Submerging Markets

The weekend brought a sobering warning from the Bank for International Settlements, which suggested that the emerging markets are facing their own version of the boom and bust cycle that brought the developed world to its knees three years ago.

Greece on the Defensive

In a match rich with economic irony and rhetorical potential, the German national team defeated the Hellenic side 4-2 in the European football championships on Friday.

Gold prices dive in fallout of FOMC decision

The price of gold was losing value on Thursday in as the U.S. dollar strengthened

Canadian Inflation on Ice

Wrapping up some fairly important Canadian data this week, CPI numbers were released earlier this morning and showed that inflationary pressures are easing somewhat, continuing to stay of the south side of the Bank of Canada's target.

Moody's Takes a Hatchet to Global Banks

Few large financial institutions managed to escape unscathed as Moody's repositioned the ratings of 15 banks and securities firms with global capital markets operations after the closing bell on Thursday.

FOMC Aftermath

Yesterday the Fed announced that they will extend their yield curve 'twisting'

Manufacturing Data Tells the Same Story

Advanced readings for German flash PMI came in at 44.7 versus a consensus of 45.2 while the euro zone services came in slightly better than expected at 46.8 versus 46.4

Fed Possibilities

Chairman Bernanke will announce his policy decision Wednesday at 12:30 EST, and considering the recent escalation in the European debt crisis

Spanish Yields, North American Data Shrugged Off

Markets are largely ignoring some very negative indicators this morning, seeming to feel that further support from central banks is imminent.

QElusional?

After the positive effects of the Greek election fade, markets will shift focus toward the Federal Reserve announcement scheduled for Wednesday.

Symbolic Victory for the Euro

The euro symbol was originally designed to resemble the Greek epsilon, in homage to the country often considered the birthplace of Western democratic ideals.

The Big Event: Greek election

Event risk is building for this weekend as the much-ballyhooed second round of Greek elections gets underway on Sunday.

Didn't Spain Just Get a Bailout?

It seems that since the very beginning of the European debt crisis the half-life of announced bailout measures is steadily contracting

Is your company missing out on 2.4 Billion worth of opportunity?

20% of surveyed Chinese companies indicate convenience and reduced FX risk for the preference to be paid in Chinese renminbi

Gold prices hover near $1,600 per troy ounce

The price of gold was flirting with the milestone value of $1,600 per troy ounce on Monday, but concerns about the euro debt crisis tempered the yellowish metal's advance, published reports state.

A Few Charts to Ponder: The Cost of Debt

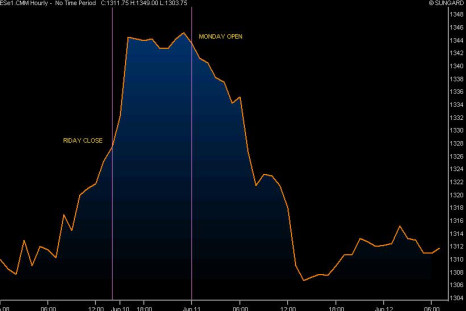

Friday closed on rumours of A Spanish Bailout, which were confirmed over the weekend, prompting a risk rally when Asian markets opened on Sunday evening.

Who's Next on the Debt Chopping Block?

Markets reacted positively to the Spanish banking sector bailout for about two hours before the sobering reality of the situation set in.

Global Outlook: Reign of the Drachma-Queens

It is easy to see why the euro is falling.

Global Outlook: Broken China?

As we have long expected, China is beginning to decelerate.

The Rain in Spain

Not wanting to leave markets complacent going into the weekend, troubling headlines continue to hit the wires from the common-currency bloc overseas.

BizProf: How small business can manage international payments

I own a small business that imports products from overseas, what advice do you have for managing international payments?

ECB Holds Rates, Euro See-Saws

Resisting crisis pressure, the European Central Bank did as expected and held rates steady at 1.0% overnight.

Aussie GDP Data Lifts Sentiment

Australia released its Q1 GDP data at 1.3%, smashing expectations of 0.5% according to a Reuters poll.

Loonie pulled down against greenback by economic data

The value of the monetary unit of Canada slipped Thursday against the U.S. dollar as a consequence of underwhelming employment data issued by the U.S.

North American Data Disappoints

Traders woke up this morning to the quite shocking news of the US Non-Farm Payroll employment numbers.

Downtrend Continues

Yesterday morning the Chicago PMI Data came in quite weak with a reading of 52.7 versus and expectation of 56.7.

Yuan slips against dollar as pact with Japan set to start

The value of the monetary unit of China dropped against the world's reserve currency on Tuesday

Diverse Data Drives Dollar Strength

Data wise, Switzerland GDP beat forecasts by coming in at 0.7% against expectations of no change

Danish Downgrades Deepen Euro's Depression

The euro shot lower yesterday, trading with a 1.23 handle as the market digested news that eight Danish banks had been downgraded.

Assets Slashed as North America Awaits Data

With Europe rattling markets and the rush to dollars, traders have dragged down Brent Crude to cap-off what looks to be its worst performance in two years.