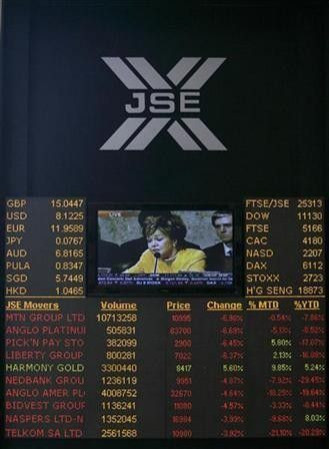

S.Africa stocks cap volatile week with flat trade

South African stocks capped a volatile week with a sideways close on Friday, as concerns about the outcome for Italy's debt crisis kept investors on the sidelines, although platinum miners and other battered-down shares ticked higher.

Shares of private hospital group Netcare rose nearly 3 percent, after the company said it expects to report an increase of up to 26 percent in full-year earnings on Monday.

Italy's parliament on Friday was rushing through austerity measures demanded by the European Union to avert a euro zone meltdown, approving a new budget law and clearing the way for approval of the package in the lower house on Saturday.

Obviously, the big thing is Italy, said Garth Mackenzie, a trader with consultancy Traders Corner.

Europe is a major trading partner of South Africa and a crisis in the euro zone could have a major impact on South African corporate earnings, he said.

I think the debate right now is what is going to happen to earnings, Mackenzie said.

The benchmark Top-40 index rose 0.11 percent to 28,888.50. For the week it rose just a little more than 1 percent.

The broader All-share index rose 0.14 percent to 32,261.65.

Shares of platinum miner Lonmin rose 1.7 percent, becoming one of the top percentage gainers among the Top-40. While spot platinum inched lower on Friday, shares of platinum miners have been battered this year, making them attractive buys, traders said.

But overall, Lonmin is down nearly 35 percent this year, making it the worst performer among the Top-40 for 2011.

Rival Impala Platinum rose 1.7 percent to 182.06 rand. Implats is down 23 percent so far this year, making it the second-worst performer on the Top-40 for 2011.

Shares of luxury goods maker Richemont fell 0.6 percent to 42.50 rand. The maker of Cartier jewellery and Mont Blanc pens struck a cautious note about the outlook for luxury products, as growth rates start to ease from their strong first-half performance.

Preliminary data from the Johannesburg exchange indicated that trade was relatively thin for the session, with 142 million shares changing hands.

Advancers outnumbered decliners, 153 to 110, while 73 shares were unchanged.

© Copyright Thomson Reuters 2024. All rights reserved.