Asian shares fell for the third day in a row Wednesday as investors grew more risk averse, with renewed uncertainty over Greece's bailout and mounting worries about slowing global economies overshadowing support provided by ample liquidity.

Spider silk is a better conductor of heat than most metals, according to a new study

Peru insists its biggest mining project to date, Newmont Gold's $4.8 billion Conga gold and copper project, will go ahead, although the final shape and form has yet to be decided.

John Salemme explores Sarajevo 20 years after the start of the Bosnian War.

The first complete genome-sequencing of "Otzi," Italy's prehistoric iceman, is revealing a wealth of details about the man who roamed the Alps 5,300 years ago and could unleash a frenzy of activity among scientists thanks to open data.

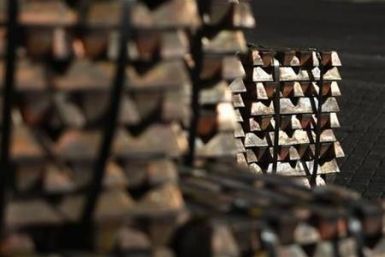

Copper miner Kazakhmys posted a flat core profit for 2011 as stronger metal prices were offset by an 18 percent rise in production costs, including soaring wages for skilled workers in Kazakhstan, home to its core operations.

The cabinet has allowed cash-rich state companies to buyback shares and participate in the government's divestment programme, Praful Patel said on Thursday, as New Delhi looks to narrow its widening fiscal deficit.

Fed Chairman Ben Bernanke said Wednesday job growth was better than expected and inflation under control, leaving markets thinking central bank intervention was a long way off. The upshot was a dollar rally that hammered gold, stocks and government bonds.

No matter which direction investors faced Friday, whether it was the recent past or the immediate future, all the signals were positive. Investors responded by boosting prices for stocks, bonds and commodities.

Newmont Mining said it expects a rise in costs for gold and copper in 2012, mainly due to higher labor and power prices and estimated lower production at a mine in Indonesia.

Gold traders in India, the world's biggest buyer of bullion, were reluctant to enter the market on Friday as the prices remained elevated, though off their 10 week highs.

Asian shares crept higher Friday as solid U.S. data improved sentiment, but gains may be limited by concerns that rising oil prices could deal a further blow to the fragile euro zone economy and moves to take profits after recent rallies.

Three economic reports lit a fire Thursday under global markets, sending U.S. stocks and many commodities higher. The S&P 500 stock index briefly topped its April 2011 peak of 1,363.61.

Copper prices are expected to remain high in 2012 as China's economic growth boosts the metal's performance, according to Intierra Resource Intelligence,, a research firm.

As one of the world's top gold producers, Newmont Mining Corp (NYSE:NEM) seems to have a lot of advantages on its side. But uncertainty about peripheral items, including the effect of recent acquisitions and political developments that could hurt its bottom line, are keeping Wall Street analysts skeptical on the company.

Canadian miner Novagold said on Wednesday it has begun the process of trying to sell its 50 percent stake in the Galore Creek copper-gold project in British Columbia so that it can focus fully on its flagship Donlin gold project in Alaska.

Gold prices retreated from an earlier two-week high in Europe on Wednesday as persistent concerns over Europe's finances hurt the euro and weighed on stock markets, while a supply upset in major producer South Africa lifted platinum to a five-month high.

The financial world welcomed Tuesday's approval of Greece's plans for what amounts to an orderly default with gains in global stocks and commodities.

The euro jumped and U.S. Treasuries dipped on Tuesday after eurozone policymakers agreed to a second bailout package for Greece in talks that went deep into the night in Brussels, but concerns that the deal is only a short-term fix kept stocks subdued and Asian stocks unaffected.

Bank of China International is on track to become the first Chinese member of the London Metals Exchange - giving the bourse a boost while it is considering possible takeover bids - following authorization by the UK financial regulator.

Asian markets rose across the board Monday as policy easing by China and expectations that Greece will secure a second bailout buoyed investor appetite for riskier assets, sending U.S. crude up nearly 2 percent and copper nearly 3 percent higher.

U.S. Supreme Court Justices Steven Breyer and Ruth Bader Ginsburg said Friday that a case challenging a century-old Montana law prohibiting corporate political spending could lead to a new challenge to the court's controversial Citizens United ruling of 2010.