RIMM: Could New Investor Demand Make it Motorola Redux?

A Canadian activist investment bank has bought into Research in Motion, demanding it maximize shareholder value before market value is lost.

I love my BlackBerry. It's a great product, Jaguar Financial CEO Victor Albioni said in an interview with IBTimes. We give BlackBerrys to our employees, and they go out and buy iPhones.

The Jaguar CEO said he started buying depressed RIMM shares in July and August and has been in touch with some other big investors about a shakeup. He said the group now controls less than five percent of the company.

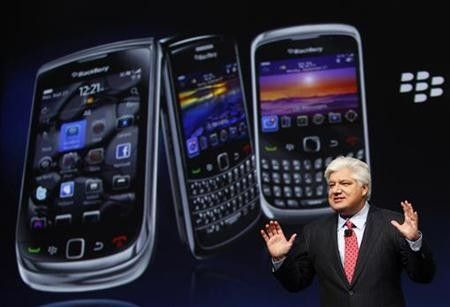

Alboini said RIMM needs an Eric Schmidt, referring to Google's executive chairman, to increase value, rather than continued leadership under co-founders Michael Lazaridis and James Balsillie. The co-CEO structure weakens performance, complicates product offerings and isn't keeping RIMM competitive, he said.

The Jaguar Financial investment evokes what happened to the former Motorola in 2007 when activist Carl Icahn started accumulating shares and ultimately forced its breakup. Last month, Google agreed to acquire Motorola Mobility, which took over Motorola's phone and set-top box divisions, for $12.5 billion.

Icahn hailed the Google move. He continues to be one of the biggest owners of Motorola Solutions, the remaining entity.

RIMM now ought to focus on its organizational structure, its culture, upgrades of its BlackBerry7 and QNX phones, Albioni added. Current management, he said, is putting all its eggs in one basket and not meeting the competition from Apple and others.

Toronto-based Jaguar Financial is not listed among RIMM's major shareholders. The company has not registered any filings with the U.S. Securities and Exchange Commission. But they wouldn't be required to, as Albioni's group has less than a five percent stake.

Jaguar Financial didn't list RIMM, based in Waterloo, Ontario, in its second-quarter financial report among major holdings. It reported cash and investments around C$14.9 million (U.S. $15 million).

RIMM shares fell 1.4 percent on Tuesday trading amid an overall market downturn. In circumstances where a better-known investor like Icahn or Providence Capital Partners had taken a major stake, the shares would more likely have gained.

Albioni said Jaguar Financial and its allies are impatient and don't have Icahn's time frame. We are focused on the short and near term, he said.

RIMM shares have fallen nearly 35 percent in the past year, giving the company a market capitalization of only $15.4 billion, compared with rival Apple's $342.4 billion.

Co-CEOs Laziridis, a physicist, and Balsillie, a veteran executive, personally own large RIMM stakes. Since nearly 80 percent of the shares are held by big institutions and mutual funds, an activist shareholder like Jaguar could receive substantial support.

Albioni also said RIMM can better tap the value of its patents and could consider an auction of some of them. In July, RIMM was part of a syndicate led by Apple and Microsoft that laid out $4.5 billion for patents auctioned by bankrupt Nortel Networks of Canada.

The Jaguar CEO cited that auction, as well as current auctions by Eastman Kodak for patents as well as InterDigital, which is completely for sale based on its wireless patent holdings.

RIMM, developer of the BlackBerry smartphones and PlayBook tablets, has lost market share to Apple and other developers. To better challenge Apple in the tablet wars, it acquired QNX Software Systems of Ottawa last year from Harman International. QNX software manages the PlayBook.

Albioni is a veteran Canadian mergers and acquisitions lawyer who set up Jaguar Financial in 2007.

© Copyright IBTimes 2024. All rights reserved.