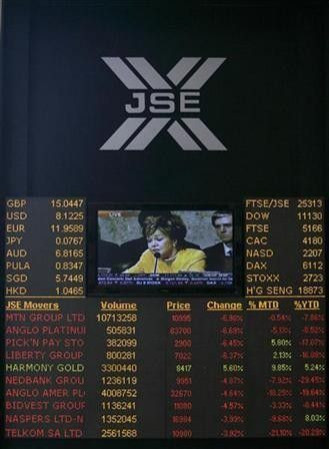

S.Africa's stocks rise on global rebound

South African stocks rose for the second straight session on Thursday, consolidating gains as global markets firmed on hopes that European policymakers would take coordinated steps to support banks there.

Optimism over near-term policy measures -- both from politicians and central banks -- are helping investors to take a break from a sell-off triggered by growing fears of a sovereign default by Greece that would hit European banks hard.

The JSE (Johannesburg Stock Exchange) traded higher today tracking global markets on the back of renewed hopes that the Eurozone will contain debt crises within member states, said Kavita Patel, trader at Sasfin Securities.

The Top-40 index of blue chips was up 1.7 percent, or 440.35 points, at 26,674.15. The broader All-Share index added 420.31 points, or 1.4 percent, to 29,888.87.

Trade was volatile as there is still a lot of uncertainty whether Europe and the United States are headed for a recession.

The market is jittery. Investors are concerned about the sustainability of economic health in the U.S., and I think the non-farm payrolls on Friday will be important to watch out for, said Mitchell Gannaway, a trader at Thebe Stockbroking.

We could see a lot more weakness if we get poor jobs data tomorrow.

The Johannesburg bourse's volatility index -- a measure of investor fear similar to the CBOE Volatility Index in the United States -- rose this week to its highest point since early 2009.

Currently trading at around 11.84 times earnings, the Top-40 index is hovering near its lowest price-earnings ratio in at least two years, according to Reuters data.

More than a third of the index's constituent stocks have single-digit price-to-earnings ratios, having been battered in the global sell-off.

Resources and industrial stocks led the charge at the bourse. Johannesburg-listed shares of platinum miner Lonmin were the biggest resources sector gainer, up 3.3 percent to 129.14 rand.

Mondi, maker of glossy paper, rose 4.3 percent to 59.85 rand.

A total of 160 shares gained, while 91 declined and 66 were flat. Total traded volume was 222.2 million shares, according to the latest exchange data available at 1604 GMT, from 248.2 million in the previous session.

© Copyright Thomson Reuters 2024. All rights reserved.