Rollover of Greek Debt Would Constitute “Default”: Fitch

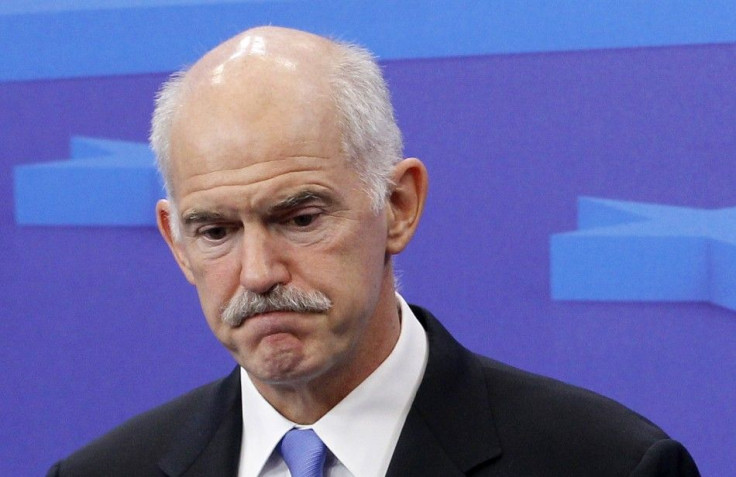

Fitch Ratings agency has warned any voluntary rollover by commercial lenders of Greece’s debt would be regarded as a “default,” putting even more pressure on Euro Zone ministers and Greek Prime Minister George Papandreou, who is facing a crucial vote of confidence.

Thus, a default status would further lead to a downgrade of Greece’s credit rating, which would likely lead to a massive fire-sale of Greek loans.

The Athens government is in the midst of imposing even harsher austerity measures on the beleaguered country in exchange for further financial aid from the European Union and International Monetary Fund.

Euro zone financial officials have given Papandreou a deadline of July 3 by which time recommended budget cuts must be implemented. Otherwise, the next tranche of money would not be forthcoming.

Nonetheless, Euro Zone ministers are also considering a whole new bailout package for Greece estimated at 120-billion euros (the previous package for last May was valued at 110-billion euros).

Andrew Colquhoun, head of Asia-Pacific sovereign ratings with Fitch, told a conference in Singapore: The essence of the problem ... is that Greece needs new money. Fitch would regard such a debt exchange or voluntary debt rollover as a default event and would lead to the assignment of a default rating to Greece.”

Fitch presently estimates that Greece is facing a funding gap of about 80-billion euros through the middle of 2014.

© Copyright IBTimes 2024. All rights reserved.