Video streaming is getting hot as competition for subscribers among big plays heats up, challenging Netflix's dominance in a market it pioneered.

The Midterms could change the game for Wall Street.

President Joe Biden has a plan to tax oil companies, but it may not be a solution.

The latest data on the U.S. employment situation shows a strong job market, but also indicates a cooling-off period ahead.

With lockdowns over, Uber is back. Ridership is soaring, but the company has yet to make any money to show its stockholders.

A technological leap is critical for emerging market economies to overcome two problems they encounter after years of reliance on foreign technology and cheap domestic labor for growth: the middle-income trap and the Lewis point.

An unexpected rise in job openings sent short-term interest rates and the dollar higher, reversing early gains from U.S stocks.

According to FRED data from the Federal Reserve Bank of St. Louis, annualized monthly inflation peaked last June at 12.83% and has been falling since then.

According to some estimates, interest rate hikes can take up to 18 months to affect the economy. Thus, the ECB may want to pause and see how the recent interest rate hikes will impact the eurozone economy before its next move.

Two Long Island restaurant owners share their tips for beating inflationary pressure.

Wall Street has bucked the trend of bad news even as the economy starts to slow

Chipotle is struggling to find the right value and price points to keep its customers coming back.

Visa and Mastercard bet on consumer spending to survive and thrive despite inflation.

Visa and Mastercard's results have come as a surprise to some industry analysts, given the challenging macroeconomic environment they operate

Microsoft beat top and bottom-line estimates, but its fast-growing intelligent Cloud segment lagged behind expectations. Google missed both top and bottom-line estimates as advertising revenues slowed down.

Is it time for traders and investors to go bargain hunting or wait on the sidelines for the worst yet to come?

Wall Street is caught between two types of fears these days.

Inflation can be good for lower-scale brands that provide value to consumers as they "trade down" from more expensive to less expensive products and services.

After spending most of the week on a roller coaster, U.S stocks staged a strong rally on Friday, ahead of major earnings reports scheduled for release next week.

Inflation could be a hot-button issue that sees Democrats losing their grip.

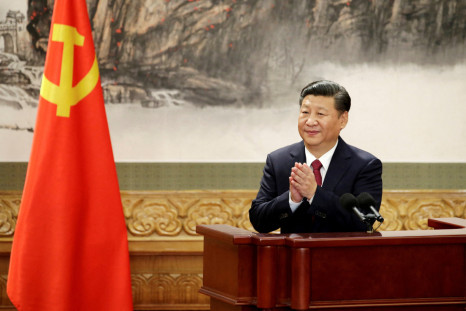

China is starting to pay a price for Xi Jinping's Societ-style leadership.

United Airlines shares were up more than 10% for the week, while American Airlines and Delta Airlines shares were up 7%.

Pakistan appealed to the International Monetary Fund to have its debt rescheduled last week.

Over the last five years, AT&T has lost close to 37% of its value as the overall market gained 44%, and its close competitor T-Mobile gained 124%.

Over the years, P&G has built several advantages to cope with challenging times and be a winner in the consumer-branded and package products retail space.

Following its recent restrictions on semiconductor sales to China, the U.S. has been accused of "weaponizing science and technology."

Netflix's new ad-supported subscription plan won't solve the company's two top problems.

With more than 220 million subscribers at home and abroad, the company is approaching the limits of the streaming market.

The Kroger-Albertsons Merger could be a game-changer for Amazon and Walmart, but will it go through?

To catch up with the U.S., China needs much more than a dose of incentives and foreign technology.

Editor's pick