Snap Might Introduce A Snapchat Gaming Platform Next Month

Snap (NYSE:SNAP) could unveil a new mobile gaming platform at its first developer conference on April 4 according to Cheddar. The platform, codenamed "Project Cognac", will reportedly feature externally developed games running inside Snapchat.

The move wouldn't be surprising -- Snap acquired Australian gaming company Prettygreat and game engine start-up PlayCanvas over the past year. Snap also launched its own augmented reality games, and its major investor Tencent (NASDAQOTH:TCEHY), the biggest game publisher in the world, also previously hinted that it would develop games with Snap.

Not really a fresh idea...

Launching a gaming platform inside a social network isn't an original idea. Tencent already hosts in-app games and apps in WeChat, the top mobile messaging platform in China. Facebook integrates "Instant" video games in Messenger, and it recently launched a gaming tab that adds Instant Games, esports streams, and other gaming content to its core social network.

Nonetheless, launching in-app games could help Snap expand its ecosystem and lock in more users. Snap's biggest challenge over the past year has been its lack of user growth.

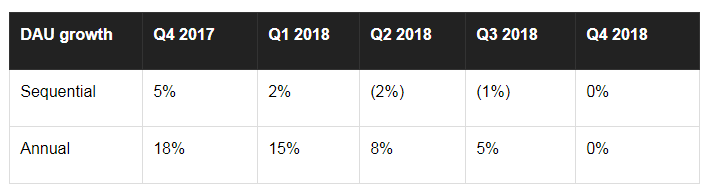

Snapchat's daily active users (DAUs) stayed flat sequentially and fell less than 1% annually to 186 million last quarter, which compared favorably to the sequential declines in prior quarters but indicated that it was struggling to attract new users.

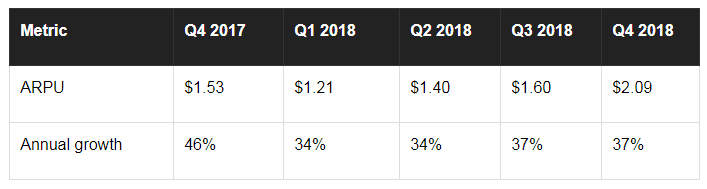

However, Snap's ARPU (average revenue per user) still consistently improved over the past year, which was the primary reason its full-year revenue rose 43%. Analysts expect its revenue to rise another 30% this year.

This indicates that Snap is still squeezing out more revenue per user with more ads, and the expansion of its ecosystem with new services -- like original videos, in-app video games, and social shopping features -- could boost the user's average time spent on Snapchat.

Tencent could help Snap

Snap's experiment with "Snappable" AR games, which let users catch eggs with their mouths or lift weights with their foreheads, offered a unique twist on mobile games within Snapchat. However, those games only appealed to a niche group of existing Snapchat users rather than draw in new users.

However, Tencent could give Snap's gaming platform a shot in the arm if it brings some of its popular mobile games -- like Clash of Clans, Arena of Valor, and PUBG Mobile -- to Snapchat with exclusive bonuses or features. A tie-up with Fortnite could also be possible, since Tencent owns nearly half of Fortnite publisher Epic Games.

Tencent could also integrate live broadcasts of those games into Snapchat's streaming video platform to complement its expanding portfolio of original shows. Tencent might even help Snap develop new AR games for its Spectacles, since Tencent also launched a pair of Spectacles-like smartglasses for its Chinese users last year.

Launching more games on Snapchat could help Tencent, which is still struggling with the fallout from a nine-month freeze on new gaming approvals in China last year. Chinese regulators restarted approvals of Tencent's games earlier this year, but many of its top licensed titles (including Fortnite and Monster Hunter: World) have yet to be approved. Therefore, launching more of its titles in the US via Snapchat could diversify its gaming business away from the Chinese market.

But it won't be a magic bullet

The expansion of Snapchat into a gaming platform is a smart move, but it won't solve Snap's other problems, which include tough competition from Facebook's Instagram, an ongoing loss of executives, and a lack of profits. Investors should keep an eye on Snap's gaming plans, but they probably won't move the needle for the company anytime soon.

This article originally appeared in the Motley Fool.

Randi Zuckerberg, a former director of market development and spokeswoman for FB and sister to its CEO, Mark Zuckerberg, is a member of The Motley Fool's board of directors. Leo Sun owns shares of FB and TCEHY. The Motley Fool owns shares of and recommends FB and TCEHY. The Motley Fool has a disclosure policy.