Over the last five years, PepsiCo's shares are up 50%, compared to 20% of Coca-Cola.

Inflation is turning from a food and energy problem to a core problem, spreading into several goods and services consumers regularly purchase, like medical services, insurance, and shelter.

The minutes began with the usual review of the economic conditions, stating that the economy is weakening faster than expected back in July.

Minimum wage hikes In California and New York have hit consumers where it hurts the most -- fast food.

Declines in PC sales translate to lower demand for semiconductors and, therefore, lower sales for the semiconductor industry.

Despite the end of COVID-related lockdowns, Americans continue to quit their jobs in droves.

All major equity indexes ended Monday's trade lower, with the S&P 500 dropping 0.75%, the Dow Jones Industrials losing 0.32% and the tech-heavy Nasdaq falling the most by 1.04%.

Black swans are low probability high events that are hard to predict, as can show up in different segments of the global financial markets.

China hasn't caught up to the United States when it comes to global innovation.

The U.S. job market is still red hot, despite attempts by the Fed to try and forcibly cool things down.

Another problem, even more significant than coronavirus, won't go away any time soon: the burst of the housing property bubble.

Despite the high job opening levels, the U.S. economy has not gained any new jobs since the pandemic, and many jobs are either part-time or temporary.

According to a recent LendingClub report, as of August, 45% of Americans who make six figures are living paycheck to paycheck, up from 38% a year ago.

Wall Street selloffs intensified last week, driven by sticky inflation numbers and hawkish Fed talks, which turned traders and investors away from stocks.

America might be changing its policy when it comes to Taiwan.

Nike is starting to feel the pressure.

The bullish S&P 500 forecasts of industry analysts should offer some relief to investors who have been seeing red on the screen in recently.

Italy's debt to GDP ratio currently stands at 152.6%, the second largest after Greece.

The Federal Reserve has faced criticism for a strategic mistake: it failed to raise interest rates as inflation reached a 40-year high.

The worst may have yet to come as new and existing home sales are plunging, and homeowners see no reason to refinance loans at higher mortgage rates.

Free money has ended on Wall Street. Here's what that means for investing.

Costco has managed to still emerge strong despite inflation. Here's how.

The nation's central bank raised the Federal Funds rate by 75 bps, bringing it to 3.25%.

In the last five months, the greenback has gained roughly 10% against the yuan due to a combination of monetary tightening in the U.S. and monetary loosening up in China.

In this new divide, India is in an enviable position, courted by Russia, China, the U.S. and the EU to take sides in the Ukraine war and the South China Sea disputes.

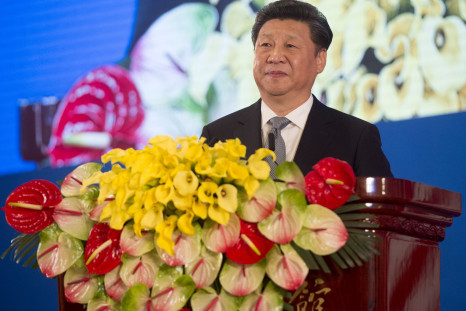

Xi Jinping is seizing the opportunity to expand Beijing's influence in the region when Putin is too busy fighting a losing war in Ukraine.

The Federal Open Market Committee meets this week to deliberate its next policy move. It will find itself between a rock and a hard place.

Here's what rising interest rates mean for everyone.

FedEx misses analyst expectations for latest quarterly earnings report, sending chilling message through global markets.

The hot U.S. labor market has been the bright spot of a cooling economy in recent months, but there might be more at play.

Editor's pick