Signs Of Market Bottom Elude Investors After Steep Selloff

Investors are studying an array of indicators for clues on how much further a brutal slide in U.S. stocks could run, with some signs suggesting the tumble in equities may not be over.

The S&P 500 extended its decline to nearly 20% from January's record peak on Thursday before an end-of-week bounce, approaching the cusp of a bear market amid concerns that persistently high inflation will prompt more aggressive Federal Reserve interest rate increases that could undermine the economy. Declines have been even steeper in the tech-heavy Nasdaq Composite, which is down 24.5% year-to-date.

Despite those losses, many widely followed indicators do not yet show the pervasive panic, supercharged volatility and outright pessimism that have emerged in past market bottoms - a potentially worrisome signal for those looking to step in and buy on the cheap after the most recent selloff in stocks.

Indeed, stocks ripped higher on Friday, with some pandemic era favorites such as the ARK Innovation ETF showing double-digit percentage gains, albeit from depressed levels.

"I don't think we are out of the woods yet on a near-term basis," said Mark Hackett, chief of investment research at Nationwide. "That being said, investor expectations have been reset dramatically."

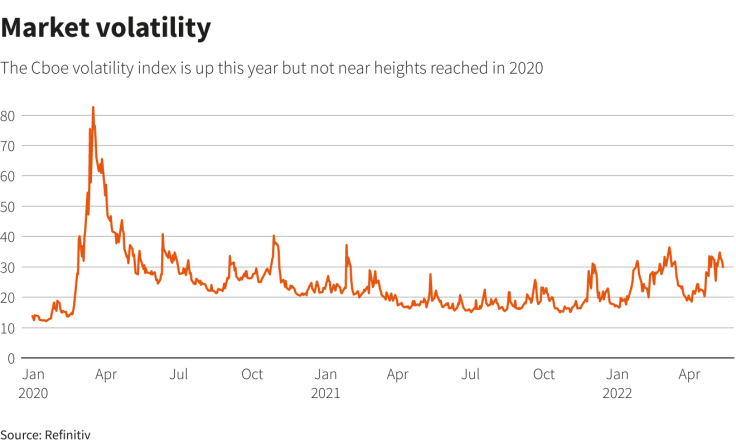

For instance, the Cboe Volatility Index, known as "Wall Street's fear gauge," now hovers around 30 compared with a long-term median of nearly 18. Past market bottoms, however, have coincided with an average level of 37, and the VIX climbed above 80 in March 2020 during a COVID-19-fueled market plunge after which the S&P 500 more than doubled from its lows on the back of unprecedented Fed stimulus.

Randy Frederick, vice president of trading and derivatives for Charles Schwab in Austin, Texas, is looking for a one-day spike to a level of at least the mid-40s as likely "where you actually see panic."

"If I don't see panic ... it might mean we are not at the bottom yet," he said.

Graphic - Market volatility:

Hackett, of Nationwide, is watching options trading for a spike in the ratio between puts, which are typically bought for downside protection, and calls.

"Most of these indicators, put/call being one of them, are already very bad historically," Hackett said. However, he said, "we haven't seen that capitulation where everything is flashing red."

Meanwhile, analysts at BofA Global Research on Friday shared their "capitulation" checklist, which showed that while some indicators, such as investor cash amounts, have hit critical territory, others have not met levels attained during the peak of past selloffs.

"Fear & loathing suggest stocks prone to imminent bear market rally but we do not think ultimate lows have been reached," they wrote.

Next week, investors will focus on earnings results from major retailers including Walmart Inc and Home Depot Inc as well as a report on monthly U.S. retail sales.

Whether clear signs of a bottom emerge or not, stock sentiment could also be swayed by market expectations of how aggressively the Fed will need to raise interest rates in the remainder of the year. The central bank has already raised rates by 75 basis points since March and has signaled that a pair of 50 basis-point increases may be coming in its next two meetings.

"I think you are going to have to at least wait for two or three 50 basis-point rate hikes before you start to see any real signs of people coming back in," said Robert Pavlik, senior portfolio manager at Dakota Wealth Management.

Rather than looking for signs of a bottom, Willie Delwiche, an investment strategist at market research firm All Star Charts, is focused on clearer indications that stocks can mount a sustained rally.

Among the factors he watches is whether the net number of 52-week highs versus lows on the New York Stock Exchange and Nasdaq combined turns positive, from current negative levels. Another is the percentage of S&P 500 stocks making 20-day highs rising to at least 55% from less than 2% at last count.

"Too many people right now are trying to pick a bottom and that's proving to be futile and expensive," Delwiche said. "This is a risk-off environment ... Moving to the sidelines, letting the volatility play out, makes a lot of sense for investors."

© Copyright Thomson Reuters 2024. All rights reserved.