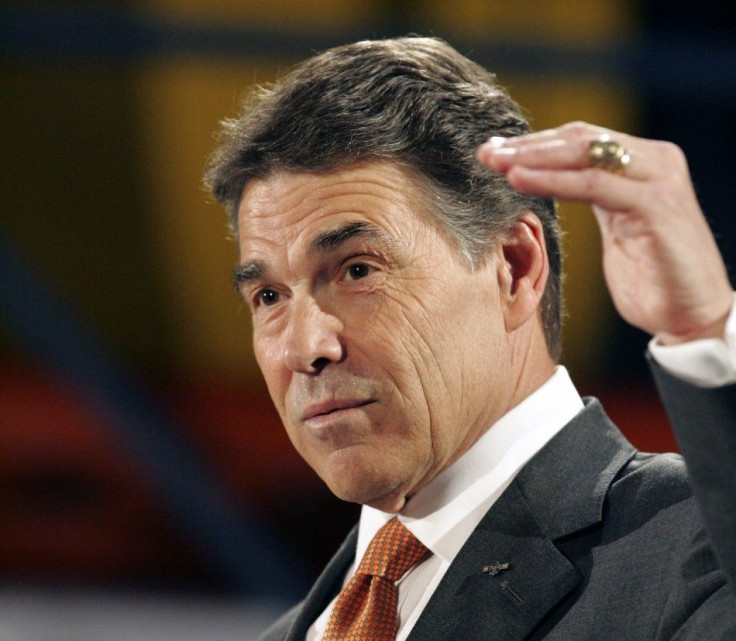

Rick Perry Flat Tax: GOP Presidential Candidate's Plan Panned Almost Universally

Rick Perry's tax plan -- one he hopes will boost his Republican presidential candidacy -- gives Americans two options.

Problem is, according to reports and multiple economic experts, those options don't add up to a very viable end result.

Perry laid out his tax plan Tuesday during a speech at an event in South Carolina, dubbing it Cut, Balance and Grow. The tax plan would give Americans two options: stay under the current tax code or become part of a new tax rate, a flat 20 percent tax on income.

Taxes will be cut on all income groups in America, Perry said in his speech. The net benefit will be more money in Americans' pockets, with greater investment in the private economy instead of the federal government.

He first laid out the plan in an op-ed in The Wall Street Journal on Tuesday, hoping to boost his candidacy with a simple plan that could go up against rival candidate Herman Cain's 9-9-9 Plan.

The plan starts with giving Americans a choice between a new, flat tax rate of 20 percent or their current income tax rate, Perry wrote in the op-ed. The new flat tax preserves mortgage interest, charitable and state and local tax exemptions for families earning less than $500,000 annually, and it increases the standard deduction to $12,500 for individuals and dependents.

The reaction to Perry's tax plan? By both liberals and conservatives, a sweeping thumbs down.

According to The New York Times, the plan would force major spending cuts while benefiting members of the wealthiest classes in America. Perry's plan likely would mean that about a quarter of the expected 2011 budgets would be cut in spending. His plan would reduce the spending percentage relative to gross domestic product to its lowest level since the mid-1960s.

Perry, in turn, said his tax plan would balance the federal budget by 2020. He proposed increasing the retirement age for receiving Social Security benefits and perhaps changing requirements for Medicare eligibility.

But the negative reviews kept coming.

From Jon Huntsman, a rival GOP presidential candidate. Governor Perry takes the easy way out by leaving in place a broken system, he told the Los Angeles Times. Because his plan is optional it will maintain our outdated system of deductions and credits.

From Alan Viard, of the conservative think-tank American Enterprise Institute. It makes no sense from a policy perspective, he told the LA Times. If the new system is the better system in which to raise revenue, then everyone should be in it. It's not better to have two systems.

And from President Barack Obama and his reelection campaign. The belief that middle class Americans will benefit if we just give another special break to those at the top was long ago discredited which is why the president is fighting to create jobs now, restore economic security for the middle class and extend a tax cut that would give the typical middle class family $1,500 per year.

The option and the reluctance to commit to one tax code and system seemed to be the key talking point denouncing Perry's tax plan. But, as Huntsman said, Perry keeps deductions in his tax code, like those for state and local taxes, charitable gifts and mortgage interest.

And there's the part in which he gets rid of the estate tax and taxes on investment income, two moves that would significantly benefit wealthy Americans.

When Perry was asked on CNBC Tuesday whether his plan is a giveaway to the wealthy, he said, I don't care about that. What I care about is them having the dollars to invest in their companies.

And if Perry is giving the taxpayer a choice, he's not giving one to the federal government. According to Ted Gayer, the co-director of the Economic Studies program and a senior fellow at the Brookings Institution, the tax plan would lead to a substantial decrease in revenues.

He told CBS it would take time to measure the tax plan's effect, but he said it would clearly lead to a reduction in revenues, I think fairly substantial.

© Copyright IBTimes 2024. All rights reserved.