The bond market's horrific two-month stretch is teaching U.S. investors who poured some $700 billion into fixed income mutual funds in recent years a harsh lesson about risk.

The Gold Price held near last night's new record highs for US, Euro and Sterling investors in London trade on Tuesday, recording an AM Gold Fix at $1426 per ounce as world stock markets gained more than 1.5%.

Auctions of $123 billion in U.S. securities will draw traders' focus in the U.S. government securities market next week and could push U.S. Treasury yields higher.

The U.S. dollar was steady on Friday ahead of payrolls data for November that could show more evidence of a strengthening recovery and give investors a reason to push benchmark U.S. Treasury yields above 3 percent and put more money in equities.

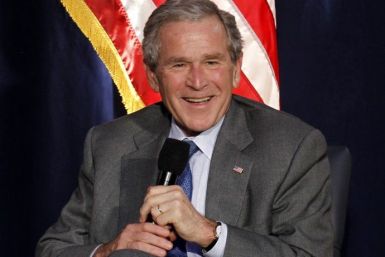

The saga surrounding the extension (or repeal) of George W. Bush’s tax cuts seems to be changing daily, almost hourly. It’s a highly complex and contentious issue that will (perhaps unfortunately) be decided solely by politics.

Retail sales in October picked up pace, and brightened the outlook for year-end shopping as purchases rose 1.2%, the highest in the last seven months.

Women lawyers in America's top law firms have not benefited from structural changes that created nuanced stratifications of lawyers, a survey by the National Association of Women Lawyers and the NAWL Foundation suggests.

To some degree, Japan allowed deflation, or at least they did not choose extremely aggressive policies to fight it. This is largely due to the influence of Japanese constituents who own fixed income, which would devalue in the face of inflation.

Suze Orman speaks to IBTimes about the current economic situation for Americans and gives advice to people with underwater mortgages and seniors living on fixed income.

The board overseeing much of the U.S. municipal bond market is investigating whether prices charged and paid by brokers and dealers are fair to customers, according to a notice released on Wednesday.

The U.S. dollar rose against the euro on Thursday as poor growth prospects and Greece's fiscal deterioration hounded the euro zone single currency, while gold slid after the International Monetary Fund said it would sell more of its bullion holdings.

The U.S. dollar rose to a near 9-month high against the euro on Thursday as the single currency was dogged by worries about sovereign debt levels and poor growth prospects, while gold fell after the International Monetary Fund said it would sell more of its bullion holdings.

In the midst of this year's once-in-a-lifetime rally in corporate bonds, some investors already see the specter that rising interest rates in the future could destroy much of their gains.

Mutual fund companies including BlackRock Inc are asking the U.S. Securities and Exchange Commission to review rules for participating in the Federal Reserve's TALF program to boost lending, the New York Post said, citing sources.