Saudi Aramco Shares Rocket On Debut After Record IPO

Saudi Aramco's shares soared on their debut on the domestic stock exchange Wednesday, becoming the world's biggest listed company worth $1.88 trillion after a record-breaking IPO.

Aramco had priced the initial public offering at 32 riyals ($8.53) per share, raising $25.6 billion and narrowly eclipsing Alibaba's IPO of 2014 to become the world's largest.

Aramco shares climbed the maximum permitted 10 percent to 35.2 riyals just seconds after the opening bell on Riyadh's Tadawul exchange and stayed there until trading stopped.

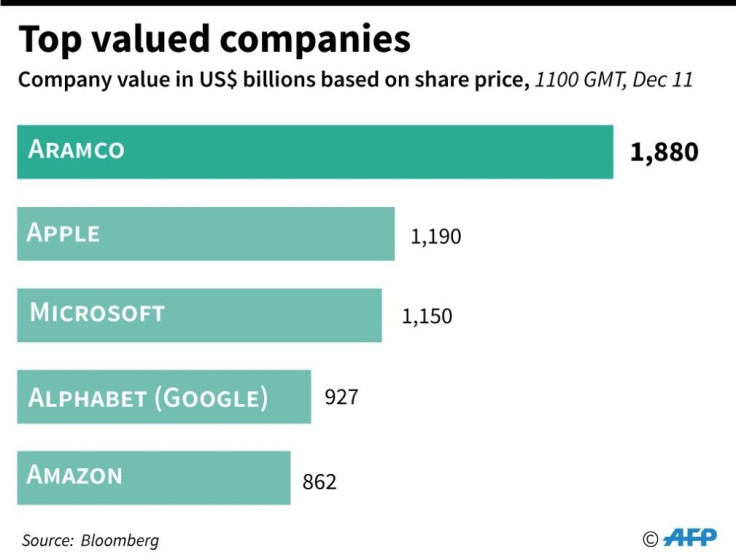

That gives Aramco a market valuation of $1.88 trillion, making it the world's most valuable company as it closes in on the $2 trillion price tag coveted by de facto ruler Crown Prince Mohammed bin Salman.

"Today is a day of immense pride for Aramco," company chief executive Amin Nasser said at a glitzy launch ceremony.

"Today we make history as Saudi Aramco marks the beginning of an important new chapter in our company's journey of prosperity," he added.

The stock sale is the cornerstone of Prince Mohammed's ambitious strategy to overhaul the oil-reliant economy by raising funds to pour into megaprojects and non-energy industries such as tourism and entertainment.

Wealthy Saudi families are reportedly under pressure from the government to invest in the Aramco stock, with nationalists calling it a patriotic duty.

Aramco also dangled sweeteners for local investors, including promises of higher dividends and the possibility of bonus shares if they hold on to the stock.

The energy giant's valuation was declared to be $1.7 trillion during the IPO process, putting it far ahead of other firms in the trillion-dollar club, including Apple and Microsoft.

And the listing of Aramco, with its huge capital value, boosts the Saudi bourse -- known as Tadawul -- to the ranks of the world's top ten.

But the scaled-down offering is still a far cry from the blockbuster originally planned by Prince Mohammed.

The much-delayed stock sale, first announced in 2016, was initially expected to raise as much as $100 billion from the listing of up to five percent of the company.

The government's plans to raise additional funds by listing on a major international market are also on hold.

The government is now piling pressure on wealthy families and institutions to buy Aramco shares after trading begins in a last-ditch effort to reach the $2 trillion mark, the Financial Times reported on Tuesday.

The Saudi government itself has pumped in huge funds to boost the IPO, which was originally intended to raise external funding for the kingdom's diversification plan.

Two-thirds of the shares were offered to institutional investors. Saudi government bodies accounted for 13.2 percent of the institutional tranche, investing around $2.3 billion, according to lead IPO manager Samba Capital.

"It's likely that we will see Aramco bid up to $2 trillion or higher in the first days of trading," Zachary Cefaratti, chief executive officer at Dalma Capital Management -- which bought shares in the IPO -- told Bloomberg News.

Some observers are dubious that the share price surge will last, while international investors have remained sceptical about the secretive company's targeted valuation.

"Everyone suspects that price rise is going to be artificial," said Ellen Wald, author of the book "Saudi Inc."

"This means the Saudi (government) will have to keep pumping it up and devoting huge amount of resources to that, which would hurt budget (and) economy."

The IPO, heavily focused on Saudi and other Gulf investors, is a crucial part of Prince Mohammed's plan to wean the economy away from oil.

But critics say the proceeds will barely cover the kingdom's budget deficit for a year. Saudi Arabia expects its budget deficit to widen to $50 billion next year.

The market debut also comes with oil prices under pressure due to a sluggish global economy hit by the US-China trade war and record output by non-OPEC crude exporters.

© Copyright AFP 2024. All rights reserved.