The small-cap heavy Russell 2000 ended the week at 2009.99, up 3.8%, beating both the S&P 500 and the Dow Jones, which gained 1.7% and 2.5%, respectively.

U.S equities continue defying gravity this week, with major market averages reaching new highs almost daily.

From Greece to Italy, France, and Germany, tractors have become the farmers' "weapons" of a "war" against Brussels and national governments, protesting EU and domestic policies threatening their livelihood.

The Containerized Freight Index has more than doubled since the beginning of October 2023, from 850 to 2,179 points. It increased 419 points or 24% since the beginning of 2024 alone.

China's slide into deflation came when Japan was snapping out of it. In the third quarter of 2023, Japan's residential property price index rose at an annual rate of 2.4%, following an even more significant rise in the previous two quarters.

U.S stocks and bonds moved in the opposite direction at the end of last week, caught between a blowout job report and solid earnings from Meta and Amazon.

The nation's central bank will maintain interest rates steady. It will leave the Federal Funds Rate unchanged at the current 5.25%-5.50% level.

The continuation of the rally in equities, which took the S&P 500 and the Dow Jones to yet new highs, came as bond prices and yields remained steady.

After years of decline, IBM's Economic Value Added (EVA), a measure of Economic Profit, the value a company generates more than the cost of capital, has been rising.

Fastenal's financial performance looks even better when it comes to Economic Value Added (EVA), the difference between the Return on Invested Capital (ROIC) and the Weighted Average Cost of Capital (WACC).

The S&P 500 closed at 4,839.81, up 1.20% for the week; the Dow Jones at 37,4853.80, up 0.70% and the tech-heavy Nasdaq at 15,310.97, up 2.2%.

Trading at around 36,000, the Nikkei is less than 15% below its old-time high of the late 1989s when Japanese equities were among the hottest in the world.

While more data is needed to reach a definite conclusion on the direction of inflation, there are a few reasons why the nation's central bank may declare victory against inflation and begin cutting interest rates.

The Panama Canal drought causes severe shipping delays from Asia to the U.S. East Coast, particularly for heavy goods. Carriers are rerouting from trans-Pacific to trans-Atlantic via the Suez Canal, with alternate routes increasing transit times by 20-30%.

The sum of all fears among traders and investors over valuations and the direction of monetary policy fueled the reversal in the fortunes of the U.S. equity and bond markets.

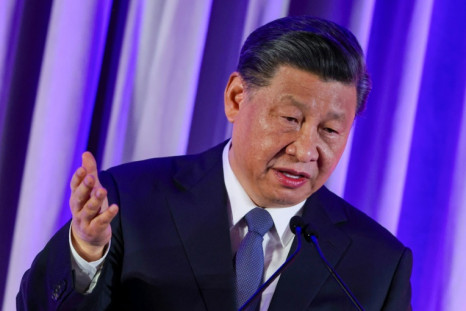

The leader is optimistic about the country's economy, but economic numbers do not support this optimism.

Oil had a smooth ride in 2003. The first part of the year traded in the $70.28-79.47 per barrel range, jumped to $89,19 in the second part and ended very close to where it began at $72.47.

The rapid deployment of Artificial Intelligence (AI) applications, computer systems that mimic human intelligence, could turn the service economy into a winner-take-everything game.

Corporate earnings and their derivative, cash-free cash flow, have always been on Wall Street's radar. They are a critical input in almost every model, which calculates the intrinsic value of a company as the present value of future cash flows to stockholders.

Fed Chair Jerome Powell may find himself in a situation similar to the late 1980s in the spring of 2024, triggering the first interest rate cut if the labor market weakens and unemployment rises.

U.S. stocks and bonds are heading into the new year with plenty of tailwinds that could broaden the rally, though risks to the downside remain.

Though past performance isn't a guarantee for future performance, as the usual Wall Street disclaimer goes, there is a good reason to believe that the Magnificent Seven will continue to outperform the market for many more years.

Lower interest rates ease the cost of financing home purchases. As a result, it could help revitalize the market for existing homes, as homeowners will be looking for opportunities to move to bigger or smaller homes, depending on their family needs.

One of the drivers for last week's gains was comments from Federal Reserve Chairman Jerome Powell signaling the end of the current monetary cycle tightening and the preparation for pivot — interest rate cuts.

Today, the Greek economy has rebounded to a new normal, contributing to the European stability. The country is witnessing healthy Gross Domestic Product (GDP) growth, while the Debt to GDP ratio is declining.

CME's FedWatch Tool points to a 98.4% probability of FOMC setting the FFR target at the current range this week, down from 97.1% a week ago and 90.9% a month ago.

One of the catalysts for last week's gains was Friday's November labor market report. It showed that the U.S. economy continued to churn new jobs at a moderate pace in line with Wall Street's expectations.

Wall Street expects the U.S. economy to have created somewhere between 160,000 and 185,000 jobs in November, based on two forecasts published by Trading Economics.

Wall Street was pleased with Ulta's financial results, sending its shares 11% higher Friday to $474 per share. Lila Margalit of Placer.ai thinks Ulta is in the right place at the right time with a suitable value proposition.

Bitcoin was up 5.2% for the week, followed by the Russell 2000 small caps index, which was up 3.5%. These gains outperformed the 0.2% tech-heavy Nasdaq 100 Index gains and the S&P 500 index's 0.9% gains.

Editor's pick