RIMM: Jaguar Didn’t Recruit Icahn for Takeover Bid, Investor Says

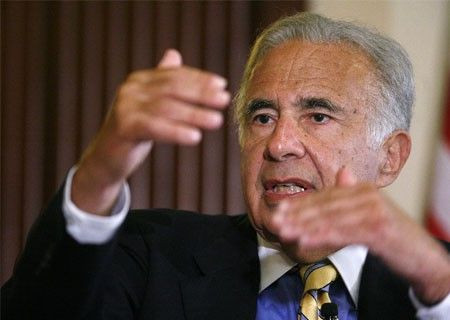

Shares of BlackBerry developer Research in Motion vaulted 6 percent Tuesday amid speculation Carl Icahn has joined Canadian hedge funds in a move to shake up the company.

RIM shares closed at $22.65, up 4.47 percent.

We did not reach out to him [Icahn}, Canadian activist investor Victor Alboini told IBTimes. If he is indeed buying into RIM, it's on his own, he said.

Icahn, a New York-based activist who dropped his latest effort to take over Clorox only last week, did not return a call.

If Icahn is acquiring a stake in RIM, he would join Toronto -based Alboini whose Jaguar Financial had already acquired a stake in RIM.

Alboini told IBTimes he would reach out to other investors, without identifying them.

Alboini said Jaguar's stake remains below 5 percent but that he has continued to reach out to Canadian and U.S. investors about RIM. By the middle or the end of October, there should be enough major investors to reach out to management, he told IBTimes.

This is not a sprint. It's a marathon, the Jaguar executive told IBTimes Tuesday.

I love my BlackBerry. It's a great product, Alboini said. We give BlackBerrys to our employees and they go out and buy iPhones.

The Jaguar CEO said he started buying depressed RIMM shares in July and August.

Alboini said RIMM needs an Eric Schmidt, Google's executive chairman, to increase value, rather than continued leadership under co-founders Michael Lazaridis and James Balsillie. The co-CEO structure weakens performance, complicates product offerings and isn't keeping RIMM competitive, he continued.

Icahn, 76, started accumulating shares in Motorola in 2006 and and ultimately foced its breakup. Last month, Google agreed to acquire Motorola Mobility, which took over Motorola's phone and set-top box divisions, for $12.5 billion.

Icahn hailed the Google move. He continues to be one of the biggest owners of Motorola Solutions, the remaining entity.

Toronto-based Jaguar Financial is not listed among RIMM's major shareholders. The company has not registered any filings with the U.S. Securities and Exchange Commission. But they wouldn't be required because Alboini's group has less than a 5 percent stake.

Jaguar Financial didn't list RIMM in its second-quarter financial report among major holdings. It reported cash and investments around C$14.9 million (US $15 million).

RIMM shares have fallen 60 percent this year, giving the company a market capitalization of only $11.8 billion, compared with rival Apple's $371.9 billion.

Co-CEOs Laziridis, a physicist, and Balsillie, a veteran executive, personally own large RIMM stakes. Since nearly 80 percent of the shares are held by big institutions and mutual funds, an activist shareholder like Jaguar could receive substantial support.

Alboini also said RIMM, based in Waterloo, Ontario, can better tap the value of its patents and could consider an auction of some of them. In July, RIMM was part of a syndicate led by Apple and Microsoft that laid out $4.5 billion for patents auctioned by bankrupt Nortel Networks of Canada.

The Jaguar CEO cited that auction, as well as current auctions by Eastman Kodak for patents as well as InterDigital, which is completely for sale based on its wireless patent holdings.

RIMM, developer of the BlackBerry smartphones and PlayBook tablets, has lost market share to Apple and other developers. To better challenge Apple in the tablet wars, it acquired QNX Software Systems of Ottawa last year from Harman International. QNX software manages the PlayBook.

Alboini is a veteran Canadian mergers and acquisitions lawyer who set up Jaguar Financial in 2007.

© Copyright IBTimes 2024. All rights reserved.