San Bernardino Shooting: Sturm, Ruger And Smith & Wesson Shares Spike In Wake Of Massacre

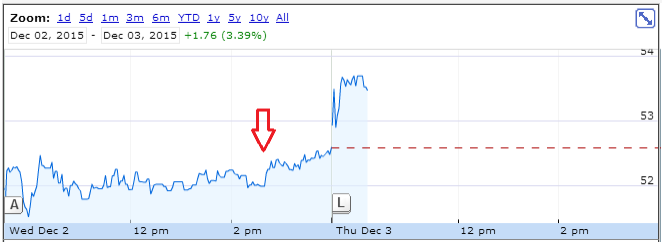

UPDATE: 5 p.m. EST -- Shares of two major American gunmakers settled up slightly Thursday after a spike in prices following Wednesday’s shooting in San Bernardino, California. Sturm, Ruger & Company (NYSE:RGR) ended Thursday up 0.78 percent, to $52.96, after an intra-day 5.3 percent jump to $55.34. Smith & Wesson Holding Corp. (NASDAQ:SWHC) ended the day almost flat, up 0.16 percent to $18.36 after rising 3.7 percent to $19.00.

Original story:

Shares in two of the nation’s leading gunmakers spiked Thursday as news of Wednesday's massacre in San Bernardino, California, rippled through financial markets. Investors are betting the latest high-profile mass murder will boost holiday gun sales.

Stock in Connecticut's Sturm, Ruger & Co. Inc. leaped 1.67 percent Thursday morning to $53.43. Meanwhile shares Smith & Wesson Holding Corp., the Massachusetts maker of Sigma semi-automatic pistols, jumped 2.84 percent to $18.85.

U.S. mass shootings tend to boost gun sales as gun-happy consumers rush to stock up on arms and ammo amid concerns the federal government will respond to these massacres by tightening gun controls.

While it’s difficult to make a direct link between the long-term movement of gun manufacturers’ share prices and high-profile multiple-homicide shootings, it was clear by the stock price movements Wednesday afternoon that some investors bought shares in response to the shooting, hoping to earn a future profit for themselves on gun sales.

Sturm Ruger has paid quarterly dividends since 2009 and returns on its stock have routinely outpaced Apple Inc. during President Barack Obama’s gun-control-supporting administration. Smith & Wesson sales have also flourished in recent years out of concern by many gunowners that Obama would reel in their ability to stock up their cabinets.

“We experienced strong consumer demand for our firearm products following a new administration taking office in Washington, D.C., in 2009,” the company said in its most recent annual report. “In addition, speculation surrounding increased gun control at the federal, state and local level[s] and heightened fears of terrorism and crime can affect consumer demand for our products. Often, such concerns result in an increase in near-term consumer demand and subsequent softening of demand when such concerns subside.”

In the wake of the July 20, 2012, shootings in Aurora, Colorado, the number of background checks for aspiring gun buyers spiked by 41 percent in the days following the murder of 12 moviegoers by James Eagan Holmes.

"It's been insane," Jake Meyers, an employee at Rocky Mountain Guns and Ammo in Parker, told the Denver Post about the rush of customers during the weekend following the shootings that occurred on a Friday.

In the months following the April 16, 2007, massacre at Virginia Tech, demand for firearms and ammunition spiked, leading to a 9 percent increase that year even as consumers were pulling back on other purchases as the housing market collapsed.

"Even though [Obama] has a lot going for him, he's not very pro-gun," Paul Pluff, a Smith & Wesson spokesman, told the Washington Post in October 2007. Gunowners, he added, are "going to go out and get [firearms] while they still can."

© Copyright IBTimes 2024. All rights reserved.