Whitney defends comments on muni bonds; adds that defaults will lead to mass layoffs, social unrest

Analyst Meredith Whitney, who caused a stir over the weekend by saying that up to 100 U.S. municipalities will default in this coming year and thereby create a huge sell-off in the muni bond market, added to her warnings by noting that such financial collapses will lead to mass layoffs and social unrest.

Europe faces new wave of bank failures and sovereign defaults: Citigroup economist

Unless the European Union (EU) formulates an effective response to the ongoing debt crisis in Europe, the continent faces a new wave of bank failures and a string of sovereign defaults, according to Willem Buiter, the chief economist at Citigroup.

EU criticizes European airports for failing to cope with bad weather

The European Union (EU) has criticized European airports for having failed to respond with frigid weather conditions that have stranded thousands of holiday travelers and cancelled hundreds of flights.

A cashless global economy might reduce organized crime and terrorism: Lipow

By getting rid of cash, nations around the world might be able to significantly reduce organized crime and political terrorism since those activities are heavily reliant on easy accessibility to dollars, euros, pounds sterling, yen and other paper currencies.

Stocks climb moderately, Dow at 28-month high

Stocks rose moderately, boosted by some M&A activity and an easing of hostilities in Korea, with the Dow Jones index reaching a 28-month high and the Nasdaq at a three-year high, albeit in light pre-holiday trading.

Nike posts higher Q2 earnings

NIKE Inc. (NYSE: NKE) reported net income of $457-million, or diluted earnings of $0.94 per share, on revenues of $4.8-billion for the fiscal second quarter of 2011.

Euro crisis far from over; euro zone policies untenable: Pimco manager

The euro crisis is far from over and the peripheral members of the euro zone should temporarily exit the currency bloc and get their financial houses in order, said a Pimco bond fund manager. Otherwise, current policies are ineffective in the absence of fiscal unity and will likely lead to a break-up of the euro.

Molycorp shares surging on deal to make rare earth magnets with Hitachi

Molycorp Inc. (NYSE: MCP) shares are surging 15.62 percent in mid-day trading after it signed an agreement with Hitachi Metls Ltd. of Japan that may lead to the production of rare earth magnets in the U.S. sometime next year.

U.S. population nears 309-million; jumped by almost 10% over past decade

The U.S. population jumped 9.7 percent over the past ten years, reaching almost 309-million people as of April 1, 2010, according to the U.S. Census Bureau.

U.S. corporations boosted dividend payments in 2010

U.S. companies are paying dividends at a healthy pace again, but they are unlikely to see the halcyon days from before the financial crisis.

Stock buybacks surged 128 percent in Q3: S&P

Stock buybacks among companies in the S&P 500 surged by 128.3 percent in the third quarter from the year-ago period, according to data from Standard & Poor's.

Jabil Circuit shares jump on strong Q1 earnings

Jabil Circuit's (NYSE: JBL) have leapt this morning in response to the company’s robust fiscal first-quarter earnings which were released yesterday after the market closed.

Adobe shares rising on strong Q4 results

Adobe Systems Inc. (Nasdaq: ADBE) is rising in early trading, on the strength of a strong fiscal fourth quarter earnings report the company released yesterday after closing.

British government borrowing soars to record high

New public sector borrowing in the U.K soared to a record high of 22.3-billion pounds sterling last month, higher than analysts expected, and up from 17.4-billion pounds a year ago, according to the Office for National Statistics (ONS).

Pfizer recalls 19,000 bottles of Lipitor over “uncharacteristic odor”

Pfizer (NYSEL PFE) has recalled about 19,000 bottles of its Lipitor tablets after an “uncharacteristic odor” was reported in a bottle of the blockbuster cholesterol drug

Recap: Bears Win NFC North; Favre Might Be Finished

The Chicago Bears soundly defeated the Minnesota Vikings 40-14 in a game that featured a number of underlying themes, including what might have be the swan song of Brett Favre's 20-year Hall of Fame career.

LIVE Monday Night Football: Chicago Bears vs. Minnesota Vikings

The following is a live play-by-play blog of the Bears-Vikings NFL game from Minneapolis, Minn. on Dec. 20, 2010. All times are Eastern Standard Time.

Stocks finish narrowly mixed in light pre-holiday trading

Stocks finished essentially flat in listless pre-holiday trading amidst low volume and a dearth of economic data.

Monday Night Football: Chicago Bears vs. Minnesota Vikings

A number of intriguing storylines surround tonight’s Monday Night Football match-up between the Chicago Bears (9-4) and the Minnesota Vikings (5-8).

Up to 100 U.S. municipalities may default next year: Whitney

Renowned Wall Street analyst Meredith Whitney has warned that the U.S. may witness between 50 to 200 “sizeable defaults” amounting to “hundreds of billions of dollars” among municipal and state governments next year, which could derail the recovery.

AmEx plunging on analyst downgrade

Shares of American Express Co. (NYSE: AXP) are tumbling after an analyst at Stifel Nicolaus downgraded the companies because of potential negative impact of pending government regulations.

Child poverty in Britain to rise: IFS

The fiscal squeeze promulgated by the British coalition government will increase child and working-age poverty in the U.K. over the next three years, according to a report funded by the Joseph Rowntree Foundation and published today by the Institute of Fiscal Studies (IFS).

Sallie Mae surging on positive report in Barron’s

Shares of SLM Corp. (NYSE: SLM) are soaring this morning, reaping the benefits of a favorable report in Barron’s over the weekend, citing that the stock looks expensive, given future earnings prospects.

American Eagle dropping on brokerage downgrade

Shares of American Eagle Outfitters Inc (NYSE: AEO) are sinking this morning after Susquehanna Financial Group downgraded the stock’s rating to neutral, citing a sluggish December sales picture.

CBI downgrades UK GDP forecast for Q1 2011

The CBI, the British business organization, reduced its forecast for UK economic growth in the first quarter of 2011 to 0.2 percent from 0.3 percent; although it noted that the recovery is expected to be “maintained.”

Spain needs deeper reforms: OECD

The Spanish economy is slowly recovering, but broad reforms will still be required to create jobs and improve government finances, according to a report from the Organisation for Economic Co-operation and Development (OECD).

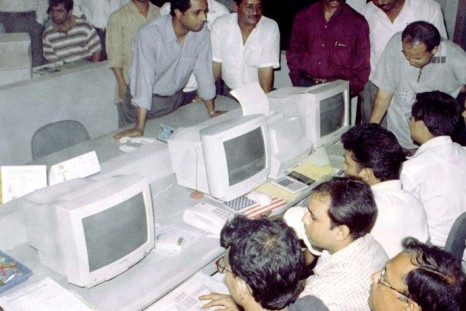

Investors in Bangladesh riot over stock market plunge

Hundreds of investors rioted in the commercial district of Dhaka, Bangladesh on Sunday after the local stock market suffered its sharpest one-day decline in its history.

Sudan's president embezzled billions: WikiLeaks

The President of Sudan Omar al-Bashir stashed away as much as $9-billion of his nation's in foreign bank accounts, according to US diplomatic cables leaked to WikiLeaks.

InterMune skyrockets on EU panel recommendation of lung drug

InterMune Inc. (Nasdaq: ITMN) soared 144.50 percent on after a European advisory panel recommended that Esbriet, the company’s lung disease drug, be approved for sale in the European Union (EU).

Stocks finish flat ahead of Obama's John Hancock on tax bill

Stocks finished narrowly mixed in a quiet session as traders await President Barack Obama signing the tax-cut extension bill into law.