Stocks rebound, ahead of Thanksgiving and Black Friday

Stock rallied broadly on some encouraging number from the labor market, shrugging off worrying geopolitical developments in Asia and some dour housing data, ahead of the Thanksgiving holiday and Black Friday, which will kick off the Christmas shopping season.

Sales of consumer electronics should be weak this holiday season: NPD

Stephen Baker. senior industry analyst for consumer technology at NPD Group, expects that overall that consumer electronics will not perform as well as they have the past couple of years this holiday season.

Online shopping expected to grow by 11 percent this holiday season: comScore

comScore (NASDAQ: SCOR), an internet marketing research company, said it expects online shopping to increase by 11 percent this holiday season.

Irish government presents severe austerity budget

The government of Ireland has released a grim four-year austerity budget that seeks to alleviate the country's debt crisis.

Supply-demand picture darkens outlook for solar energy

Solar energy stocks received a load of bad news last week when an analyst at Credit Suisse downgraded the entire sector and lowered price targets, raising concerns about the industry's near-term prospects

Brazil central bank head to step down

Brazil's central bank governor, Henrique Meirelles, will step down from his position, according to a report in the Folha de Sao Paulo newspaper.

German business confidence soars to record high in November

Business confidence in Germany surged to record highs in November, despite sovereign debt woes in Ireland and fears of a contagion to other euro zone members.

Stocks sink on Korean geopolitical tensions, euro zone dent worries

Stocks tumbled on heightened geopolitical tensions in Korea and rising fears about the spread of euro zone debt crisis. Minutes from the last FOMC meeting which revealed disagreements among policymakers over the efficacy of the second round of quantitative easing did not help market sentiment either.

FOMC minutes indicate divisions over stimulus plan

According to minutes from the most recent Federal Open Market Committee (FOMC) meetings, policymakers argued over the merits of introducing a $600-billion long-term bond purchase program, but passed the measure anyway.

A lithium ETF: A new type of commodity investment

Given the explosive expansion of electronic gadgets in recent years, the demand for lithium has surged. Now, with the imminent development of more electric and hybrid vehicles (whose batteries will increasingly use lithium), demand for this obscure metal could skyrocket.

EU/IMF pressuring Greece to accelerate economic reforms

Greece's international lenders have agreed to provide the debt-ridden country with the third installment of a loan – valued at 9-billion euros -- but warned that the Greeks must make an extra effort to address its deficit next year.

Stocks overcome early Irish contagion worries to finish mixed

Stocks finished mixed, but bounced back from early lows on worries that Ireland’s debt crisis could spread to other peripheral euro zone nations, follow a request by the Irish government for a multi-billion euro funding bailout.

Mexico's recovery slows down

Mexico’s economy expanded by 5.3 percent on an annualized basis, significantly below the 7.6 percent growth recorded in the second quarter, the country’s INEGI statistical office INEGI showed on M

Despite the hype surrounding GM, Ford is the better buy: Analyst

Despite the hugely successful initial public offering General Motors (NYSE: GM) underwent last week, the company still has numerous questions surrounding it, particularly its huge pension liabilities. As such, David Silver, an equity research analyst at Wall Street Strategies in New York, believes that Ford Motor Co. (NYSE: F) is the better auto company and more attractive stock right now.

Irish banks hammered in early U.S. trading

Despite signs that the government of Ireland will receive a huge bailout package from the European Union (EU) and International Monetary Fund (IMF), Irish banks that trade in the U.S. as ADRs are getting hammered this morning in early trading.

One million jobless women in the U.K.

While the unemployment rate in the U.K. appears to be stabilizing, the jobless rate for British women keeps rising – to the point that more than one million females are now without work.

Extension/Repeal of Bush tax cuts coming down to the wire

The saga surrounding the extension (or repeal) of George W. Bush’s tax cuts seems to be changing daily, almost hourly. It’s a highly complex and contentious issue that will (perhaps unfortunately) be decided solely by politics.

Stocks finish wild week with a modest gain

U.S. stocks finish a volatile week with modest gains on Friday, finishing flat for the week as a whole. In the absence of major economic data in the U.S., investors focused on moves by China to rein in their inflation, while Ireland continues to negotiate a bailout arrangement from the European Union and International Monetary Fund (IMF).

South Korean stock values dampened by corporate governance issues

South Korean companies demonstrate enormous potential and yet many of them trade at a significant discount to their Asian and global peers.

Joblessness among American Indians doubled during recession

The Great Recession has seen joblessness soar in the U.S. One overlooked segment of the population, the Native Americans (or American Indians) have also suffered from rising unemployment.

Paris Club cancels more than half of DR Congo's debt

The Paris Club of creditor nations and Brazil have agreed to cancel $7.35-billion of debt owed by the Democratic Republic of Congo (DRC), representing more than half of the nation’s foreign debt.

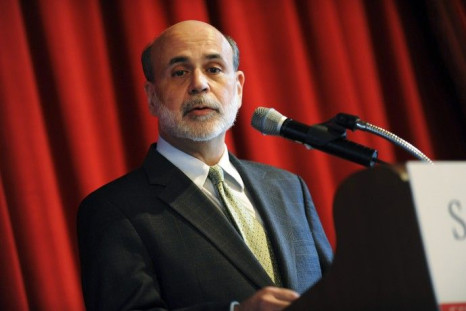

Full-Text: Speech by Ben Bernanke at ECB Central Banking Conference, Frankfurt, Germany

Full-text of speech by Fed Chairman Ben Bernanke at the sixth European Central Bank Central Banking Conference, in Frankfurt, Germany , on Nov. 19, 2010.

Portugal unlikely to seek external financing in near-term

As Ireland appears to be on the verge of resolving its debt crisis, the focus may now shift to yet another fiscally-troubled peripheral euro nation, Portugal.

Turkmenistan offers to supply gas to EU nations

The Central Asian nation of Turkmenistan has promised to supply natural gas for the proposed Nabucco pipeline -- a project that could allow European Union (EU) countries to rely less on Russian energy in the future.

EU10 nations set stage from strong economic recovery: World Bank

The nations of the EU-10 – which comprise various countries in Eastern Europe -- have commenced a meaningful economic recovery and look to strengthen even further in 2011, according to a report from the World Bank.

Ireland rules out hiking corporate tax in exchange for bailout

The government of Ireland has stated that it will not raise the country's low corporation tax rate in exchange for a bailout from the European Union (EU), amidst speculation that France and Germany want the tax rate increased.

Stocks soar on GM offering, Irish bailout hopes

Stocks surged, buoyed by the successful huge initial public offering of General Motors (NYSE: GM), reports that the Republic of Ireland will receive a bailout to solve its troubled banking system and better-than-expected manufacturing activity data.

American men and women are waiting longer to marry.

According to recent study from the U.S. Census Bureau, the median age at first marriage increased to 28.2 for men and 26.1 for women in 2010, an increase from 26.8 and 25.1 in 2000.

Two million may lose unemployment benefits at year-end

Two million long-term unemployed – those who have been seeking work for six months or longer – will lose their unemployment insurance benefits before the end of this year if Congress fails to act to maintain extended benefits.

Municipal bonds turn bearish as yields rise

Yields on municipal bonds has risen recently, with long-term yields rising more sharply than those on the short-end since the beginning of the November.