to acquire Atheros for $3.2 bln

Qualcomm Inc. agreed to purchase chip maker Atheros Communications for $45 per share, or a total of about $3.2-billion.

France heavily involved in industrial espionage against European neighbors: WikiLeaks

France is heavily involved in industrial espionage against its European neighbors, not China, Russia or the U.S., according to the diplomatic cables leaked by WikiLeaks.

Is Wal-Mart coming to New York City?

Retailing giant Wal-Mart Stores (NYSE: WMT) may be seeking to establish a foothold in New York City, according to a report on the NY1 news station.

Qualcomm reportedly to acquire Atheros

Qualcomm Inc. (Nasdaq: QCOM) is preparing to acquire semiconductor company Atheros Communications (Nasdaq: ATHR), for about $45 per share, or $3.5 billion, according to a report in the New York Times.

Stocks mixed as commodities sink

Stocks finished mixed, and traders apparently were unimpressed by some good economic data on factory orders and auto sales, while commodities dropped on likely profit-taking.

Progress towards full employment and price stability “disappointingly slow”: FOMC

While certain members of the FOMC were increasingly confident of an economic recovery in the U.S., they found progress towards achieving maximum employment and price stability to be “disappointingly slow,” according to the minutes of the past Fed board policy meeting in mid-December.

Full-Text: FOMC Minutes from Dec. 14, 2010

Minutes from the last FOMC meeting held on Dec. 14, 2010.

BP shares jump on Shell takeover speculation

Shares of BP plc (NYSE: BP) have leapt today partially on a report in the UK newspaper Daily Mail that Royal Dutch Shell (NYSE: RDS.A) may be interested in merging the two global oil giants.

Factory orders unexpectedly jumped in November

Orders for U.S. factory goods unexpectedly climbed 0.7 percent in November to $423.85 billion from the prior month, according to the Commerce Department said Tuesday.

Alcoa jumps on analyst upgrade

Shares of aluminum maker Alcoa Inc. (NYSE: AA) have jumped this morning after receiving an upgrade from Deutsche Bank, as well as a strong vote of confidence from television stock maven Jim Cramer.

Opinion: Pakistan shows how disconnected financial markets are from social realities

Perhaps the surprising good health of Pakistan’s equity market shows how disconnected financial trading markets can be from the state of the society they reside in.