The chances of Portugal accepting a bailout has increased as hopes of reining in the borrowing costs of peripheral European governments have faded.

China may have more potential than ever to influence U.S. debt prices after data showed the country owns more than a $1 trillion in Treasuries, almost a third more than previously thought.

Deutsche Boerse AG's planned takeover of NYSE Euronext faces intense scrutiny from German regulators and European antitrust authorities, potentially imperiling the blockbuster exchange tie-up.

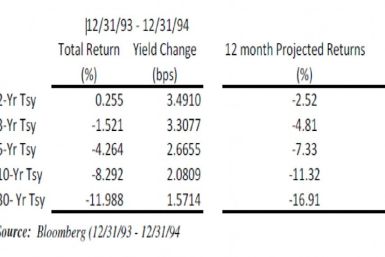

While 1994 was dubbed as the worst year for fixed income investors, we believe that the next twelve months could be even worse

This is a world obsessed with demand...[and] many central banks' policy settings are very, very loose...making for serious inflationary pressures, UBS said. The outlook for food prices is that they could rise exponentially from here if we were to see another shock. There's no buffer right now.

The rupee steadied on Monday after rising early, tracking the domestic sharemarket and some dollar inflows, but traders expected it to remain range bound during the day.

The Egyptian pound fell on Sunday when trade resumed after a week-long suspension due to political unrest, but the drop was less sharp than many traders had feared as the central bank appeared to support the currency.

Egypt's Banks opened for the first time in a week to queues of customers seeking to access their accounts on Sunday, but the Egyptian pound weakened only modestly after violent protests gave way to calmer political talks.

Stocks gained for the second day running on Wednesday with Vodacom (VODJ.J) among the top gainers on upbeat quarterly results while metal prices boosted miners.

Stocks gained for the second day running on Wednesday with Vodacom among the top gainers on upbeat quarterly results while metal prices boosted miners.

South Africa has taken measures to counter capital inflows but the rand is still overvalued, the country's finance minister said on Friday.

Kenya's central bank cut its benchmark lending rate on Thursday for the first time since July, in a surprise move seen as a bid to curb rising Treasury bill and bond yields.

Morgan Stanley said fourth-quarter shareholder profit surged 60 percent as rising fees from wealth management offset the weak fixed-income trading results that have marred its competitors earnings.

Goldman Sachs earned less money in fourth quarter 2010, led by declines in their ultra-profitable market making business.

The companies that reported earnings before the markets open on Wednesday are: Goldman Sachs, Wells Fargo, U.S. Bancorp, State Street, Northern Trust, Bank of New York Mellon and Hudson City Bancorp.

Safaricom, Kenya's largest company by market capitalisation, dragged down the main

index after losing more than 4.0 percent on Friday.

At least 10 asset managers are preparing to launch yuan-denominated funds in Hong Kong to tap robust overseas demand for yuan assets amid expectations of faster yuan appreciation and broader investment channels, two people with direct knowledge of the matter said.

2011 is shaping up as a race to the bottom for currency values, writes Harvard professor Kenneth Rogoff in today's Financial Times. No wonder gold has been so attractive.

Text of Goldman Sachs 8-K filing showing 2010 earnings under new disclosure standards

The consolidation in the banking sector will continue, according to two industry executives whose institutions are in a position (and open to) buying smaller banks.

Robert W. Baird & Co. CEO Paul Purcell speaks to IBTimes about his firm's performance during the financial crisis, navigating the financial services industry after the crisis, and the advantages of being a privately-held financial services firm.

Many observers believe the bond bull has run out of steam, although a 'pop' in the bond bubble is probably unlikely.