Striking a balance between the bright and dark sides of asylum policies is difficult. It requires meticulous planning and effective execution to pursue the best results for asylum seekers and host countries.

The August core Personal Consumption Expenditure (PCE), which excludes food and energy, rose 0.1% from July, half of the June-July rise and half of analysts' estimates.

A Placer.ai report shows that Costco's traffic has been gaining momentum, with year-over-year visits increasing 3% during August, 4.5% in July and 3.6% in June.

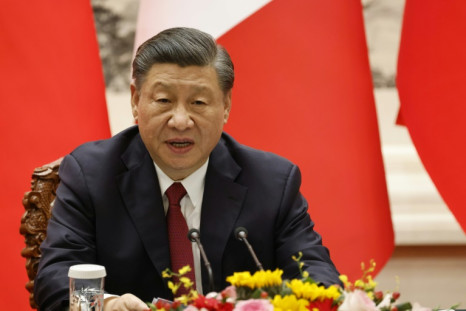

Once upon a time, China's leadership could swiftly address the country's economic problems. It could quickly turn economic slowdowns into booms.

September is usually a dismal time for investors. It's the month after the end of the summer when money managers make portfolio adjustments and trade volume picks up.

The Federal Reserve's tight monetary policy, which has pushed short-term rates above 5%, is beginning to take its toll on the equity and debt markets.

US stocks, Treasury bonds, and oil have been under pressure recently as Wall Street faces massive headwinds, which scare traders and investors away.

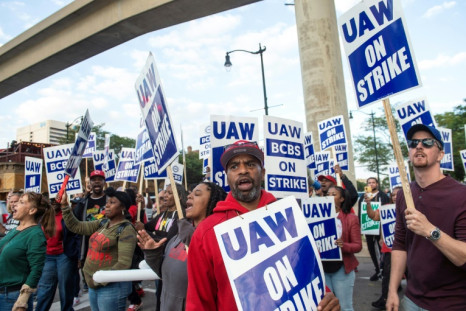

In their long history, U.S. automakers have been through good and bad times.

The gains in gasoline prices place the nation's central bank on alert for a resumption of inflation, making the September interest rate hike a hawkish rather than a dovish pause.

Traders and investors were encouraged by the release of a report by the U.S. Census Bureau before the market opening, which showed that sales increased by 0.6% in August from the previous month.

The rapid depreciation of the Chinese currency sounds like a paradox. China is still a significant exporter of manufacturing goods with a trade surplus, creating a strong demand for its currency.

Equities came under pressure from a sell-off in big tech companies like Apple, Qualcomm and Nvidia, which weigh heavily on major equity indexes.

China must recognize its youth unemployment problem. It's getting from bad to worse, with the government stopping providing data on it.

Nvidia has better sales growth and a higher Economic Value Added (EVA) than Tesla and Amazon and trades at a lower Price-to-Earnings ratio (PE).

The S&P 500 ended the week at 4,515, up 1.9% for the week, the Dow Jones at 34,837, up 0.70%, and the tech-heavy Nasdaq at 14,031, up 2.4%.

Positive earnings surprises usually drive equity prices higher. But not this time around.

Aiding the down pressure on stocks was the anticipation of a hawkish message by the Fed chair in the annual economic conference at Jackson Hole.

China's aggressive expansion into Africa may have solved some of the problems of the old continent while enriching the country's construction companies in the process. But it has yet to help solve China's growing economic problems.

This year, traders and investors on Wall Street will pay close attention to figure out whether rising bond yields and China's woes will give the Fed a good reason for a dovish message — a pause in interest rate hikes in fighting inflation.

The S&P 500 ended last week with 90 points or a 2% loss, the Dow Jones with 1200 or a 3.4% loss, and the tech-heavy Nasdaq with 337 points or a 2.5% loss.

Evergrande's problems reveal something scary about China's debt: Nobody knows how big and how bad it is.

Both companies are cracking down on password sharing, meaning that the effective subscription rates for friends and family become even costlier.

When bond yields rise, the opportunity cost of capital committed to equities rises, and therefore, the expected return on equities decreases. As a result, equities command lower valuations.

If the shift in the weather pattern is the case, it could lead to a slowdown and even a reversal of tourism trends between northern and southern Europe, as north Europeans would rather spend their summer vacation time at home than travel in south Europe.

Twelve months ago, Wall Street was trading on the narrative that the U.S. economy will slide into a full-blown recession for the rest of the year.

Both headline July Consumer Price and Producer Price Index are highly volatile, as they include food and energy, which are influenced by seasonal and geopolitical factors.

According to a recent FactSet Geographic Revenue Exposure report, S&P 500 companies with more than 50% overseas sales have suffered a revenue and earnings shortfall, underperforming those with less than 50% overseas sales presence.

After the close of the regular trade session on Wednesday, Amazon reported a second-quarter net income of $6.7 billion or 65 cents per share on $134.4 billion in revenues.

The Bureau of Labor Statistics (BLS) will release the July nonfarm payrolls report on Friday morning. It's a survey of private business establishments in the country measuring the net number of jobs generated monthly.

Artificial Intelligence (AI) is the next big thing that promises to change the world and bring new fortunes to Wall Street.

Editor's pick