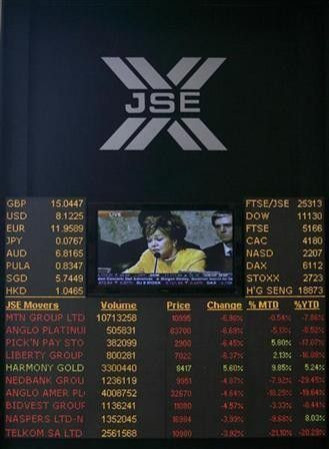

S.Africa stocks book biggest 1-day fall in 5 weeks

South African stocks posted their biggest one-day loss in five weeks on Wednesday, dropping 2.3 percent as fears about the outlook for Italy's debt crisis pushed investors to sell off recent gainers such as miners and banks.

Shares of AngloGold Ashanti avoided the heavy selling, ending flat after the world's No.3 gold miner reported record quarterly earnings, beating forecasts on bullion's bull run.

Worries about Italy's ability to service its debt gave investors an excuse to sell South African stocks -- which had been hovering near a six-month high.

We think there's a lot of emerging markets hubris priced into many of our companies, in particular the retailers, said Nic Norman-Smith, a fund manager at Lentus Asset Management.

When you're buying assets that are priced for perfection, or priced for strong growth, any little bit of bad news can be quite detrimental to the share price.

The benchmark Top-40 index fell 2.3 percent to 28,651.43, booking its biggest one-day decline since early October.

The broader All-share index dropped 2 percent to 32,017.01.

Shares of global miner Anglo American Plc tumbled 3.6 percent to 297 rand, after rising nearly 7 percent in the previous five sessions.

Diversified miner Exxaro slid 3.4 percent to 181 rand. As of Tuesday's close, the company had gained more than 37 percent so far this year, making it the second-best performer among the Top-40.

The top performer is Woolworths Holdings -- a food and clothing retailer similar to Britian's Marks And Spencer Group -- which has gained nearly 50 percent this year.

Shares of Woolworths edged down by nearly 1 percent.

IT firm Allied Technologies were little changed at 52.50 rand. The company said on Wednesday it was no longer in talks to acquire unlisted Kenyan IT firm Symphony, a deal Reuters previously reported could be worth up to $60 million.

Preliminary data indicated that trade was relatively robust, with 177 million shares changing hands, according to data available at 1500 GMT.

Decliners outnumbered advancers by a ratio of more than 2 to 1.

© Copyright Thomson Reuters 2024. All rights reserved.